- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:COST

Assessing Costco (COST) Valuation: What Years of Steady Growth Reveal About Investor Expectations

Reviewed by Simply Wall St

See our latest analysis for Costco Wholesale.

Even though Costco’s share price has seen only modest movement lately, the real story is in its remarkable long-term run. While the 1-year total shareholder return sits at 4.73%, it is the impressive 92% three-year and 169% five-year total returns that really underscore investors’ confidence and Costco’s ability to deliver steady growth over time.

If you are thinking beyond retail giants and want to spot what is next, now is the perfect time to broaden your search and discover fast growing stocks with high insider ownership.

With Costco’s shares climbing steadily for years, current valuations raise the debate: is there more upside for patient investors, or has the market already factored in all of Costco’s potential growth?

Most Popular Narrative: 12.9% Undervalued

Costco’s narrative fair value sits notably above its recent closing price, signaling a gap that turns many heads. The details fueling this perspective are hard to ignore.

Costco plans to continue expanding its warehouse locations, with 28 new openings planned for fiscal year 2025. This expansion is likely to increase membership and sales volume, driving revenue growth.

Curious what’s powering the narrative behind that lofty valuation? It’s a mix of bold future sales projections, ambitious expansion, and profit margin improvements. Find out which aggressive assumptions and numbers analysts believe will justify this premium price. What may seem out of reach now could be the new normal if their growth story plays out.

Result: Fair Value of $1,061 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, foreign exchange fluctuations and rising labor costs could pressure Costco’s margins and create uncertainty around the optimistic outlook for long-term growth.

Find out about the key risks to this Costco Wholesale narrative.

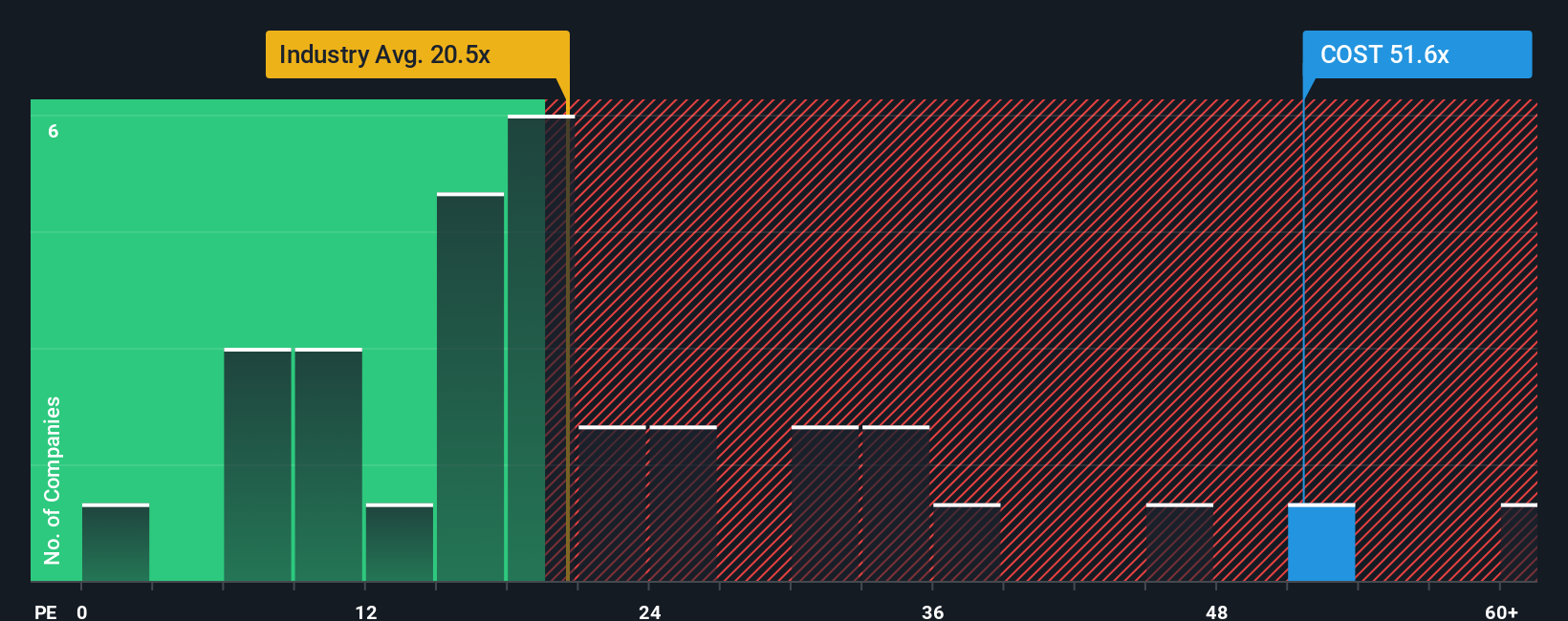

Another View: Valuation by Multiples

While analyst narratives paint Costco as undervalued, the company’s price-to-earnings ratio is much higher than industry norms. At 50.6x, Costco trades significantly above its industry average of 20.8x and peer average of 22.4x and also exceeds its own fair ratio of 29.4x. This steep premium suggests that much of Costco’s growth story could already be reflected in the shares, raising questions about how much room is left for upside.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Costco Wholesale Narrative

If you see the story differently or would rather dig into the numbers yourself, you can quickly shape your own take in just a few minutes with Do it your way.

A great starting point for your Costco Wholesale research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Unlock even greater opportunities. There is a whole world of innovative companies beyond Costco waiting to boost your portfolio’s growth and potential rewards.

- Tap into the future of computing by reviewing these 28 quantum computing stocks, featuring pioneers pushing the envelope with quantum breakthroughs and industry-disrupting advancements.

- Secure a steady income stream by evaluating these 21 dividend stocks with yields > 3% that offer reliable yields and the potential to reinforce your financial stability.

- Get ahead of the curve in digital finance by researching these 81 cryptocurrency and blockchain stocks with exposure to blockchain innovation and cryptocurrency markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COST

Costco Wholesale

Engages in the operation of membership warehouses in the United States, Puerto Rico, Canada, Mexico, Japan, the United Kingdom, Korea, Australia, Taiwan, China, Spain, France, Iceland, New Zealand, and Sweden.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives