- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:DADA

Market Cool On Dada Nexus Limited's (NASDAQ:DADA) Revenues Pushing Shares 26% Lower

Dada Nexus Limited (NASDAQ:DADA) shares have retraced a considerable 26% in the last month, reversing a fair amount of their solid recent performance. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 60% loss during that time.

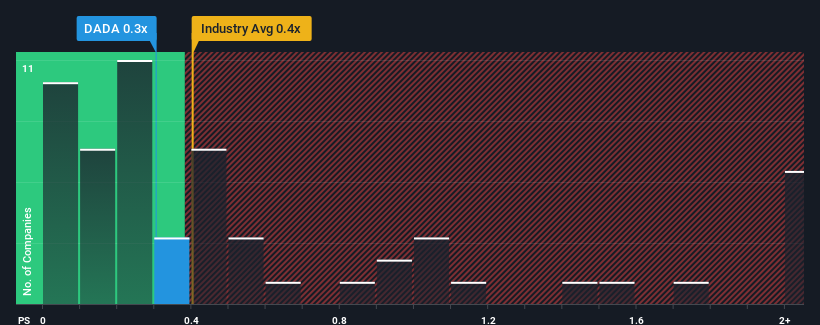

Although its price has dipped substantially, there still wouldn't be many who think Dada Nexus' price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S in the United States' Consumer Retailing industry is similar at about 0.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Dada Nexus

What Does Dada Nexus' P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Dada Nexus' revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Dada Nexus' future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Dada Nexus?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Dada Nexus' to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 2.6%. Even so, admirably revenue has lifted 57% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 8.9% per annum during the coming three years according to the eleven analysts following the company. That's shaping up to be materially higher than the 5.0% per annum growth forecast for the broader industry.

In light of this, it's curious that Dada Nexus' P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Following Dada Nexus' share price tumble, its P/S is just clinging on to the industry median P/S. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Despite enticing revenue growth figures that outpace the industry, Dada Nexus' P/S isn't quite what we'd expect. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Dada Nexus that you need to be mindful of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:DADA

Dada Nexus

Operates a platform of local on-demand retail and delivery in the People’s Republic of China.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives