- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:DLTR

How Investors Are Reacting To Dollar Tree (DLTR) Downgrade Amid Shifting Retail Demographics

Reviewed by Sasha Jovanovic

- Last week, Goldman Sachs downgraded Dollar Tree from Buy to Sell, highlighting concerns about the retailer's declining appeal to its core lower-income demographic and current valuation.

- This marks a meaningful turn in analyst sentiment that could impact how investors assess Dollar Tree's long-term growth prospects and position in the discount retail sector.

- We'll explore how this analyst downgrade and shifting consumer sentiment might alter the outlook for Dollar Tree's investment narrative.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Dollar Tree Investment Narrative Recap

To be a Dollar Tree shareholder, you need to believe the company can maintain its value-focused positioning while expanding its multi-price point strategy and controlling costs. The recent Goldman Sachs downgrade raises concerns about the company's core lower-income shopper appeal and may increase near-term focus on brand perception, which is now a more prominent short-term catalyst. At the same time, the biggest risk remains Dollar Tree’s reliance on price increases, which could further challenge customer loyalty, recent events do not materially affect this risk.

Of the recent announcements, Dollar Tree’s reaffirmed Q3 and fiscal 2025 guidance, with comparable same-store sales growth of 3.8%, is most relevant here. This update shows that, despite analyst skepticism and shifting consumer sentiment, management expects steady growth in the near term, supporting the narrative that operational execution and traffic trends remain key drivers to watch.

However, investors should be aware that, despite positive near-term guidance, the ongoing risk of reduced value perception among loyal customers could...

Read the full narrative on Dollar Tree (it's free!)

Dollar Tree's outlook anticipates $22.1 billion in revenue and $1.4 billion in earnings by 2028. This scenario assumes 6.0% annual revenue growth and a $0.3 billion increase in earnings from the current $1.1 billion figure.

Uncover how Dollar Tree's forecasts yield a $108.26 fair value, in line with its current price.

Exploring Other Perspectives

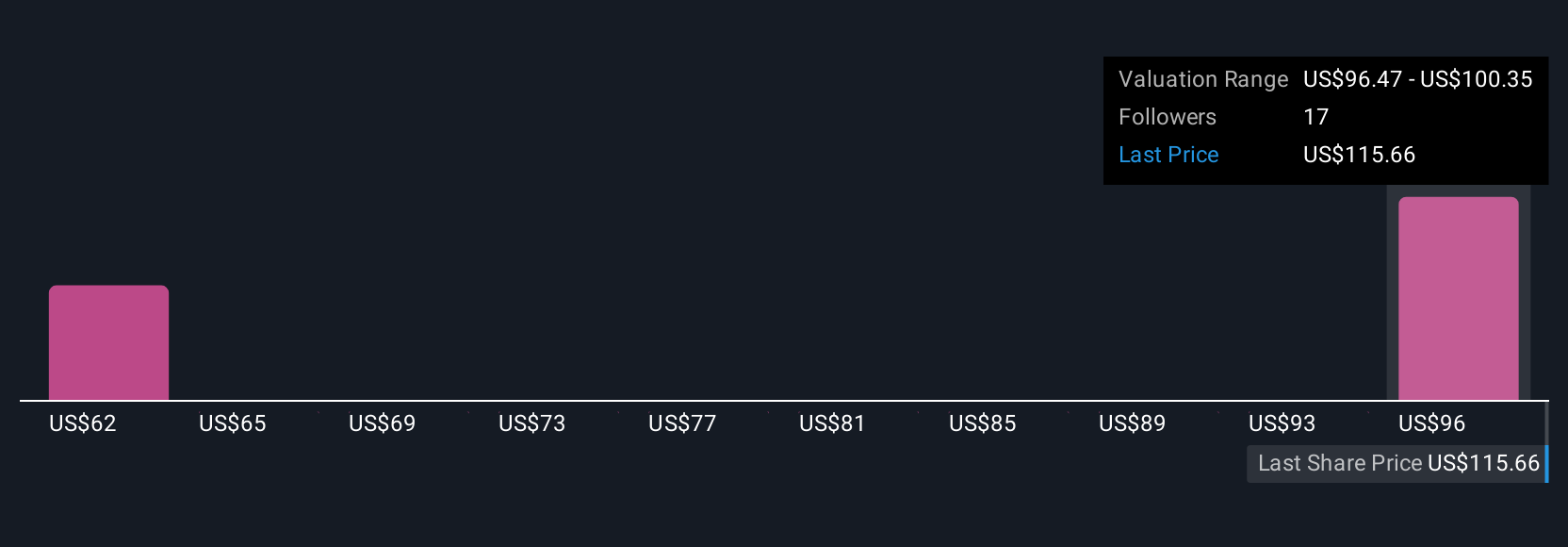

Three members of the Simply Wall St Community have published fair value estimates for Dollar Tree ranging from US$58.09 to US$108.26 per share. While analyst consensus points to risks around price increases and customer retention, broad community opinions signal a spectrum of possible outcomes for Dollar Tree’s future performance.

Explore 3 other fair value estimates on Dollar Tree - why the stock might be worth 45% less than the current price!

Build Your Own Dollar Tree Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dollar Tree research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Dollar Tree research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dollar Tree's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DLTR

Dollar Tree

Operates retail discount stores under the Dollar Tree and Dollar Tree Canada brands in the United States and Canada.

Mediocre balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives