- United States

- /

- Insurance

- /

- NYSE:BOW

3 US Stocks Estimated To Be Trading At Discounts Ranging From 13% To 41%

Reviewed by Simply Wall St

In the midst of geopolitical tensions and fluctuating market indices, the U.S. stock market is experiencing a cautious sentiment as investors react to recent earnings reports and global developments. Despite these uncertainties, opportunities may arise for discerning investors who focus on identifying stocks that are potentially undervalued, offering a chance to invest in companies trading at significant discounts relative to their intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| First National (NasdaqCM:FXNC) | $23.30 | $46.25 | 49.6% |

| Capital Bancorp (NasdaqGS:CBNK) | $27.37 | $53.44 | 48.8% |

| West Bancorporation (NasdaqGS:WTBA) | $23.58 | $46.82 | 49.6% |

| Business First Bancshares (NasdaqGS:BFST) | $28.12 | $55.07 | 48.9% |

| Five Star Bancorp (NasdaqGS:FSBC) | $32.35 | $63.87 | 49.4% |

| Afya (NasdaqGS:AFYA) | $16.43 | $31.50 | 47.8% |

| Datadog (NasdaqGS:DDOG) | $125.97 | $243.25 | 48.2% |

| Advanced Energy Industries (NasdaqGS:AEIS) | $109.84 | $219.25 | 49.9% |

| WEX (NYSE:WEX) | $178.01 | $345.87 | 48.5% |

| Marcus & Millichap (NYSE:MMI) | $40.84 | $78.74 | 48.1% |

We'll examine a selection from our screener results.

ChromaDex (NasdaqCM:CDXC)

Overview: ChromaDex Corporation is a bioscience company that develops healthy aging products and has a market cap of $522.07 million.

Operations: ChromaDex's revenue is primarily derived from its Consumer Products segment at $71.72 million, followed by Ingredients at $16.95 million, and Analytical Reference Standards and Services at $3.00 million.

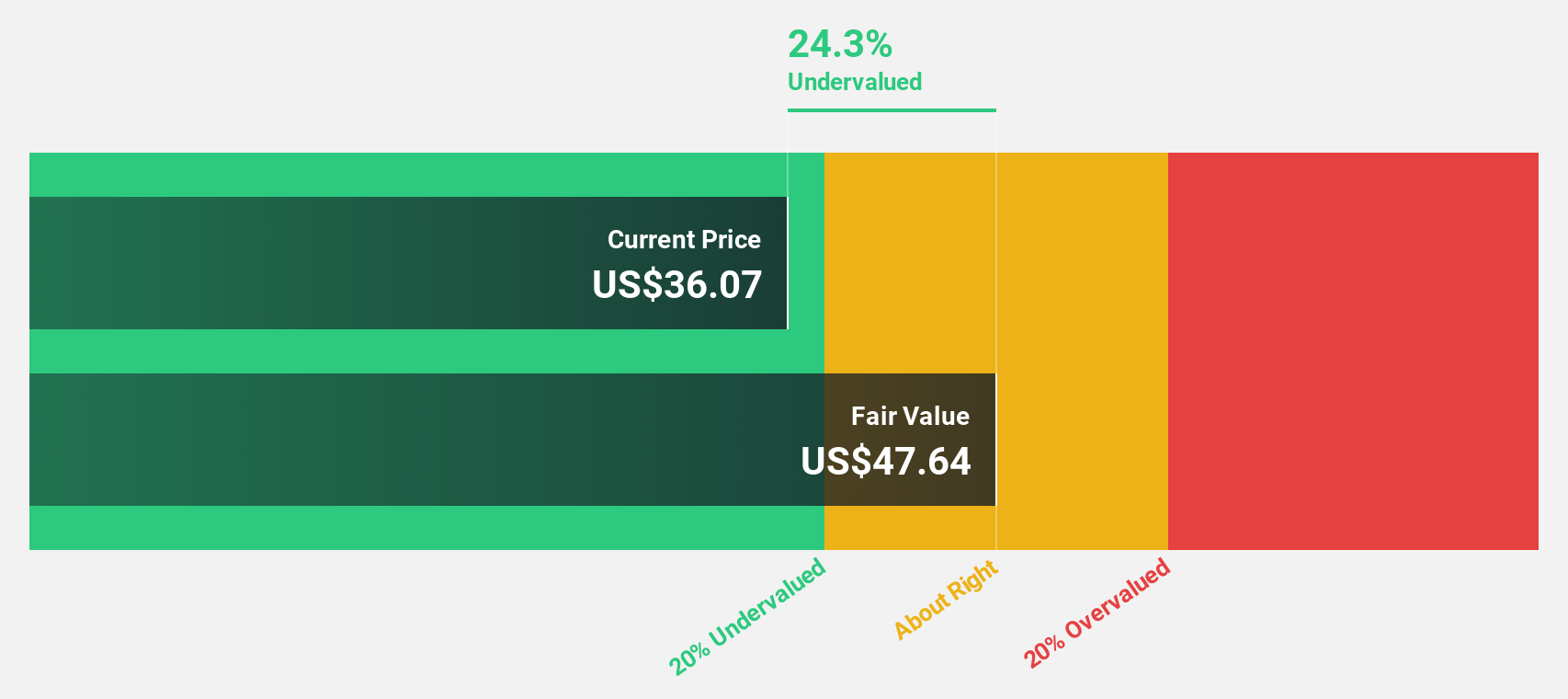

Estimated Discount To Fair Value: 13%

ChromaDex's recent profitability and revenue growth, highlighted by a Q3 sales increase to US$25.58 million, underscore its potential as an undervalued stock based on cash flows. Trading at US$7.27, it is below the estimated fair value of US$8.35, reflecting a 13% discount. The company's strategic expansion with Niagen IV enhances its market position and supports projected earnings growth of over 80% annually, outpacing broader market expectations for both revenue and profit growth.

- In light of our recent growth report, it seems possible that ChromaDex's financial performance will exceed current levels.

- Get an in-depth perspective on ChromaDex's balance sheet by reading our health report here.

Bowhead Specialty Holdings (NYSE:BOW)

Overview: Bowhead Specialty Holdings Inc. offers specialty property and casualty insurance products in the United States and has a market cap of approximately $1.10 billion.

Operations: The company's revenue is derived from its specialty property and casualty insurance segment, totaling $389.14 million.

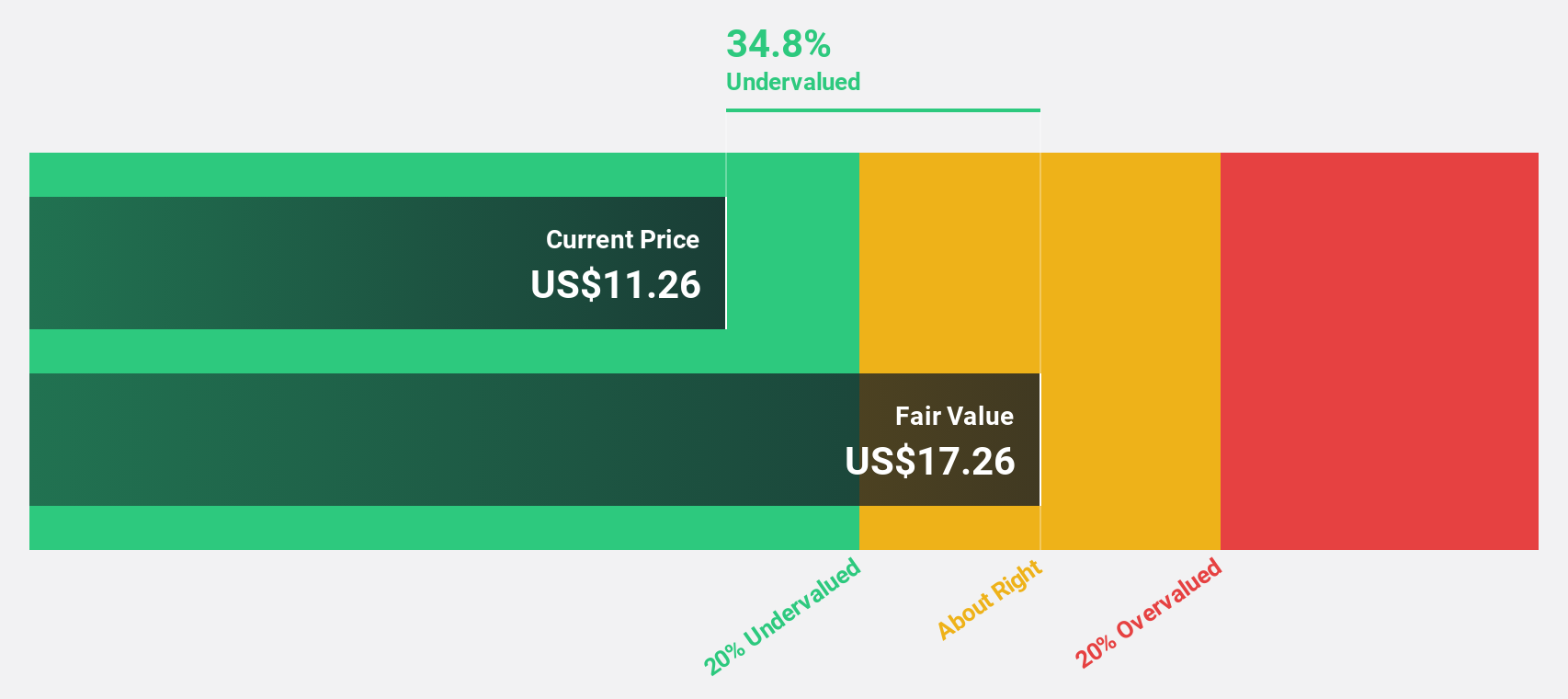

Estimated Discount To Fair Value: 25.8%

Bowhead Specialty Holdings, trading at US$33.72, is undervalued with an estimated fair value of US$45.44. The company reported a Q3 revenue increase to US$116.76 million from US$76.09 million last year and net income growth to US$12.09 million from US$8.71 million, reflecting strong cash flow potential. With projected earnings and revenue growth rates exceeding 36% and 21% annually respectively, Bowhead's financial outlook surpasses market averages significantly despite its low future return on equity forecast of 14.5%.

- The analysis detailed in our Bowhead Specialty Holdings growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of Bowhead Specialty Holdings.

VIZIO Holding (NYSE:VZIO)

Overview: VIZIO Holding Corp. operates in the United States through its subsidiaries, offering smart televisions, sound bars, and accessories, with a market cap of approximately $2.28 billion.

Operations: The company's revenue segments consist of $1.04 billion from Device sales and $700.30 million from Platform+ services.

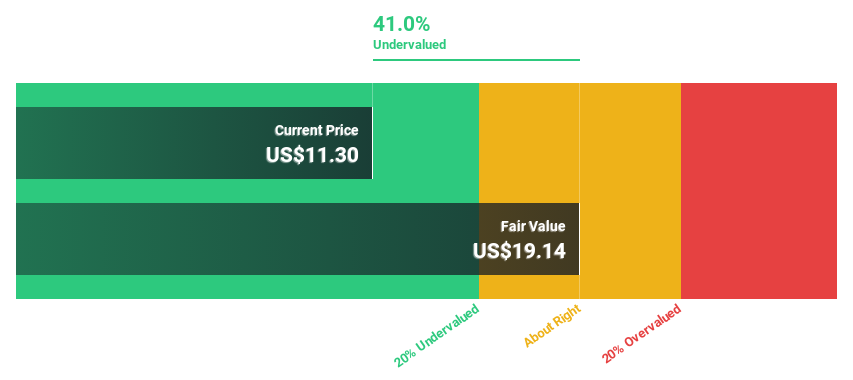

Estimated Discount To Fair Value: 41%

VIZIO Holding, trading at US$11.30, is significantly undervalued with a fair value estimate of US$19.14. Despite recent challenges, including a net income drop to US$0.5 million in Q3 2024 from US$13.8 million the previous year, its earnings are forecast to grow substantially by 58% annually over the next three years—outpacing market averages. However, profit margins have decreased to 0.1%, and shareholder dilution has occurred recently.

- Our expertly prepared growth report on VIZIO Holding implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of VIZIO Holding here with our thorough financial health report.

Summing It All Up

- Access the full spectrum of 197 Undervalued US Stocks Based On Cash Flows by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bowhead Specialty Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BOW

Bowhead Specialty Holdings

Provides specialty property and casualty insurance products in the United States.

High growth potential with excellent balance sheet.