- United States

- /

- Consumer Durables

- /

- NYSE:SGI

Will Somnigroup International's (SGI) Board Expansion Deepen Its Competitive Edge in Bedding Retail?

Reviewed by Sasha Jovanovic

- On September 30, 2025, Somnigroup International Inc. expanded its Board of Directors from seven to eight members and appointed Christopher T. Cook, founder of Sleep Experts and former Director at Mattress Firm, as an independent director.

- Mr. Cook's deep experience in the retail bedding industry and track record in leadership roles reflects Somnigroup's intent to enhance its expertise amidst continued efforts for growth and value creation.

- We’ll consider how the addition of Mr. Cook’s industry expertise could shape Somnigroup’s growth and integration of recent acquisitions.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Somnigroup International Investment Narrative Recap

To be a shareholder in Somnigroup International, you need to believe in its ability to extract value from acquisitions like Mattress Firm and drive margin expansion through operational improvements, even as competition in the bedding market intensifies. The recent appointment of Christopher T. Cook to the board adds significant sector knowledge, but it is unlikely to alter the near-term focus on delivering cost and sales synergies from the Mattress Firm integration, nor does it materially reduce the ongoing risk of market saturation in North America.

The most relevant recent announcement in this context is the ongoing progress on integrating Mattress Firm, with management reporting both cost and sales synergies tracking ahead of schedule. This continues to be Somnigroup’s most important catalyst, underpinning margin growth, while the addition of Cook’s experience could support longer-term implementation but does not fundamentally change the current risk profile tied to regional overexposure.

However, investors should also be aware that if Somnigroup’s reliance on North America and acquisitions persists...

Read the full narrative on Somnigroup International (it's free!)

Somnigroup International is projected to reach $8.5 billion in revenue and $931.4 million in earnings by 2028. This outlook assumes annual revenue growth of 12.5% and a $663.6 million increase in earnings from the current $267.8 million level.

Uncover how Somnigroup International's forecasts yield a $85.78 fair value, in line with its current price.

Exploring Other Perspectives

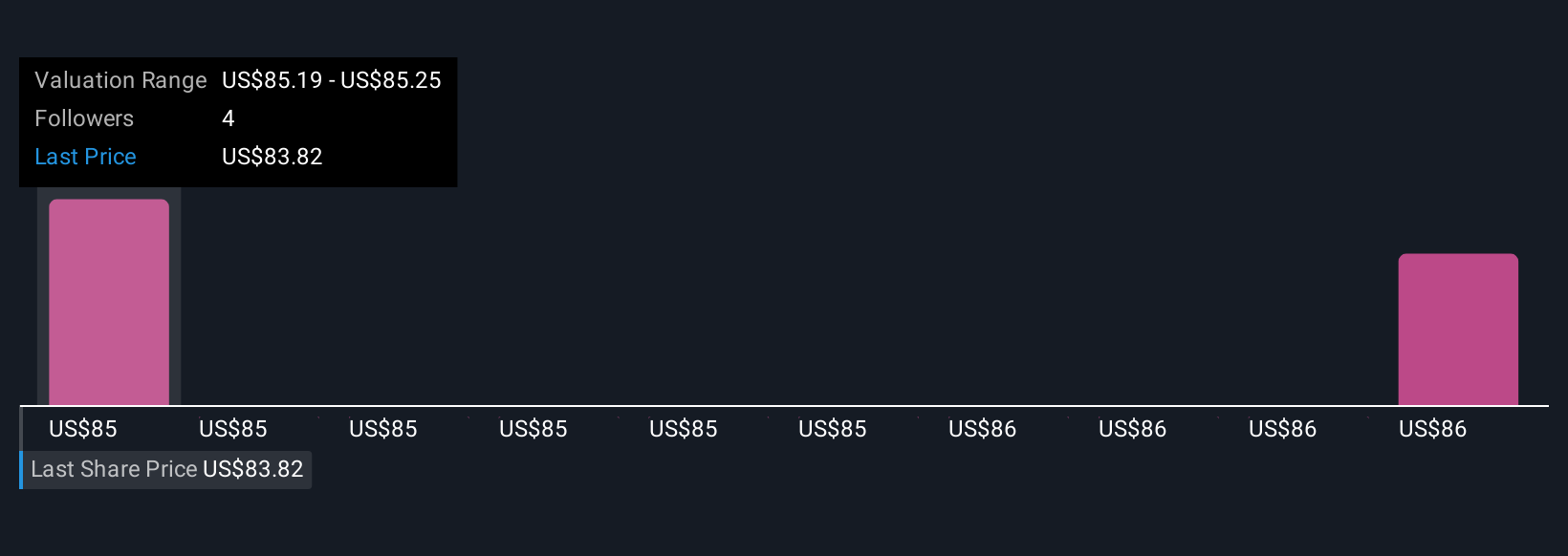

Simply Wall St Community participants provided two fair value estimates for Somnigroup International ranging from US$84.96 to US$85.78 per share. Many are mindful that ongoing integration of Mattress Firm, while progressing well, is central to the company’s current outlook so it remains important to weigh each perspective thoughtfully.

Explore 2 other fair value estimates on Somnigroup International - why the stock might be worth just $84.96!

Build Your Own Somnigroup International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Somnigroup International research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Somnigroup International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Somnigroup International's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SGI

Somnigroup International

Designs, manufactures, distributes, and retails bedding products in the United States and internationally.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives