- United States

- /

- Luxury

- /

- NYSE:VFC

Can Lawsuits Over Vans Disclosures Reshape V.F (VFC) Management’s Credibility and Strategic Narrative?

Reviewed by Sasha Jovanovic

- In the past week, multiple law firms announced class action lawsuits against V.F. Corporation, alleging the company and certain executives made materially false and misleading statements about its turnaround strategies and the financial health of the Vans brand between October 2023 and May 2025.

- A unique aspect of the case is that investor concerns escalated after the company disclosed a significant downturn in Vans' revenue growth and unexpected reset actions, which had not been fully communicated previously.

- We will now examine how these allegations of misleading turnaround disclosures, especially regarding Vans, could reshape V.F.'s investment narrative and risks.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

V.F Investment Narrative Recap

For V.F. shareholders, the central thesis rests on a successful turnaround, especially at Vans, through portfolio resets, direct-to-consumer expansion, and disciplined cost controls. The recent class action lawsuits alleging misleading statements about Vans and turnaround strategies squarely spotlight the key short-term catalyst (restoring sustainable growth at Vans) and intensify the risk that execution challenges or further credibility issues could undermine progress; these legal and reputational concerns are likely to be material for near-term sentiment and could complicate recovery efforts.

The lawsuit’s relevance is heightened by V.F.’s May 2025 earnings release, where the company acknowledged an unexpected revenue decline and reset actions at Vans, which triggered the steep stock price drop and now forms the basis for the litigation, placing both past turnaround optimism and future turnaround execution under closer scrutiny within the investor community.

By contrast, investors should be aware that ongoing execution risk tied to brand innovation and premiumization at Vans remains a...

Read the full narrative on V.F (it's free!)

V.F's narrative projects $10.3 billion in revenue and $571.3 million in earnings by 2028. This requires 2.6% yearly revenue growth and a $466.4 million increase in earnings from $104.9 million today.

Uncover how V.F's forecasts yield a $15.49 fair value, in line with its current price.

Exploring Other Perspectives

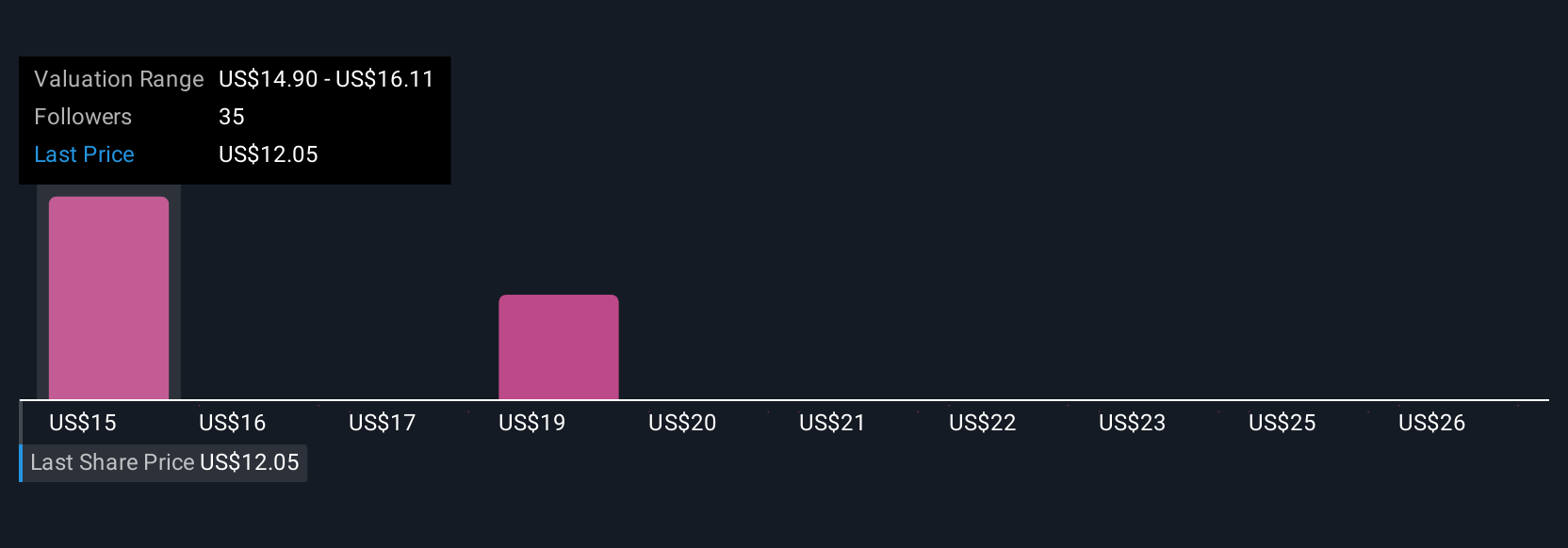

Eight fair value estimates from the Simply Wall St Community range from US$10 to US$27.85 per share, showing substantial differences in outlook. With legal and execution risks in focus, consider these varied viewpoints as you assess the company’s direction and future value.

Explore 8 other fair value estimates on V.F - why the stock might be worth as much as 81% more than the current price!

Build Your Own V.F Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your V.F research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free V.F research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate V.F's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VFC

V.F

Offers branded apparel, footwear, and accessories for men, women, and children in the Americas, Europe, and the Asia-Pacific.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Community Narratives