- United States

- /

- Luxury

- /

- NYSE:WWW

Wolverine World Wide (WWW): Exploring Valuation After Merrell and Gramicci Debut the Moab 2 Siren Collaboration

Reviewed by Simply Wall St

Wolverine World Wide (WWW) has drawn investor interest following a fresh collaboration between its Merrell brand and Gramicci. The new Moab 2 Siren hiking boot combines Merrell’s heritage with Gramicci’s innovative approach to apparel and design.

See our latest analysis for Wolverine World Wide.

Momentum has been building for Wolverine World Wide, with recent excitement around the Merrell-Gramicci launch adding a spark to the story. While the stock experienced a 5.5% drop in its latest trading day, it is still sitting on a 15.6% share price gain year-to-date and boasts a standout 68.8% total shareholder return over the last twelve months. Growth potential and changing risk perceptions are clearly on investors’ minds as the company enters its next earnings season.

If you want to broaden your investing radar beyond the outdoor footwear space, now could be a great time to discover fast growing stocks with high insider ownership.

With shares still trading at a sizable discount to analyst targets, the question for investors is whether Wolverine World Wide remains underrated or if an impressive year has already captured all the future upside.

Most Popular Narrative: 22.4% Undervalued

Wolverine World Wide’s most popular narrative suggests the shares are trading well below what analysts see as fair value compared to the last close price of $26.14. This view draws on the company’s aggressive revenue ambitions and transformation efforts, indicating a potential gap between the current price and projected future performance.

Wolverine is capitalizing on growing demand for branded footwear globally by expanding Saucony and Merrell into new international markets and activating key cities (for example, Tokyo, Paris, London), which is expected to boost revenue growth and diversify geographic exposure. The company is executing a digital transformation, prioritizing direct-to-consumer (DTC) channels, enhancing digital experiences, and launching branded apps (such as Sweaty Betty in the UK) to drive higher-margin sales and improve earnings quality.

Curious how analysts reach their bullish fair value? The details are in bold revenue targets, rising margins, and optimistic profit assumptions. Wondering what market dynamics or numbers drive this narrative confidence? Dive in to see which future milestones are factored in and which ones may surprise you.

Result: Fair Value of $33.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent reliance on wholesale channels and sluggish legacy brand growth could quickly alter Wolverine World Wide’s bullish outlook if trends reverse.

Find out about the key risks to this Wolverine World Wide narrative.

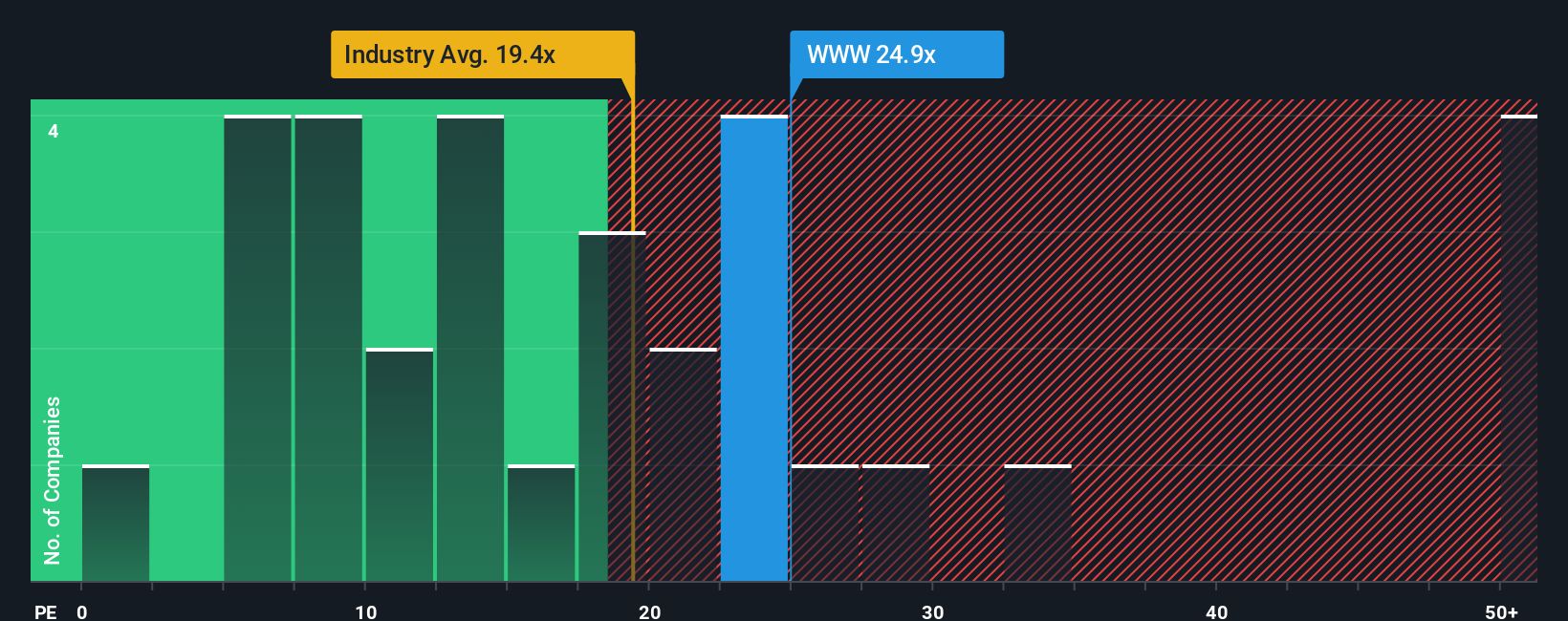

Another View: Market Ratios Tell a Different Story

Looking at common market ratios, Wolverine World Wide appears expensive compared to its industry and peers. Its price-to-earnings ratio of 25.3x is above the average for similar companies and is also above its own fair ratio of 24.3x. This higher-than-average valuation could reflect optimism, but also means there is less room for upside if expectations moderate. Does this premium suggest unseen strength, or simply raise the stakes for any slip in performance?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Wolverine World Wide Narrative

If these views do not quite resonate or you would rather dive into the numbers yourself, you can craft your own personalized analysis in just a few minutes. Do it your way.

A great starting point for your Wolverine World Wide research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Serious about elevating your portfolio? The right opportunities are out there, but you need the tools to find them before everyone else. Start building your edge with these handpicked stock screens:

- Unlock steady potential and boost your income with these 17 dividend stocks with yields > 3%, which offers attractive yields above 3%.

- Capitalize on breakthroughs and growth in healthcare technology through these 33 healthcare AI stocks, which is already transforming patient outcomes and medical innovation.

- Capture big moves in the digital asset space by reviewing these 80 cryptocurrency and blockchain stocks, a tool at the forefront of cryptocurrency and blockchain advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wolverine World Wide might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WWW

Wolverine World Wide

Designs, manufactures, sources, markets, licenses, and distributes footwear, apparel, and accessories in the United States, Europe, the Middle East, Africa, the Asia Pacific, Canada and Latin America.

Established dividend payer with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives