- United States

- /

- Luxury

- /

- NYSE:ZGN

Will Analyst Attention Drive Zegna’s (ZGN) Direct-to-Consumer Growth Ambitions?

Reviewed by Sasha Jovanovic

- In October 2025, multiple major investment banks, including Jefferies and JPMorgan Chase & Co., initiated coverage of Ermenegildo Zegna, expressing increased analyst attention toward the luxury apparel group and its brands.

- This wave of analyst coverage highlights growing institutional interest and may signal shifting sentiment within the luxury fashion sector regarding Zegna's long-term positioning.

- Let's assess how this heightened analyst focus could influence Ermenegildo Zegna's near-term investment narrative and its ongoing direct-to-consumer expansion.

Find companies with promising cash flow potential yet trading below their fair value.

Ermenegildo Zegna Investment Narrative Recap

To be a shareholder in Ermenegildo Zegna, you need to believe in the company’s ability to drive growth through its direct-to-consumer expansion and high-end menswear positioning despite global challenges, such as softness in Greater China and wholesale channel declines. The recent uptick in analyst coverage reflects elevated institutional interest, but it is not expected to materially change the near-term catalyst, which remains the successful scaling of direct-to-consumer sales. The biggest risk for Zegna continues to be revenue pressure in the Greater China region, a key market for the brand.

Of the latest developments, the private placement of treasury shares in July 2025 stands out for its potential to support investment in store expansion and brand-building. This influx of US$126.38 million complements Zegna’s drive to accelerate direct sales and broaden its reach to new customer bases, reinforcing the ongoing direct-to-consumer strategy cited as the core growth catalyst.

By contrast, investors should not overlook how sustained weakness in Greater China could introduce volatility to revenue forecasts even as sentiment improves…

Read the full narrative on Ermenegildo Zegna (it's free!)

Ermenegildo Zegna is projected to reach €2.2 billion in revenue and €127.2 million in earnings by 2028. This outlook assumes a 3.4% annual revenue growth rate and a €50.1 million increase in earnings from the current €77.1 million.

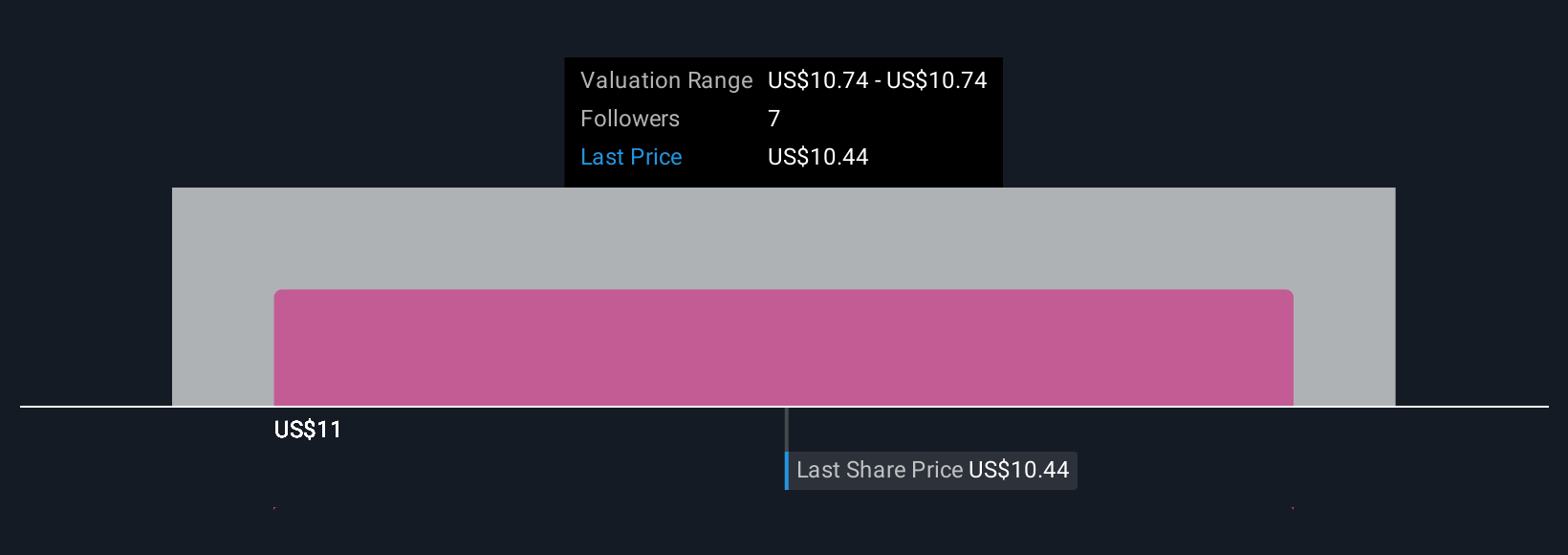

Uncover how Ermenegildo Zegna's forecasts yield a $10.74 fair value, a 3% upside to its current price.

Exploring Other Perspectives

Only one Simply Wall St Community member has provided a fair value estimate for Zegna, at US$10.74. While new analyst coverage could boost the near-term outlook, persistent risks in key markets remain important for reviewing future performance.

Explore another fair value estimate on Ermenegildo Zegna - why the stock might be worth as much as $10.74!

Build Your Own Ermenegildo Zegna Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ermenegildo Zegna research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Ermenegildo Zegna research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ermenegildo Zegna's overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ermenegildo Zegna might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZGN

Ermenegildo Zegna

Designs, manufactures, markets, and distributes luxury menswear and womenwear, children’s clothing, footwear, leather goods, and other accessories worldwide.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives