- United States

- /

- Luxury

- /

- NYSE:UAA

Is Under Armour A Bargain After Product Refresh And Recent Share Price Rebound?

Reviewed by Bailey Pemberton

- For investors wondering whether Under Armour at around $4.50 is a beaten-down bargain or a value trap, this breakdown outlines what the market might be overlooking.

- Despite a difficult longer term track record, with the share price still down 44.1% year to date and 74.0% over five years, the stock has recently bounced 4.6% over the last week and 7.1% over the last month, prompting some investors to revisit the story.

- Recent headlines have highlighted Under Armour refreshing its product lineup and brand positioning as the company seeks to rebuild momentum in a highly competitive athleticwear market. At the same time, ongoing commentary about inventory discipline and a more focused North America strategy has added nuance to how investors interpret the latest price moves.

- Within our framework, Under Armour scores a 3 out of 6 valuation checks, which suggests there may be pockets of undervaluation. In the sections ahead, we walk through multiple valuation approaches, then conclude with a more holistic way to think about what the stock may be worth.

Find out why Under Armour's -47.4% return over the last year is lagging behind its peers.

Approach 1: Under Armour Discounted Cash Flow (DCF) Analysis

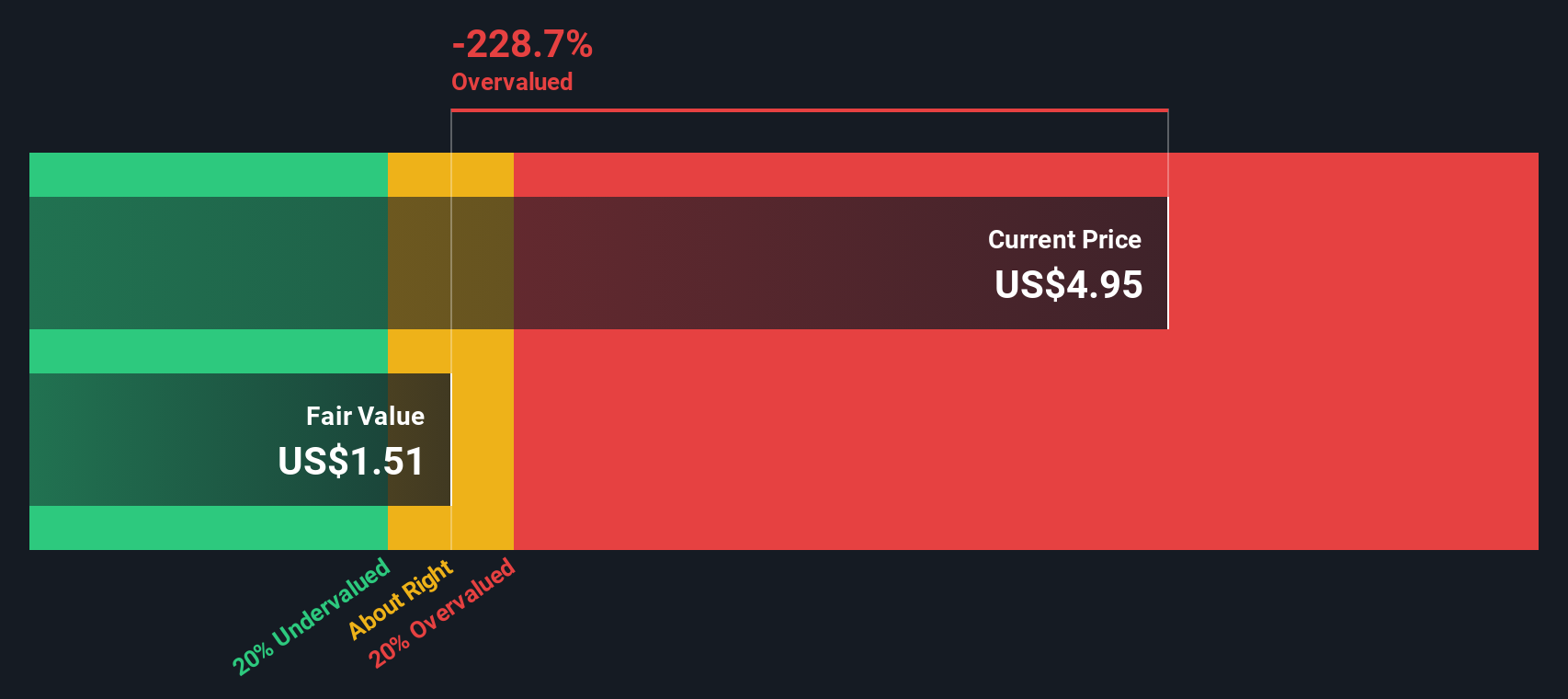

A Discounted Cash Flow model estimates what a business is worth by projecting its future cash flows and discounting them back to today in $ terms. For Under Armour, the 2 Stage Free Cash Flow to Equity model starts from last twelve month free cash flow of about $48 Million, which is currently negative, and then uses analyst forecasts and longer term assumptions to map a path back to positive territory.

Analysts see free cash flow still in the red at around $43 Million in 2026, before swinging to roughly $120 Million in 2027. Beyond the explicit analyst horizon, Simply Wall St extrapolates more modest growth, projecting free cash flow of about $51 Million by 2035. When all those future cash flows are discounted back to today, the model suggests an intrinsic value of roughly $1.11 per share, implying the stock is about 308.9% overvalued versus the current price near $4.50.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Under Armour may be overvalued by 308.9%. Discover 913 undervalued stocks or create your own screener to find better value opportunities.

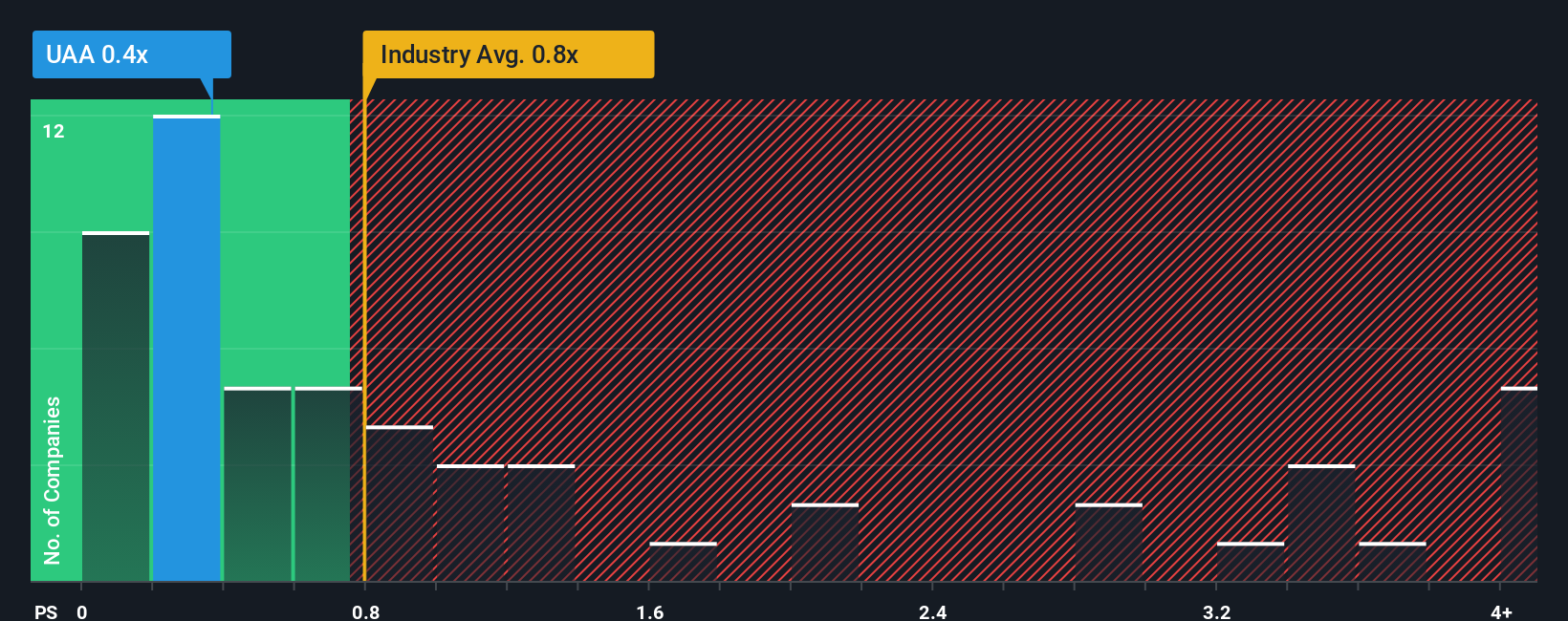

Approach 2: Under Armour Price vs Sales

For companies like Under Armour where profitability is uneven, price to sales is often a more reliable yardstick than earnings based metrics because it focuses on the scale of the business rather than volatile net income. In general, higher growth and lower perceived risk justify a richer sales multiple. In contrast, slower or uncertain growth and competitive pressures tend to cap what investors are willing to pay per dollar of revenue.

Under Armour currently trades on a price to sales ratio of about 0.38x, which is roughly half the Luxury industry average of 0.74x and well below the peer group average of around 1.28x. Simply Wall St’s Fair Ratio framework goes a step further by estimating what a reasonable multiple should be, given Under Armour’s specific mix of revenue growth, margins, competitive position, size, and risk profile. For UAA, that Fair Ratio is 0.89x, implying the stock would command a higher multiple if it traded in line with its fundamentals rather than headline comps alone.

Because the current 0.38x multiple sits meaningfully below the 0.89x Fair Ratio, the price to sales view points to the shares being undervalued on this metric.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1463 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Under Armour Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, an easy tool on Simply Wall St’s Community page that lets you attach your own story about a company to the numbers you believe in. You can link that story to a detailed forecast for revenue, earnings and margins, and then translate it into a Fair Value you can compare with today’s share price to decide whether to buy, hold, or sell. That Fair Value automatically refreshes as new news, earnings or guidance arrives. For example, one Under Armour investor might build a bullish Narrative around margin recovery, steady digital growth and a Fair Value closer to the top analyst target near $13.80. A more cautious investor could frame a bearish Narrative that assumes persistent tariff pressure, slower sales and a Fair Value closer to the low end around $4.00. Both investors would be using the same platform but different stories to drive clearer, more confident decisions.

Do you think there's more to the story for Under Armour? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UAA

Under Armour

Engages developing, marketing, and distributing performance apparel, footwear, and accessories for men, women, and youth.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion