- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:PSMT

Will PriceSmart's (PSMT) FOCUSfactor Beverage Launch Accelerate Its Health and Wellness Expansion?

Reviewed by Sasha Jovanovic

- Synergy CHC Corp. recently announced that PriceSmart will introduce FOCUSfactor Focus + Energy beverages across 47 clubs in 13 countries throughout Latin America and the Caribbean, bringing these functional wellness products to more than 3 million members.

- This partnership enables PriceSmart to expand its health and wellness portfolio, capturing rising consumer interest in functional beverages and enhancing its offering within its international club network.

- We'll examine how PriceSmart's launch of FOCUSfactor beverages across its clubs could shape the company's growth and competitive positioning.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

PriceSmart Investment Narrative Recap

To believe in PriceSmart as a shareholder, you need confidence in its ability to drive consistent membership growth and expand into new markets while maintaining profitability amid currency and supply chain challenges. The introduction of FOCUSfactor beverages across 47 clubs boosts the health and wellness segment, but the impact on near-term earnings or on the main risk, FX and liquidity volatility in key markets, is unlikely to be material right away. The most relevant recent announcement is the company’s opening of its seventh club in Guatemala, which directly supports the long-term catalyst of accelerating club rollout in growth markets and broadening PriceSmart’s addressable market. Yet, investors should not underestimate the ongoing unpredictability around currency conversion in markets like Trinidad and Honduras, especially when...

Read the full narrative on PriceSmart (it's free!)

PriceSmart's narrative projects $6.9 billion revenue and $209.1 million earnings by 2028. This requires 10.1% yearly revenue growth and a $66.5 million earnings increase from $142.6 million today.

Uncover how PriceSmart's forecasts yield a $116.67 fair value, a 5% downside to its current price.

Exploring Other Perspectives

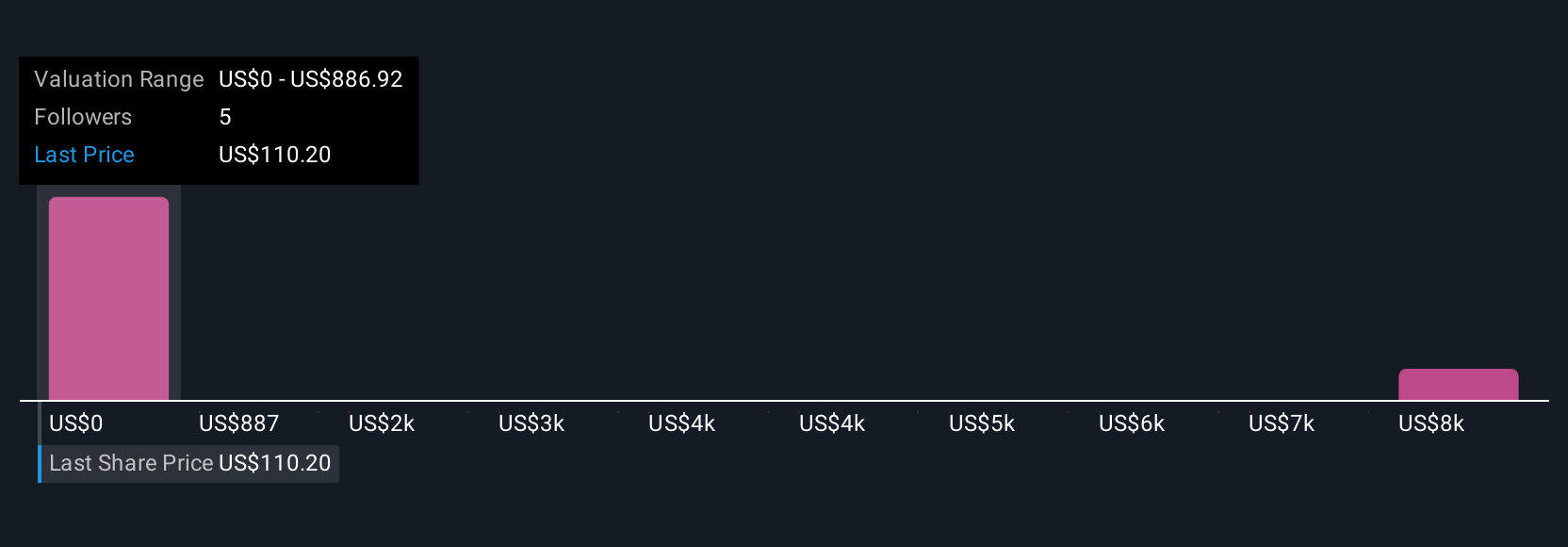

Fair value estimates from five Simply Wall St Community members range from US$886,922 to US$8,869,220, showing broad divergence. As currency and liquidity risks persist in certain markets, consider how sharply opinions can differ when assessing future potential.

Explore 5 other fair value estimates on PriceSmart - why the stock might be a potential multi-bagger!

Build Your Own PriceSmart Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PriceSmart research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free PriceSmart research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PriceSmart's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PSMT

PriceSmart

Owns and operates U.S.-style membership shopping warehouse clubs in the United States, Central America, the Caribbean, and Colombia.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives