- United States

- /

- Consumer Durables

- /

- NYSE:SKY

Champion Homes (NYSE:SKY) shareholders have earned a 23% CAGR over the last five years

When you buy a stock there is always a possibility that it could drop 100%. But on the bright side, if you buy shares in a high quality company at the right price, you can gain well over 100%. For example, the Champion Homes, Inc. (NYSE:SKY) share price has soared 184% in the last half decade. Most would be very happy with that. It's down 1.5% in the last seven days.

Let's take a look at the underlying fundamentals over the longer term, and see if they've been consistent with shareholders returns.

See our latest analysis for Champion Homes

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

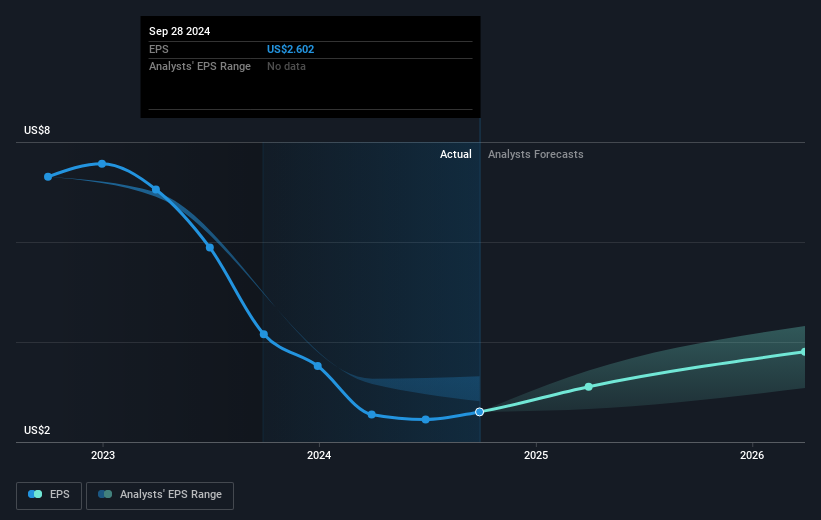

Over half a decade, Champion Homes managed to grow its earnings per share at 22% a year. This EPS growth is reasonably close to the 23% average annual increase in the share price. Therefore one could conclude that sentiment towards the shares hasn't morphed very much. In fact, the share price seems to largely reflect the EPS growth.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Dive deeper into Champion Homes' key metrics by checking this interactive graph of Champion Homes's earnings, revenue and cash flow.

A Different Perspective

We're pleased to report that Champion Homes shareholders have received a total shareholder return of 53% over one year. That's better than the annualised return of 23% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand Champion Homes better, we need to consider many other factors. For instance, we've identified 2 warning signs for Champion Homes that you should be aware of.

Of course Champion Homes may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:SKY

Champion Homes

Engages in the production and sale of factory-built housing in North America.

Flawless balance sheet with moderate growth potential.