- United States

- /

- Consumer Durables

- /

- NYSE:SN

SharkNinja (SN): Assessing Valuation After Strong Earnings, Upbeat Outlook, and Walmart Expansion

Reviewed by Simply Wall St

SharkNinja (SN) recently raised its full-year earnings guidance and delivered strong third quarter numbers, signaling momentum for both sales and profits. The company also expanded its product reach by launching Shark Beauty on Walmart.com.

See our latest analysis for SharkNinja.

Despite a series of upbeat developments including raised earnings guidance and high-profile product launches, SharkNinja’s share price has faced significant pressure, dropping 26% over the last 90 days and finishing with a 1-year total shareholder return of -12.8%. While operational momentum looks promising, recent share price moves suggest the market is still cautious about the company’s long-term growth narrative.

If you want to see which other companies are showing momentum and fresh leadership, now’s a great time to discover fast growing stocks with high insider ownership

With shares still well below analyst targets despite double-digit revenue and net income growth, the key question is whether SharkNinja represents an attractive value opportunity or if investors are already pricing in future gains.

Most Popular Narrative: 33.6% Undervalued

SharkNinja’s last closing price sits well below where the most popular narrative pegs its fair value, opening the door for debate on what’s driving such a conspicuous gap. This is a story of ambitious growth plans, tempered optimism in the face of market skepticism, and a valuation shaped by bold financial projections.

Rapid expansion of new product categories, such as beauty technology and outdoor appliances, positions SharkNinja to capture fresh demand fueled by consumer focus on health, wellness, and convenience. This supports above-market revenue growth and higher net margins through premium innovation.

What is the hidden engine guiding this premium fair value? Behind the number is a narrative built on aggressive growth expectations, margin expansion, and a profit multiple not often seen outside the hottest names. Curious what assumptions unlock that target? Take a closer look and discover the calculations most investors never see.

Result: Fair Value of $132.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising production costs and slower consumer demand could challenge SharkNinja’s ambitious growth outlook. These factors may potentially limit the upside case for the stock.

Find out about the key risks to this SharkNinja narrative.

Another View: The Market’s Multiples Send a Different Signal

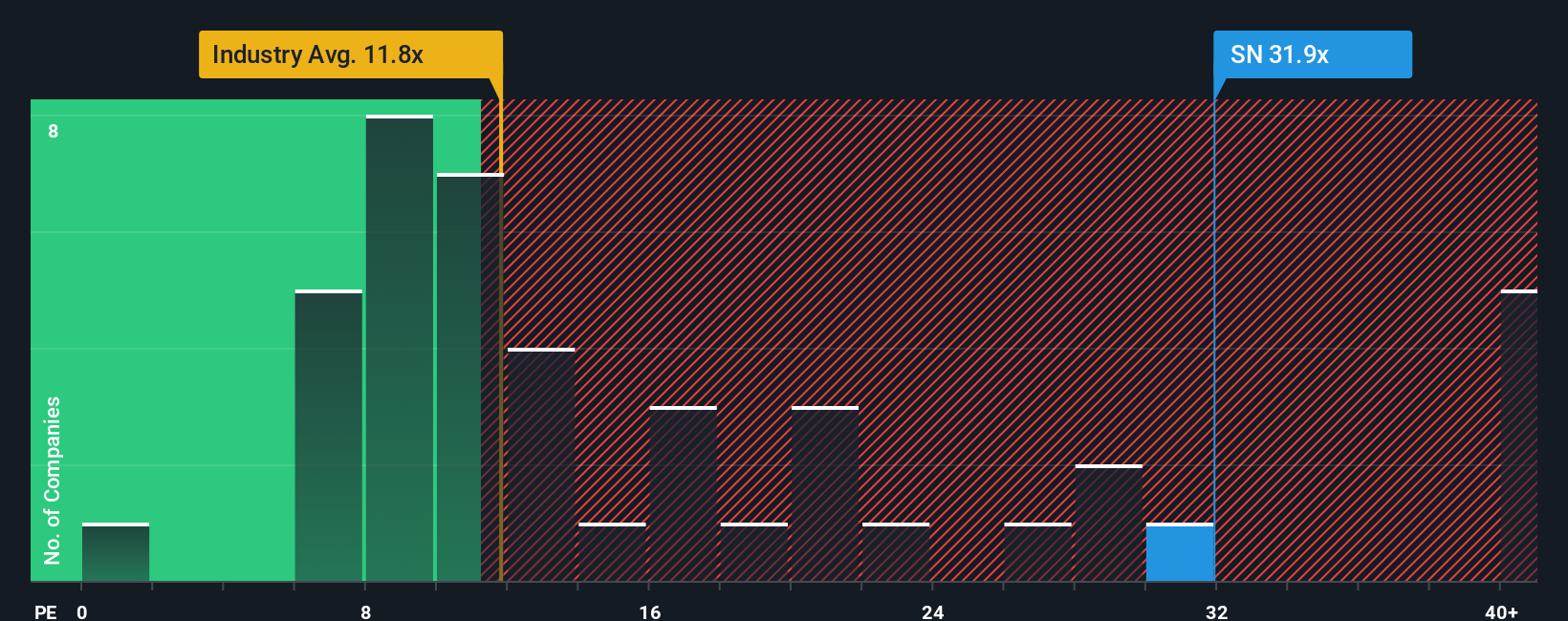

Looking through the lens of price-to-earnings ratios, SharkNinja trades at 21.6x earnings, which is above both its fair ratio of 19.6x and the broader US Consumer Durables industry average of just 10.5x. That gap means investors are paying a premium for growth that may already be factored in, raising risks if expectations are not met. So is the market’s optimism truly warranted, or is there value danger hiding beneath the surface?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SharkNinja Narrative

If you see the story differently or want to investigate the numbers on your own terms, you can craft your own perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding SharkNinja.

Looking for More Investment Ideas?

Smart investing comes from spotting trends early and seizing opportunities others overlook. Don’t miss your chance to stay ahead with these powerful research tools:

- Maximize your potential returns by targeting these 874 undervalued stocks based on cash flows that look set for a strong rebound based on solid fundamentals.

- Capture the income advantage and outperform traditional savings when you review these 17 dividend stocks with yields > 3% boasting yields above 3%.

- Get ahead of the curve as artificial intelligence reshapes industries by selecting these 26 AI penny stocks that lead in transformative tech innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SN

SharkNinja

A product design and technology company, engages in the provision of various solutions for consumers in the United States, China, and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives