- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:DLTR

Dollar Tree (DLTR): Rethinking Valuation After Goldman Sachs Downgrade and Shifting Shopper Trends

Reviewed by Simply Wall St

Goldman Sachs has shifted its outlook on Dollar Tree (DLTR), lowering its rating after raising concerns about valuation and the retailer’s connection with lower income shoppers. This rethink has caught the market’s attention.

See our latest analysis for Dollar Tree.

After Goldman’s sharp downgrade, Dollar Tree’s share price saw a quick dip but still holds onto a robust year-to-date share price return of 37%. While short-term momentum has turned positive in the past month with a 9% share price gain, long-term investors have experienced ups and downs. A 1-year total shareholder return of 63% is a standout. However, the 3-year total shareholder return remains steeply negative. This week’s real estate news may not shake up the story, but investor sentiment is evolving fast as valuation concerns move front and center.

If you’re interested in spotting what else is gaining traction, now’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

With shares rallying despite recent analyst warnings, the question now is whether Dollar Tree is undervalued after the downgrade, or if the market has already accounted for future growth and challenges in its current price.

Most Popular Narrative: 3% Undervalued

Dollar Tree's most-followed narrative pins fair value at $108.26, just above the last close of $104.75, suggesting modest upside. The stage is set for further debate on whether current growth initiatives justify the uptick.

Aggressive store expansion into new markets, including conversions of legacy stores and recent acquisitions (such as former 99 Cents Only and Party City locations), leverages underserved suburban and rural regions. This supports long-term unit growth and broadens the addressable customer base, thus driving higher revenue.

Want to see the strategy behind this valuation? The full narrative reveals pivotal analyst debates, bold growth forecasts, and surprising assumptions woven deep into that fair value. Find out what could make or break the outlook.

Result: Fair Value of $108.26 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent tariff pressures and reduced SNAP benefits could jeopardize margin improvement and sales momentum. This may potentially challenge Dollar Tree’s current narrative.

Find out about the key risks to this Dollar Tree narrative.

Another View: Market Ratio Tells a Different Story

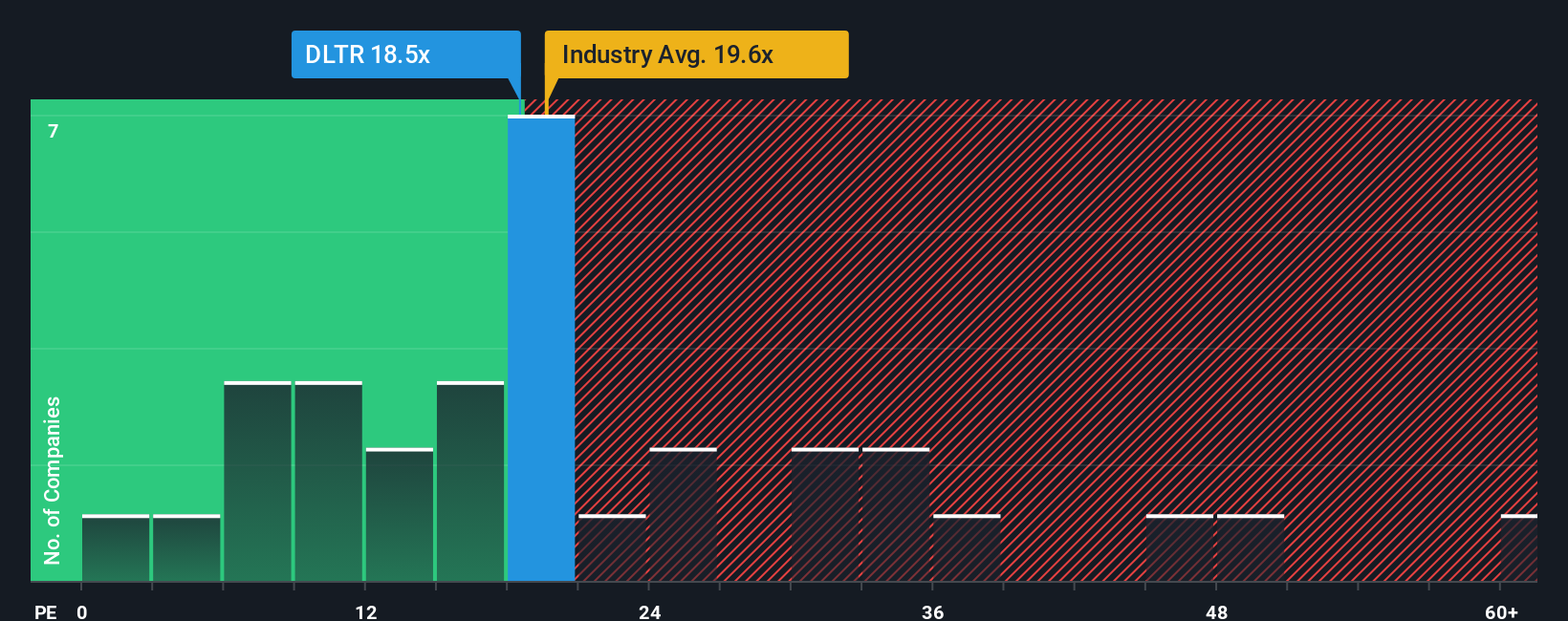

Looking at the price-to-earnings ratio offers a different perspective. Dollar Tree trades at 19.2x earnings, which is just under the US Consumer Retailing industry average of 19.8x, but above both the peer average of 18.9x and the fair ratio of 18.4x. This small premium could signal investors have high hopes, or it might mean they are taking on extra valuation risk. So is the current price truly a bargain, or is the upside already priced in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Dollar Tree Narrative

Readers who want to dig into the details or take a different approach can quickly build their own narrative in just a few minutes. Do it your way

A great starting point for your Dollar Tree research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t stop at just one opportunity. Smart investors reach wider and secure their edge with fresh ideas others are missing out on right now.

- Catch serious growth potential by reviewing these 877 undervalued stocks based on cash flows, a resource for stocks trading beneath their true worth and poised for a turnaround.

- Unlock reliable income streams as you browse these 16 dividend stocks with yields > 3%, which includes companies offering strong yields above 3%.

- Stay ahead of the tech curve and get inspired by these 25 AI penny stocks, featuring AI leaders shaping tomorrow’s winners.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DLTR

Dollar Tree

Operates retail discount stores under the Dollar Tree and Dollar Tree Canada brands in the United States and Canada.

Mediocre balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives