- United States

- /

- Food and Staples Retail

- /

- NasdaqCM:HFFG

Investors Give HF Foods Group Inc. (NASDAQ:HFFG) Shares A 26% Hiding

To the annoyance of some shareholders, HF Foods Group Inc. (NASDAQ:HFFG) shares are down a considerable 26% in the last month, which continues a horrid run for the company. The recent drop has obliterated the annual return, with the share price now down 7.3% over that longer period.

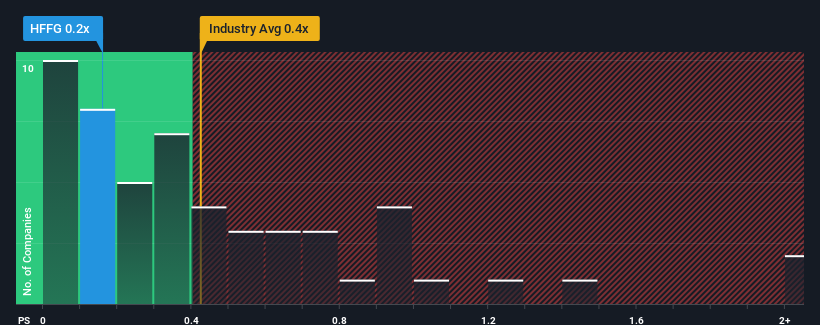

Although its price has dipped substantially, it's still not a stretch to say that HF Foods Group's price-to-sales (or "P/S") ratio of 0.2x right now seems quite "middle-of-the-road" compared to the Consumer Retailing industry in the United States, where the median P/S ratio is around 0.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for HF Foods Group

How HF Foods Group Has Been Performing

The recent revenue growth at HF Foods Group would have to be considered satisfactory if not spectacular. One possibility is that the P/S is moderate because investors think this good revenue growth might only be parallel to the broader industry in the near future. If not, then at least existing shareholders probably aren't too pessimistic about the future direction of the share price.

Although there are no analyst estimates available for HF Foods Group, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is HF Foods Group's Revenue Growth Trending?

In order to justify its P/S ratio, HF Foods Group would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 4.7% last year. The latest three year period has also seen an excellent 99% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 3.8% shows it's noticeably more attractive.

With this information, we find it interesting that HF Foods Group is trading at a fairly similar P/S compared to the industry. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Bottom Line On HF Foods Group's P/S

Following HF Foods Group's share price tumble, its P/S is just clinging on to the industry median P/S. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

To our surprise, HF Foods Group revealed its three-year revenue trends aren't contributing to its P/S as much as we would have predicted, given they look better than current industry expectations. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for HF Foods Group with six simple checks on some of these key factors.

If you're unsure about the strength of HF Foods Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if HF Foods Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:HFFG

HF Foods Group

Operates as a marketer and distributor of specialty food products, seafood, fresh produce, frozen and dry food, and non-food products to Asian restaurants and other foodservice customers in the United States.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives