- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:COST

A Fresh Look at Costco (COST) Valuation Following Recent Momentum Shift

Reviewed by Simply Wall St

See our latest analysis for Costco Wholesale.

Costco’s slight dip this week follows a broader trend of cooling momentum, as its 30-day share price return is down 3.35% and gains year-to-date are now just 1.45%. Still, the company’s long-term performance remains impressive, with a 2.28% total shareholder return over the past year and a remarkable 162.66% gain over five years. This reminds investors why it is often viewed as a reliable name through market cycles.

If this shift in Costco’s momentum has you wondering what other companies are accelerating, this could be your opportunity to discover fast growing stocks with high insider ownership

With Costco’s latest pullback and robust long-term track record, the big question now is whether the recent drop leaves shares undervalued, or if expectations for future growth are already reflected in the current price?

Most Popular Narrative: 12.9% Undervalued

Costco’s most widely followed narrative puts fair value well above its last close, hinting that the market may still be underestimating future upside. This perspective contrasts strong operational execution with a premium price tag and draws from a broad analyst consensus.

Costco plans to continue expanding its warehouse locations, with 28 new openings planned for fiscal year 2025. This expansion is likely to increase membership and sales volume, driving revenue growth.

Want to know the growth blueprint behind this high valuation? The key element of this narrative is record-breaking earnings and a future profit multiple usually associated with tech leaders. Interested in which bold financial projections support that price target? Dive deeper to see the surprising numbers that drive this fair value calculation.

Result: Fair Value of $1,059.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising labor costs or unfavorable currency movements could squeeze Costco’s margins and challenge the prevailing bullish narrative in the future.

Find out about the key risks to this Costco Wholesale narrative.

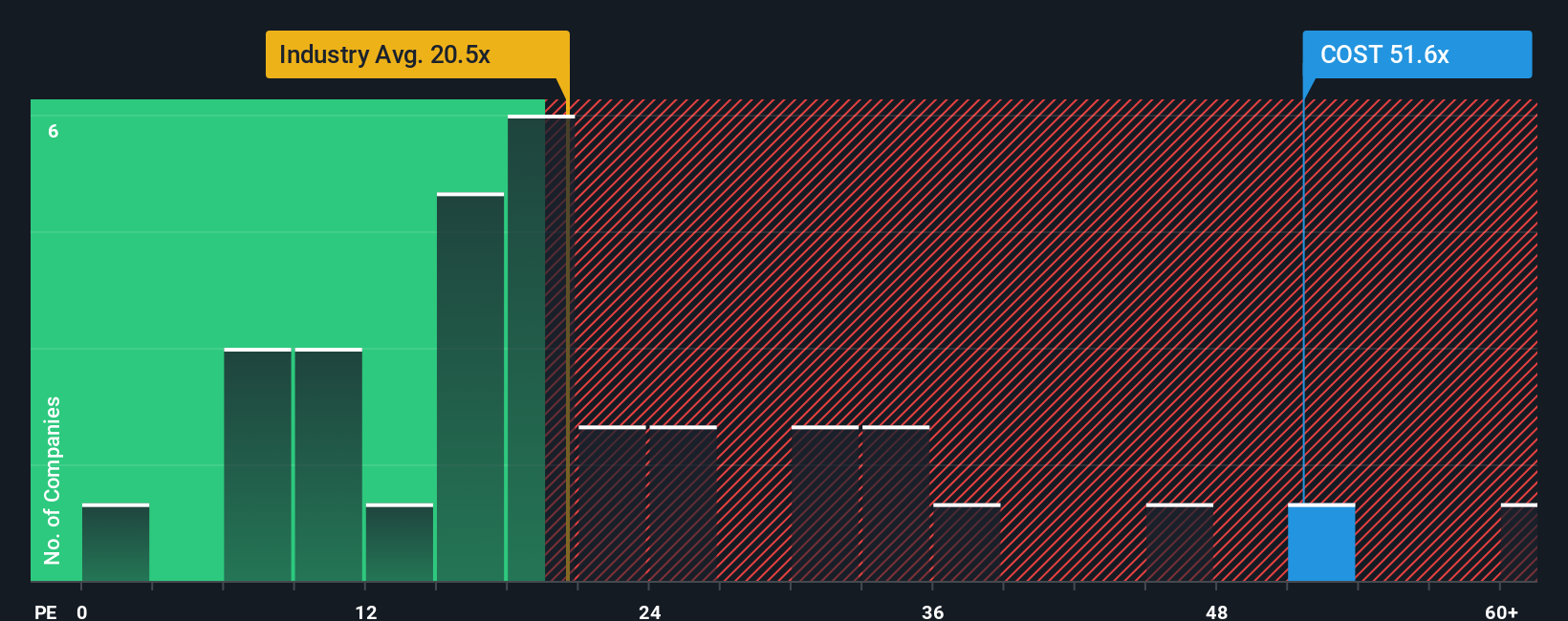

Another View: Valuation by Earnings Ratio

Looking at Costco’s price-to-earnings ratio offers a different angle. Shares trade at 50.5 times earnings, which is much higher than both the consumer retail industry average of 19.8x and the peer average of 22.4x. The fair ratio, calculated at 33.3x, suggests Costco is currently expensive by this metric. This large gap hints at increased valuation risk if market sentiment cools. Can these premium expectations truly last?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Costco Wholesale Narrative

Prefer to see things for yourself or have a different perspective? You can dig into the figures and shape your own narrative in under three minutes. Just Do it your way.

A great starting point for your Costco Wholesale research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for Your Next Great Investment?

Don’t let opportunity pass you by. Tap into powerful, tailored stock ideas beyond Costco. With these smart screens, you could uncover tomorrow’s outperformers today.

- Capture steady income streams when you check out these 16 dividend stocks with yields > 3% packed with companies offering yields above 3% and robust fundamentals.

- Spot hidden gems gaining momentum and strong backing by exploring these 3592 penny stocks with strong financials for businesses with impressive financial strength in a fast-moving market.

- Find undervalued gems flying under most investors’ radar by reviewing these 878 undervalued stocks based on cash flows for stocks primed for a potential re-rating based on solid cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COST

Costco Wholesale

Engages in the operation of membership warehouses in the United States, Puerto Rico, Canada, Mexico, Japan, the United Kingdom, Korea, Australia, Taiwan, China, Spain, France, Iceland, New Zealand, and Sweden.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives