- United States

- /

- Consumer Durables

- /

- NYSE:SN

SharkNinja (SN): Evaluating Value After Product Launch and JPMorgan’s Updated Holiday Outlook

Reviewed by Kshitija Bhandaru

SharkNinja (NYSE:SN) caught attention after rolling out the Ninja CRISPi PRO Countertop Glass Air Fryer. This is a timely product launch as retailers stay cautious with inventory and sales growth expectations for the quarter soften a bit.

See our latest analysis for SharkNinja.

SharkNinja’s headline-grabbing product launches and updated outlook from JPMorgan have kept investors watching closely. After a strong run earlier this year, the stock’s momentum has faded, with a 90-day share price return of -18.4% and total shareholder return over the past year at -13.8%. This suggests that investor sentiment is shifting toward caution as holiday sales approach and the company navigates retailer conservatism.

If you’re curious about what else is drawing attention among consumer brands, now’s a great moment to broaden your investing lens and discover fast growing stocks with high insider ownership

With shares currently trading at a substantial discount to analysts’ targets, but facing tempered sales forecasts, the question for investors is clear: is this a buying opportunity in disguise, or is future growth already fully reflected in SharkNinja’s price?

Most Popular Narrative: 30.9% Undervalued

With SharkNinja’s estimated fair value set at $135.84 and the last close at $93.92, this narrative implies a material valuation gap. Investors have a lot to consider as projected growth and margin improvements play a central role in the optimism behind this target.

"Commitment to an aggressive innovation pipeline, with increasing integration of connected, AI-powered, and automated features, aligns SharkNinja with the accelerating adoption of smart home technology. This expands its addressable market and supports sustained revenue and margin growth."

Want a look under the hood of this ambitious price tag? The most closely-watched assumptions include how fast SharkNinja’s earnings engine is projected to rev up and how premium those future profits could become. The real surprise is the profit and valuation hurdles this narrative expects the company to clear. Get the details before you draw your own conclusion.

Result: Fair Value of $135.84 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising manufacturing costs and renewed competition could challenge profit growth. These factors act as powerful counterweights to the bullish outlook on SharkNinja.

Find out about the key risks to this SharkNinja narrative.

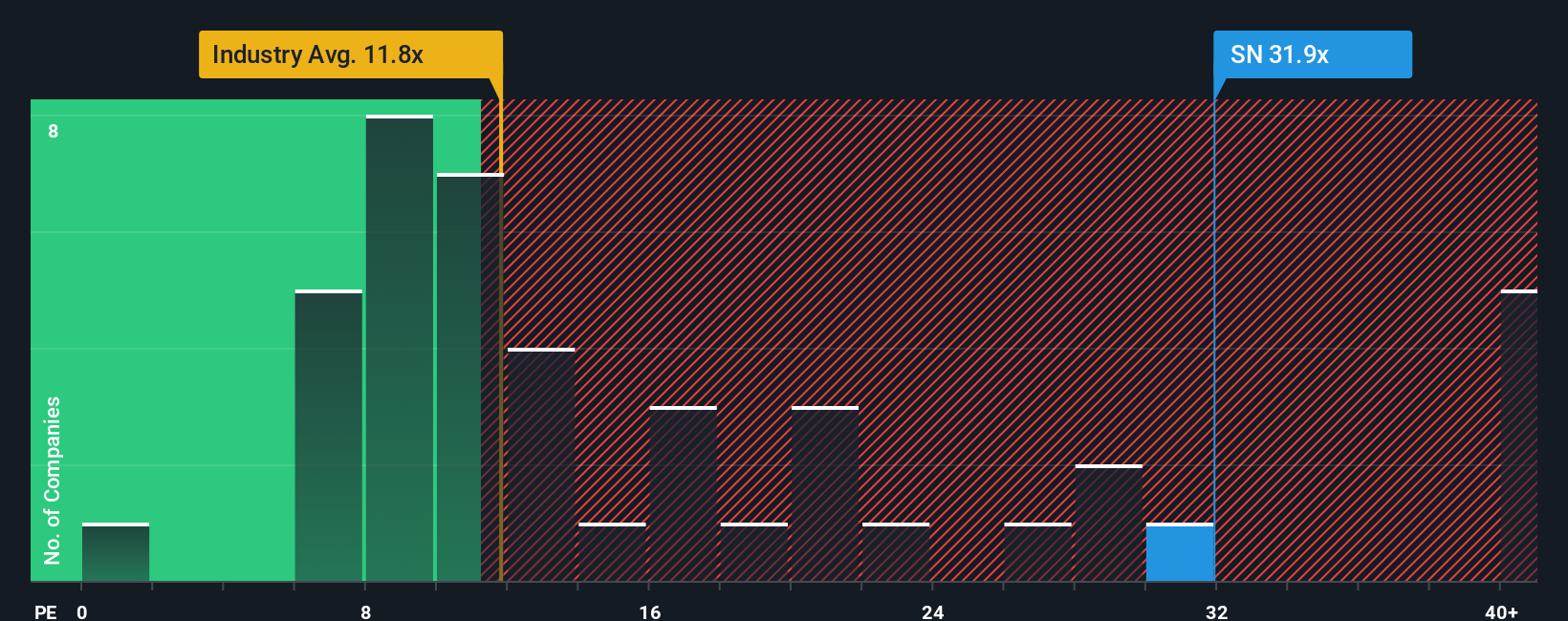

Another View: What Do Market Multiples Tell Us?

Taking a step back from the fair value model, SharkNinja’s price-to-earnings ratio stands at 25.6x. This is much higher than the US Consumer Durables industry average of 10.2x, and it is also above its fair ratio of 22.6x. While peers trade at 27.9x, investors are still paying a notable premium for SharkNinja, possibly introducing valuation risk if industry trends shift or company performance falls short. Could the market be overestimating the company's growth story, or is the premium justified?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SharkNinja Narrative

If this perspective does not quite fit your outlook or you are keen to run your own numbers, you can craft a personalized narrative in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding SharkNinja.

Looking for more investment ideas?

Smart investors do not wait for the crowd. Open up your investing playbook by seizing unique stock opportunities you might not have considered before.

- Catch high yields for your portfolio by tapping into these 18 dividend stocks with yields > 3% with impressive dividends above 3%.

- Capitalize on innovations transforming industries with these 24 AI penny stocks leading the way in artificial intelligence breakthroughs.

- Get ahead of Wall Street by spotting value in these 872 undervalued stocks based on cash flows that the broader market has yet to fully appreciate.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SN

SharkNinja

A product design and technology company, engages in the provision of various solutions for consumers in the United States, China, and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives