- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:CART

Instacart (CART): Evaluating Valuation After TikTok Advertising Partnership Announcement

Reviewed by Kshitija Bhandaru

Maplebear (CART) set the stage for new digital advertising options by announcing a partnership with TikTok. This collaboration enables select brands to use its retail media network data directly inside TikTok’s ad platform.

See our latest analysis for Maplebear.

The TikTok integration builds on a string of tech partnerships for Maplebear, including its recent tie-up with Advantage Solutions. Despite these innovations, the momentum has slipped, with a 30-day share price return of -17.4% and a total shareholder return of -10.6% over the past year. Investors are watching closely to see if these moves translate into renewed growth or further volatility.

If Maplebear’s latest digital strategy sparked your curiosity, now is a good moment to broaden your investing horizons and discover fast growing stocks with high insider ownership

With the stock now trading at a deep discount to analyst price targets, investors face a key question: Is Maplebear undervalued after its decline, or is the market already factoring in stronger growth ahead?

Most Popular Narrative: 34.8% Undervalued

Maplebear closed at $38.31, but the most popular narrative puts its fair value much higher. This gap could fuel debate about near-term potential. The narrative’s thesis supports this premium with forward-looking assumptions and ambitious quantitative targets.

Deepening enterprise partnerships and a growing suite of omnichannel retailer integrations (such as Storefront, Carrot Ads, Caper Carts, Carrot Tags) are increasing stickiness with major retail chains, creating new recurring revenue streams and driving higher-margin, non-transaction-based revenues (e.g., advertising, in-store tech). This makes the business model less volatile and supports sustainable margin expansion and earnings resilience.

Want to know which big bets and financial growth levers the narrative believes will unlock this upside? Key factors include highly optimistic revenue, earnings, and margin assumptions, plus a bold profit multiple outpacing industry norms. Eager to uncover what’s powering this bullish forecast? Dive in for the full picture.

Result: Fair Value of $58.72 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory changes or increased competition could put pressure on Maplebear’s margins and add uncertainty to its long-term growth story.

Find out about the key risks to this Maplebear narrative.

Another View: What Do the Ratios Say?

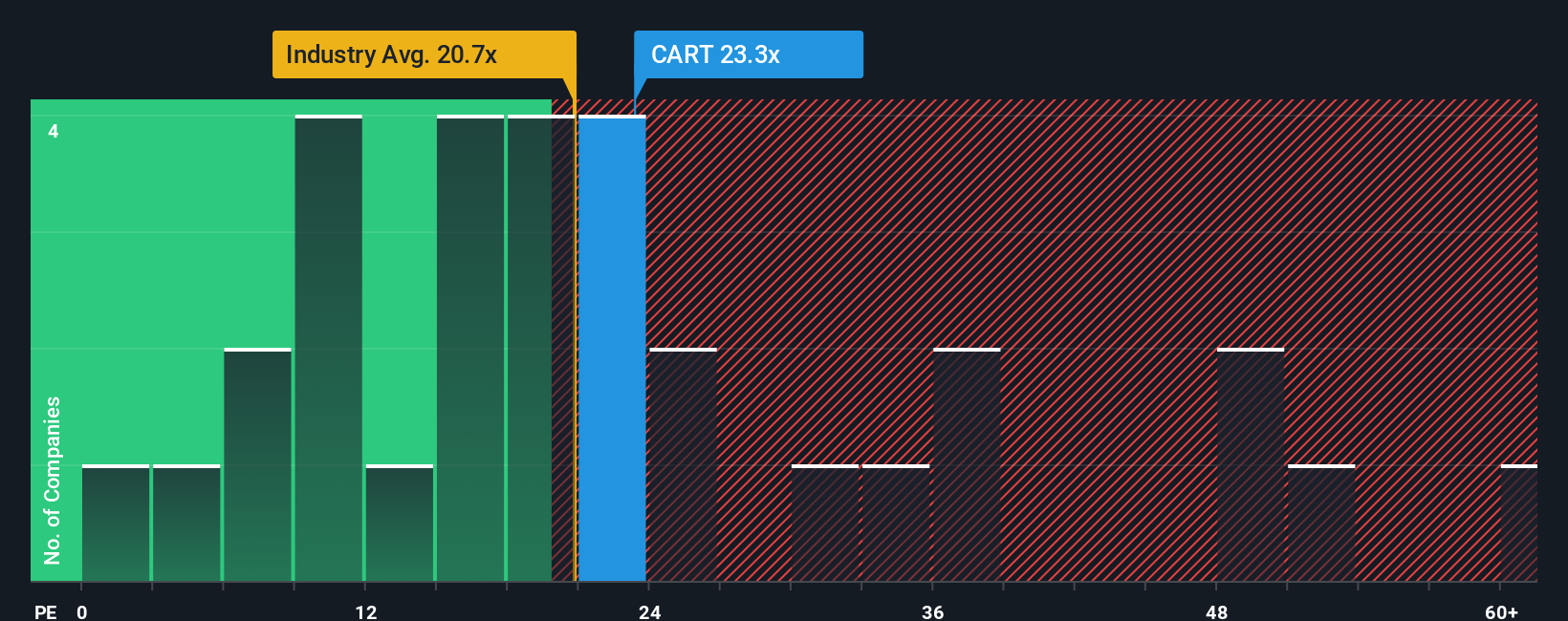

Looking at Maplebear through the lens of its price-to-earnings ratio tells a different story. The company trades at 21.1x, a premium compared to the industry average of 20.5x and its peer average of 20.7x. Yet, this remains below the fair ratio of 22.1x, which suggests limited room for further upward re-rating. If the market moves toward the fair ratio, how much upside could be left?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Maplebear Narrative

If you have a different perspective or want to reach your own conclusion with fresh data, you can create your personalized narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Maplebear.

Looking for More Investment Ideas?

Time your next move with confidence. Spot under-the-radar opportunities and stay ahead of market trends so you don't let the best ideas slip by unnoticed.

- Boost your portfolio with reliable income by checking out these 19 dividend stocks with yields > 3% offering steady yields above 3%.

- Tap into industry-changing innovation by tracking these 24 AI penny stocks blazing a trail in artificial intelligence and automation.

- Uncover exceptional value by targeting these 891 undervalued stocks based on cash flows primed for growth based on powerful cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CART

Maplebear

Maplebear Inc., doing business as Instacart, engages in the provision of online grocery shopping services to households in North America.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives