- United States

- /

- Luxury

- /

- NYSE:TPR

A Look at Tapestry (TPR) Valuation Following BTIG’s New Buy Rating and Brand Strength Focus

Reviewed by Kshitija Bhandaru

BTIG has just launched coverage on Tapestry (TPR), starting the retailer off with a Buy rating and drawing attention to the company’s ongoing brand momentum among its peers. Analyst initiations like this often get investors curious about a company’s valuation and future growth prospects.

See our latest analysis for Tapestry.

Tapestry’s share price has surged by 77.5% year-to-date, and its total shareholder return over the past year stands at an impressive 162.6%. This highlights strong momentum as investor confidence grows in the company’s sustained brand relevance and leadership moves. Recent recognition, such as the publication of "BAG MAN," which celebrates Coach’s transformation story, adds to the positive sentiment. However, the primary driver appears to be substantial gains as the fashion group sharpens its competitive edge.

If you’re interested in what else is gaining ground, now’s the perfect time to broaden your search and discover fast growing stocks with high insider ownership

But with shares rallying so sharply this year, the key question for investors is whether Tapestry remains undervalued at these levels, or if the market has already factored in its next phase of growth.

Most Popular Narrative: 1.3% Undervalued

With Tapestry’s current share price just under the narrative’s fair value estimate, expectations are tightly matched, yet the narrative sees more room for upside. Investors eye whether the company’s growing digital strength and international expansion can deliver on high future margin and earnings targets.

Ongoing investments in digital infrastructure, omnichannel capabilities, and data-driven customer engagement are expected to enable margin expansion and direct-to-consumer growth. This may enhance both revenue and net margins over the long term. Strong brand equity and product innovation (such as elevated AUR, full-price selling, and blockbuster product launches) are delivering higher average selling prices and gross margin expansion. There may be further upside as premiumization and experiential demand strengthen globally.

What really sets this valuation apart? The narrative’s fair value hinges on a set of aggressive growth drivers and ambitious margin targets, amplified by expectations for stronger brand loyalty worldwide. There is a carefully calculated foundation behind these numbers; unlock it to see the full picture.

Result: Fair Value of $118 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering risks remain, including ongoing tariff challenges and potential setbacks if key brands such as Coach lose their current momentum.

Find out about the key risks to this Tapestry narrative.

Another View: Is the Market Paying Too Much?

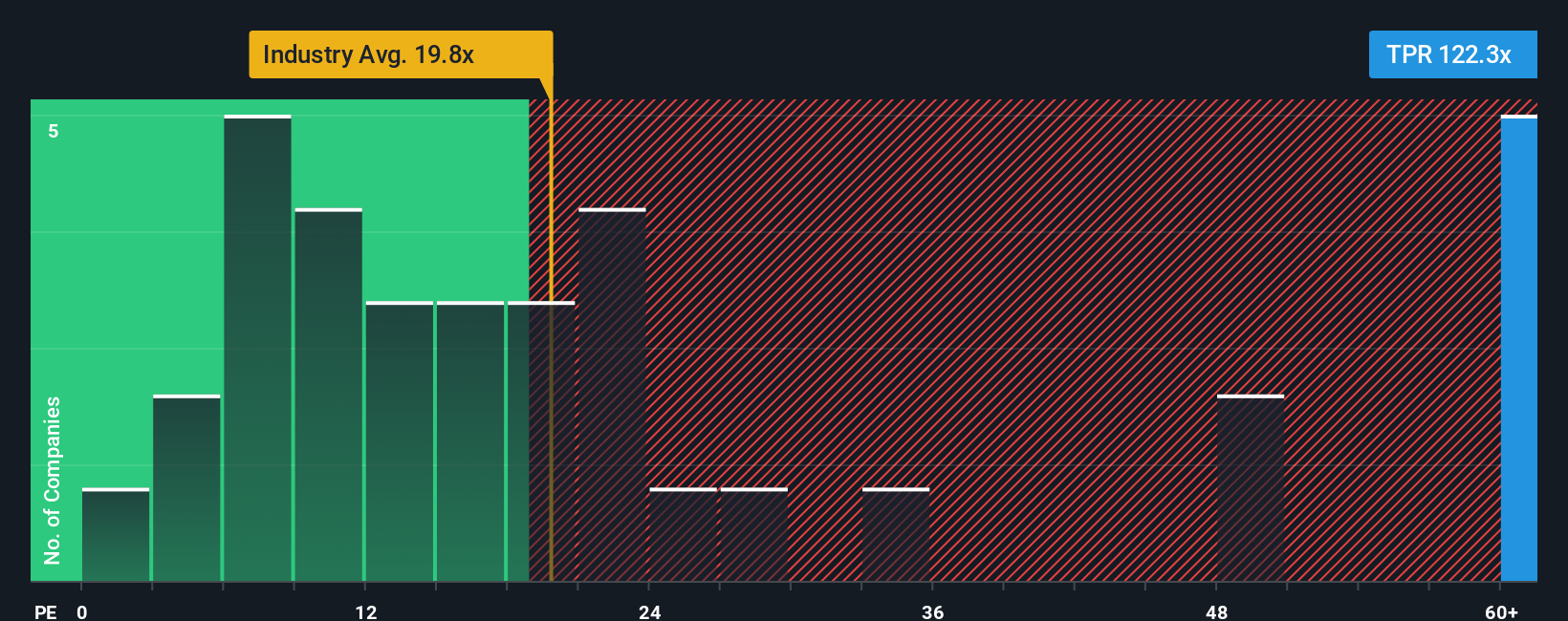

Looking at valuation from a different angle, Tapestry’s price-to-earnings ratio stands at 131.6x, which is far higher than both its industry average of 19.9x and a fair ratio estimate of 28.4x. This suggests the stock is priced aggressively, possibly leaving less room for upside if growth stalls. Is momentum enough to justify this premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tapestry Narrative

If you see things differently or favour your own analysis, you can quickly build your personal view based on the latest data in only a few minutes, and Do it your way.

A great starting point for your Tapestry research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Take control of your investment strategy by tapping into opportunities tailored to a variety of interests and goals, all powered by Simply Wall Street’s powerful screeners.

- Uncover the potential of artificial intelligence by checking out these 24 AI penny stocks driving advancements in technology and automation.

- Capture steady cash flow with these 20 dividend stocks with yields > 3% that offer yields over 3% for income-focused portfolios.

- Spot undervalued winners early with these 876 undervalued stocks based on cash flows and position yourself for the next wave of standout gains.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tapestry might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TPR

Tapestry

Provides accessories and lifestyle brand products in North America, Greater China, rest of Asia, and internationally.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives