- United States

- /

- Consumer Durables

- /

- NYSE:SN

SharkNinja (SN): Evaluating Valuation Following Launch of Advanced Robot Vacuum, Mop, and Upgraded Glass Air Fryer

Reviewed by Simply Wall St

SharkNinja (SN) just rolled out two new products that could shake up the smart-home and kitchen appliance scene. The company’s latest robot vacuum and AI-powered mop, along with an upgraded glass air fryer, showcase how innovation remains central to its strategy.

See our latest analysis for SharkNinja.

SharkNinja’s burst of innovation arrives as the company navigates a mixed period for shareholders. After a solid run-up earlier this year, the latest product announcements have yet to translate into sustained market momentum. The year-to-date share price return is nearly flat, and the 1-year total shareholder return is -12.94%. Recent launches may help shift sentiment if they spark renewed growth or alter perceptions about the company’s long-term potential.

If new tech in household appliances has you curious, this could be the perfect moment to broaden your horizons and discover fast growing stocks with high insider ownership

With SharkNinja’s shares trading at a meaningful discount to analyst price targets while recent results remain muted, investors now face a key question: is there a compelling buying opportunity here, or is future growth already reflected in the price?

Most Popular Narrative: 28.8% Undervalued

SharkNinja's most popular narrative sees a fair value of $135.84, which is well above the last close at $96.75. This significant gap spotlights bullish expectations, but what’s really driving the thesis?

Rapid expansion of new product categories, such as beauty technology and outdoor appliances, positions SharkNinja to capture fresh demand fueled by consumer focus on health, wellness, and convenience, supporting above-market revenue growth and higher net margins through premium innovation.

Want to see what kind of numbers back up a price target much higher than today's stock price? This narrative leans on aggressive revenue growth, rising profit margins, and an ambitious path into premium segments. Unpack the key projections that analysts believe will propel the brand; your curiosity will be rewarded.

Result: Fair Value of $135.84 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cost pressures in Asia and significant investments required for growth could challenge SharkNinja’s ability to deliver the projected profit improvements.

Find out about the key risks to this SharkNinja narrative.

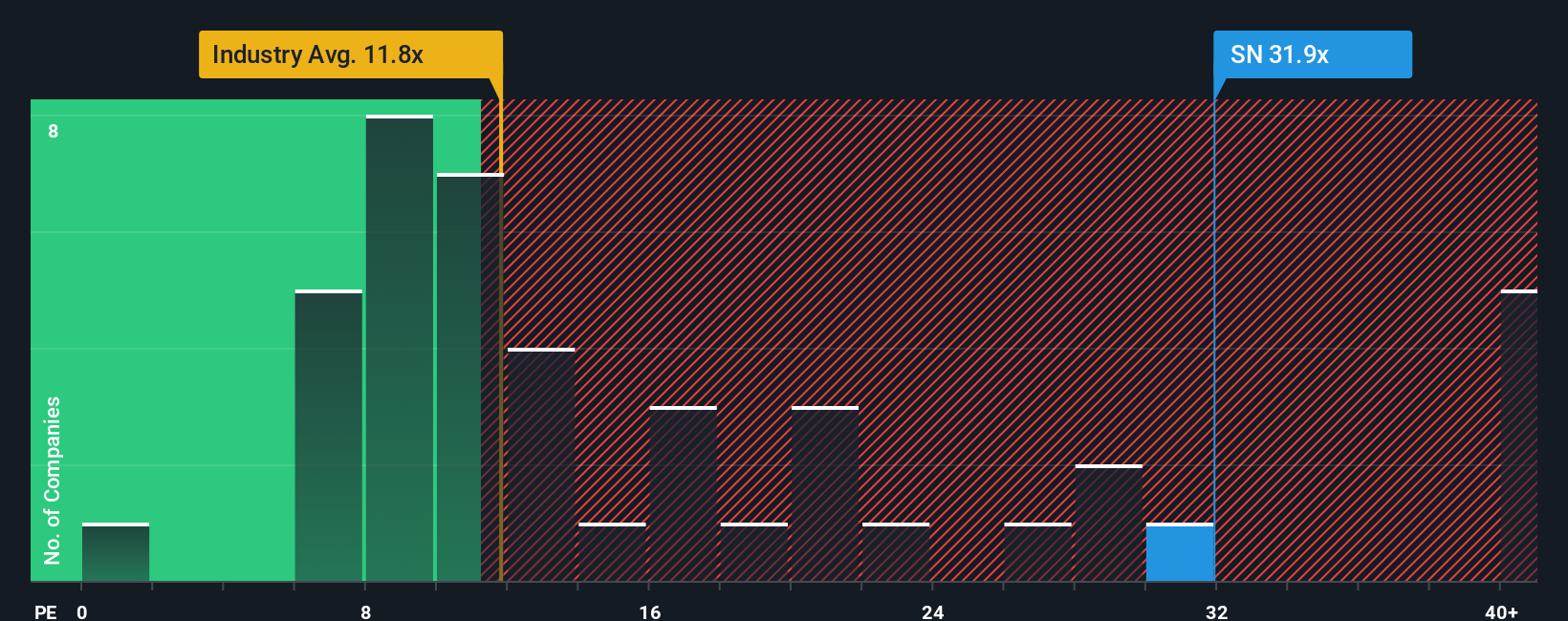

Another View: Looking at the Market Multiple

While analyst fair value and discounted cash flow models point to SharkNinja being undervalued, its current price-to-earnings ratio is 26.3x. That is much higher than the US Consumer Durables industry average of 11.1x, and even above its fair ratio of 22.7x. This means the stock trades at a steep premium, raising questions about how much future growth is already priced in, and whether the risk/reward is still attractive for new investors.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SharkNinja Narrative

If you see things differently or prefer your own analysis, you can dive in and create a personalized view of SharkNinja’s outlook in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding SharkNinja.

Looking for More Opportunities?

Don’t limit your next move to a single stock. Let Simply Wall Street’s powerful tools help you pinpoint under-the-radar opportunities other investors might miss.

- Capture impressive yields and steady passive income when you check out these 19 dividend stocks with yields > 3% with payouts above 3%.

- Ride the artificial intelligence surge by reviewing these 27 AI penny stocks that are pushing transformative innovation at the frontier of tech.

- Stay ahead of the market by targeting value with these 875 undervalued stocks based on cash flows, which have strong cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SN

SharkNinja

A product design and technology company, engages in the provision of various solutions for consumers in the United States, China, and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives