- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:PSMT

Here's Why PriceSmart (NASDAQ:PSMT) Can Manage Its Debt Responsibly

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, PriceSmart, Inc. (NASDAQ:PSMT) does carry debt. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for PriceSmart

What Is PriceSmart's Net Debt?

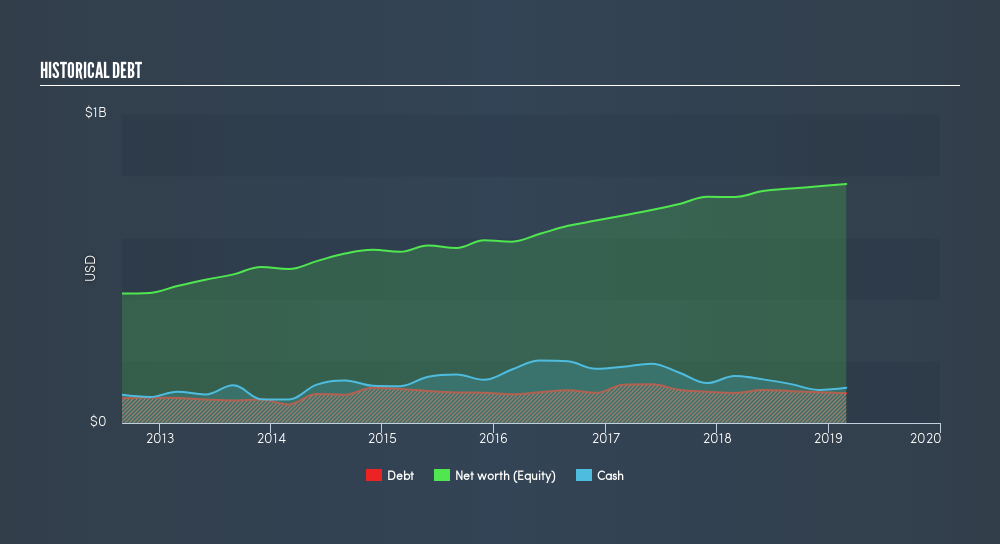

The chart below, which you can click on for greater detail, shows that PriceSmart had US$96.6m in debt in February 2019; about the same as the year before. However, it does have US$113.8m in cash offsetting this, leading to net cash of US$17.2m.

How Strong Is PriceSmart's Balance Sheet?

According to the last reported balance sheet, PriceSmart had liabilities of US$392.6m due within 12 months, and liabilities of US$92.1m due beyond 12 months. On the other hand, it had cash of US$113.8m and US$25.3m worth of receivables due within a year. So it has liabilities totalling US$345.6m more than its cash and near-term receivables, combined.

PriceSmart has a market capitalization of US$1.54b, so it could very likely ameliorate its balance sheet if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution. Given that PriceSmart has more cash than debt, we're pretty confident it can manage its debt safely.

But the other side of the story is that PriceSmart saw its EBIT decline by 7.3% over the last year. That sort of decline, if sustained, will obviously make debt harder to handle. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if PriceSmart can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. PriceSmart may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. In the last three years, PriceSmart created free cash flow amounting to 12% of its EBIT, an uninspiring performance. That limp level of cash conversion undermines its ability to manage and pay down debt.

Summing up

Although PriceSmart's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of US$17m. So we don't have any problem with PriceSmart's use of debt. We'd be motivated to research the stock further if we found out that PriceSmart insiders have bought shares recently. If you would too, then you're in luck, since today we're sharing our list of reported insider transactions for free.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:PSMT

PriceSmart

Owns and operates U.S.-style membership shopping warehouse clubs in the United States, Central America, the Caribbean, and Colombia.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives