- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:DLTR

Does Dollar Tree’s (DLTR) Employee Stock Ownership Shift Signal a New Approach to Strategic Focus?

Reviewed by Simply Wall St

- Dollar Tree, Inc. recently filed a US$342.45 million shelf registration for an Employee Stock Ownership Plan and announced a Chief Legal Officer transition, with John S. Mitchell, Jr. set to succeed Jonathan B. Leiken following the past sale of the Family Dollar business.

- This combination of leadership change and a significant equity offering for employees suggests a period of transformation as Dollar Tree sharpens its focus after divesting Family Dollar.

- We'll now examine how Dollar Tree's new Chief Legal Officer and ESOP-related equity move influence its investment narrative and future direction.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 25 best rare earth metal stocks of the very few that mine this essential strategic resource.

Dollar Tree Investment Narrative Recap

To own Dollar Tree, Inc. stock, investors generally need conviction in the company’s ability to drive better profitability and operational focus following the Family Dollar sale. The announced Chief Legal Officer transition and US$342.45 million ESOP shelf registration signal organizational changes, but do not materially affect the immediate catalyst, successfully integrating post-sale cost structures or the primary near-term risk of potential margin pressure from transitional costs and increased spending.

The ESOP-related equity registration stands out from recent news, as it reflects additional efforts to align employee interests during this period of reshaping the core business. With post-divestiture operational focus in mind, employee ownership could influence morale but does not remove the continued challenge of controlling rising SG&A costs, especially as Dollar Tree invests in IT, payroll, and distribution upgrades tied to its evolving store format strategy.

By contrast, investors should be aware that the risk of higher corporate shared services costs after the Family Dollar deal could lead to a...

Read the full narrative on Dollar Tree (it's free!)

Dollar Tree's narrative projects $21.1 billion in revenue and $1.3 billion in earnings by 2028. This requires 6.3% yearly revenue growth and a $0.3 billion increase in earnings from the current $1.0 billion.

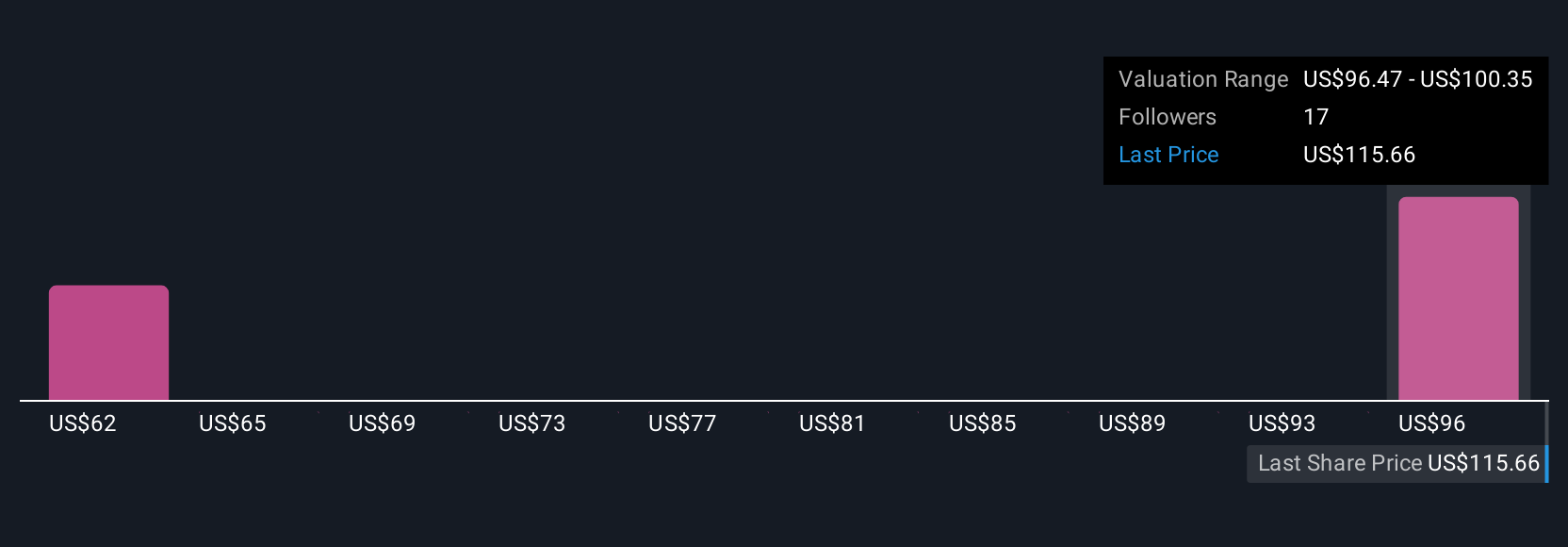

Uncover how Dollar Tree's forecasts yield a $100.35 fair value, a 13% downside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community range from US$59.60 to US$100.35 based on three private investors’ models. While opinions vary, many are weighing how ongoing SG&A cost increases could shape future earnings and operational efficiency, inviting you to consider a broad set of views.

Explore 3 other fair value estimates on Dollar Tree - why the stock might be worth as much as $100.35!

Build Your Own Dollar Tree Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dollar Tree research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Dollar Tree research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dollar Tree's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DLTR

Dollar Tree

Operates retail discount stores under the Dollar Tree and Dollar Tree Canada brands in the United States and Canada.

Adequate balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives