- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:CASY

What Casey's General Stores (CASY)'s Rising Hedge Fund Interest and Reinvestment Means for Shareholders

Reviewed by Sasha Jovanovic

- Earlier this year, ClearBridge Mid Cap Strategy highlighted Casey’s General Stores for its extensive reinvestment in stores over the past decade, citing improvements in same-store sales and customer loyalty during a period of contraction for gas volumes across the sector.

- An increase in hedge fund portfolios holding Casey’s, up from 35 to 47 by the end of the second quarter, signals greater institutional confidence, setting the company apart from sector peers facing broader pressure.

- We'll explore how this growing institutional interest and effective reinvestment strategy may influence Casey’s investment outlook and future growth narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Casey's General Stores Investment Narrative Recap

To own shares of Casey’s General Stores, you need to believe in the company’s ability to keep growing despite headwinds in fuel sales and regional economic exposure. The recent recognition from ClearBridge and notable hedge fund attention highlight confidence in Casey’s robust reinvestment approach, but these developments do not materially change the core catalysts at play or the most immediate risks, particularly the challenge of integrating newly acquired stores and driving meaningful margin gains.

One recent announcement that ties closely to these trends is Casey’s guidance reaffirmation in September, which forecasted steady inside same-store sales growth of 2% to 5% and stable margins. This aligns with the continued focus on expanding prepared foods and in-store offerings, a key catalyst that could influence both short-term results and longer-term growth, especially as new and remodeled stores ramp up operations.

Yet, investors should keep in mind that, despite promising signals, integration risks tied to recent acquisitions remain front and center…

Read the full narrative on Casey's General Stores (it's free!)

Casey's General Stores' outlook anticipates $19.5 billion in revenue and $760.7 million in earnings by 2028. This is based on a projected 6.0% annual revenue growth rate and represents a $179 million earnings increase from the current earnings of $581.7 million.

Uncover how Casey's General Stores' forecasts yield a $585.85 fair value, a 10% upside to its current price.

Exploring Other Perspectives

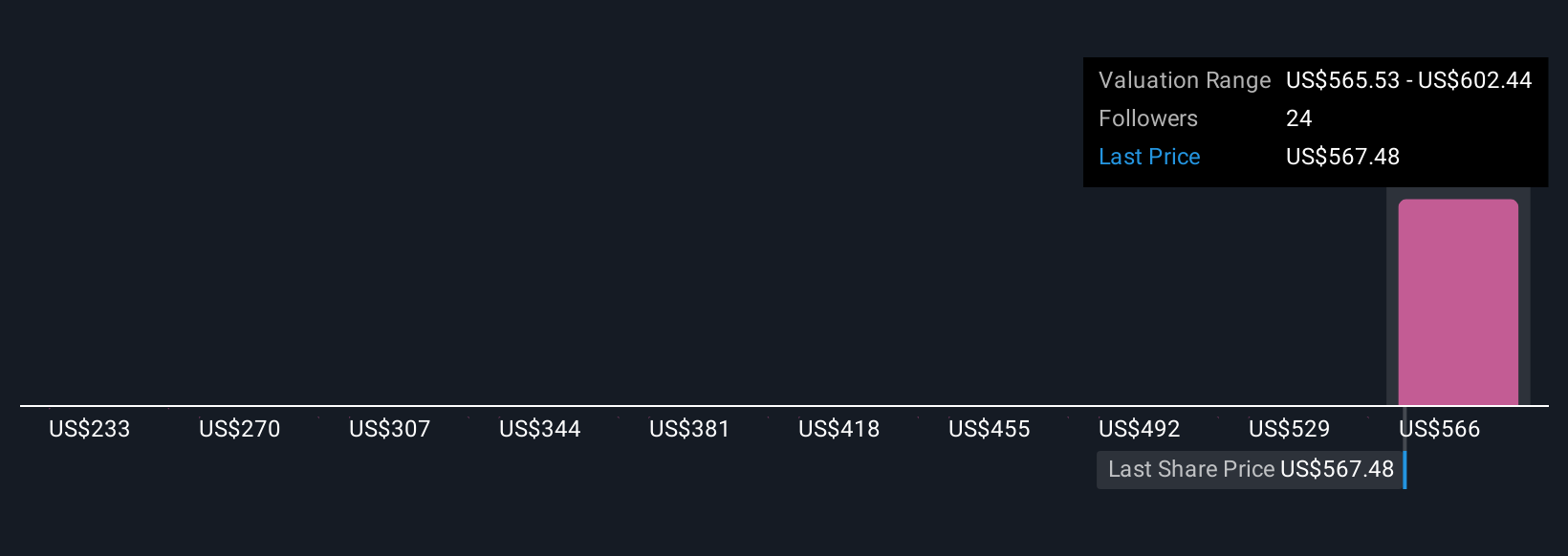

Fair value estimates from four Simply Wall St Community members range widely from US$233.38 up to US$605.04 per share. Opinions vary significantly as many weigh Casey’s ongoing integration of acquired stores and margin potential, which may affect growth expectations in the eyes of different market participants.

Explore 4 other fair value estimates on Casey's General Stores - why the stock might be worth less than half the current price!

Build Your Own Casey's General Stores Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Casey's General Stores research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Casey's General Stores research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Casey's General Stores' overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CASY

Casey's General Stores

Operates convenience stores under the Casey's and Casey’s General Store names in the United States.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives