- United States

- /

- Luxury

- /

- NYSE:VFC

V.F Corporation (VFC): Assessing Valuation After Lawsuits and Weak Vans Outlook Shake Investor Confidence

Reviewed by Simply Wall St

A wave of class action lawsuits has landed on V.F (VFC) after the company disclosed weaker growth for its Vans brand, along with a downbeat outlook in its fiscal 2025 results. These legal developments are raising questions for investors about management oversight and disclosure practices.

See our latest analysis for V.F.

The stream of legal challenges and disappointing guidance hit V.F’s stock hard, with the share price tumbling over 15% after the May disclosure and momentum remaining subdued. While the stock clawed back some gains recently, rising 13.8% on a 90-day basis, it still sits far below prior levels, with a year-to-date share price return of -29% and a 1-year total shareholder return of -12%. The longer-term picture is even starker, as the five-year total shareholder return stands at -75%, reflecting persistent headwinds and also hinting that sentiment could shift if management can deliver a credible turnaround.

If you’re weighing your next move or just curious about what’s working elsewhere, now is the perfect time to check out fast growing stocks with high insider ownership.

With the company’s valuation now at historic lows and future prospects clouded by recent lawsuits and leadership challenges, investors must ask whether the worst is already reflected in the price or if a genuine recovery could deliver outsized returns from this point.

Most Popular Narrative: 1.4% Undervalued

With the narrative’s fair value estimate of $15.49 slightly above the last close of $15.28, analysts see V.F as modestly undervalued. This tight gap suggests the stock now trades near what many believe is its justified level, following the recent volatility and legal challenges.

The strategic focus on expanding higher-margin channels, including direct-to-consumer and e-commerce, is beginning to drive improved gross margins and deeper customer engagement. These efforts are expected to lift both revenue growth and net margins over time as V.F. capitalizes on the sustained consumer shift toward digital and premium shopping experiences.

Want to see what powers this valuation? The forecast combines a dramatic profit turnaround, surging margins, and big expectations for global brand momentum. What’s the full model underpinning these numbers? Get all the answers in the full narrative.

Result: Fair Value of $15.49 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness at Vans or a failure to deliver sustained growth across premium brands could quickly undermine this optimistic outlook.

Find out about the key risks to this V.F narrative.

Another View: High Price Ratios Signal Caution

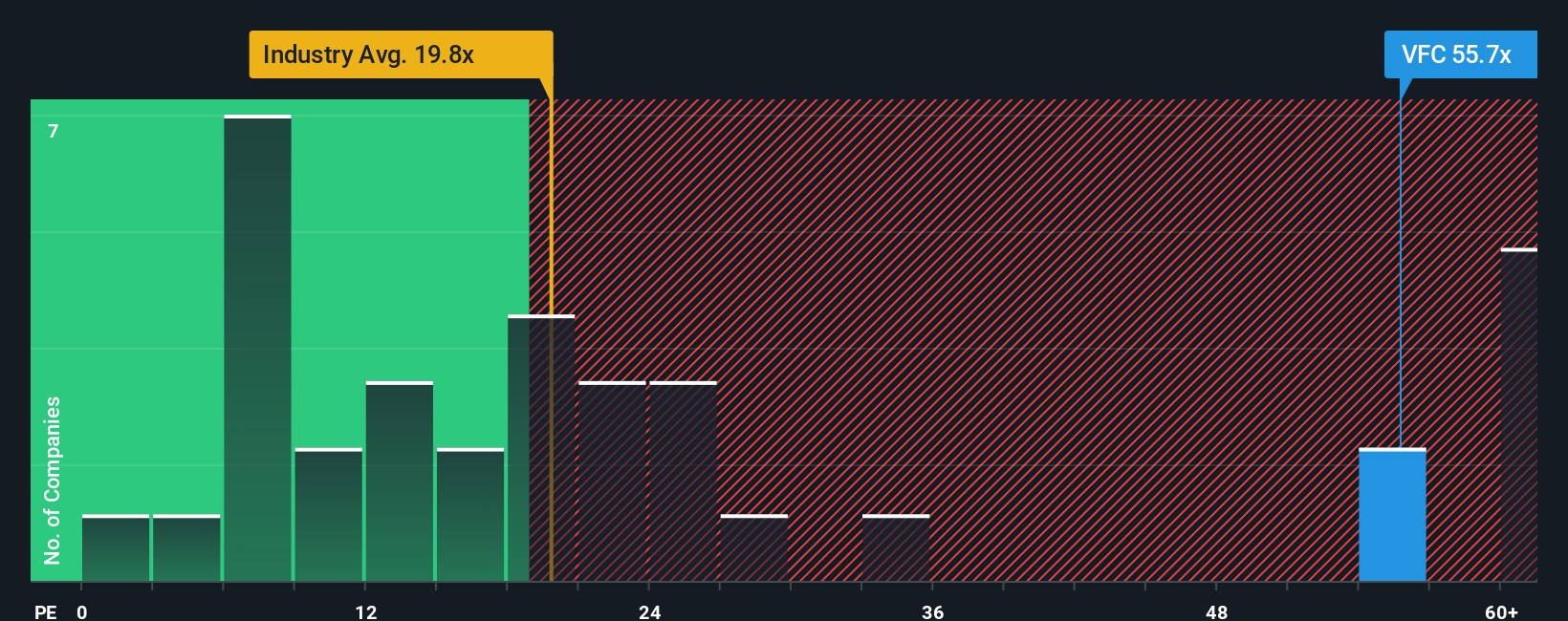

Looking from another angle, V.F’s shares are trading at a price-to-earnings ratio of 56.9 times, which is much higher than both the US Luxury industry average of 19.6 times and the peer average of 14.2 times. Even compared to the fair ratio of 29.2 times, V.F stands out as expensive. This raises the risk that if profit improvements do not materialize as expected, the stock could face further downside. Is the market already betting too much on a turnaround, or could these multiples compress quickly?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own V.F Narrative

If you have your own angle or prefer to dig into the numbers yourself, it takes just a few minutes to build your own story for V.F, so why not Do it your way.

A great starting point for your V.F research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let opportunity pass you by. Set yourself up for success by uncovering stocks with compelling growth stories using the Simply Wall Street Screener.

- Unlock potential long-term wealth by targeting regular income with these 17 dividend stocks with yields > 3% and stay ahead with yield-focused strategies.

- Seize the edge in future tech by harnessing breakthroughs through these 27 quantum computing stocks leading advancements in quantum computing and innovation.

- Cement your portfolio’s foundation with undervalued opportunities by turning to these 879 undervalued stocks based on cash flows based on real cash flow metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VFC

V.F

Offers branded apparel, footwear, and accessories for men, women, and children in the Americas, Europe, and the Asia-Pacific.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Community Narratives