- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:COST

How Rising Executive Memberships and Strong Sales Growth at Costco (COST) Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

- In November 2025, Costco Wholesale reported US$21.75 billion in net sales for October and US$48.33 billion for the first nine weeks of its fiscal year, both up over 8% from the previous year.

- Executive membership initiatives, like exclusive early shopping access, helped boost both member upgrades and sales, pointing to the profitable impact of enhanced loyalty strategies.

- We’ll look at how growth in Executive memberships and membership upgrades shapes Costco’s investment narrative and future prospects.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Costco Wholesale Investment Narrative Recap

Costco shareholders need to believe that sustained membership growth and high renewal rates can support steady revenue expansion, even as competition and margin pressures persist. The latest sales report, showing 8% year-on-year growth, supports the short term catalyst of robust membership momentum, while margin pressures from higher labor costs remain a key risk; this news does not materially change that balance. One recent announcement directly tied to these catalysts is Costco’s introduction of exclusive early shopping hours for Executive members. This initiative has reportedly increased weekly U.S. sales by around 1% and encouraged upgrades to more profitable membership tiers, further reinforcing Costco’s focus on loyalty-driven growth. Still, against these strong results, investors should not overlook...

Read the full narrative on Costco Wholesale (it's free!)

Costco Wholesale's narrative projects $329.0 billion revenue and $10.4 billion earnings by 2028. This requires 7.0% yearly revenue growth and a $2.6 billion earnings increase from $7.8 billion.

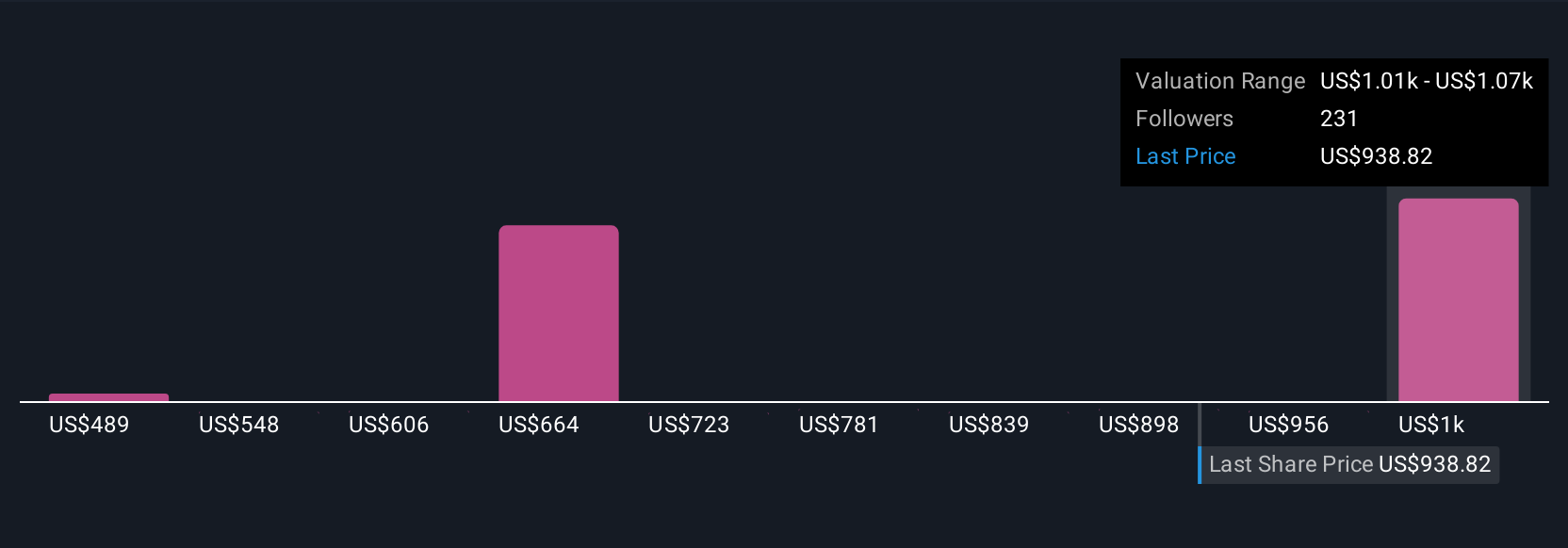

Uncover how Costco Wholesale's forecasts yield a $1060 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Twenty two members of the Simply Wall St Community calculated fair values for Costco stock ranging from US$683.78 to US$1,059.55. With Executive membership upgrades helping to boost top line growth, these wide-ranging estimates highlight why it pays to consider multiple viewpoints before making decisions.

Explore 22 other fair value estimates on Costco Wholesale - why the stock might be worth as much as 15% more than the current price!

Build Your Own Costco Wholesale Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Costco Wholesale research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Costco Wholesale research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Costco Wholesale's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COST

Costco Wholesale

Engages in the operation of membership warehouses in the United States, Puerto Rico, Canada, Mexico, Japan, the United Kingdom, Korea, Australia, Taiwan, China, Spain, France, Iceland, New Zealand, and Sweden.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives