- United States

- /

- Consumer Durables

- /

- NYSE:SGI

Somnigroup International (NYSE:SGI): Exploring Fair Value and Growth Upside After Recent Analyst Upgrades

Reviewed by Kshitija Bhandaru

Somnigroup International (NYSE:SGI) has caught attention recently as investors re-examine the stock’s long-term growth trajectory. With recent gains and solid performance, many are curious about the underlying factors shaping SGI’s valuation today.

See our latest analysis for Somnigroup International.

Somnigroup International’s recent momentum has caught the attention of investors, as the stock continues to deliver a 1-year total shareholder return of 0.59% and a solid 3-year figure of 2.14%. While share price returns have picked up lately, much of the optimism rests on the company’s ongoing ability to convert strong fundamentals into sustained growth. Investors are keeping an eye on both short-term swings and long-term potential.

If you’re curious about what other opportunities are out there, now’s a great time to broaden your perspective and discover fast growing stocks with high insider ownership

With SGI trading near its analyst price target and fundamentals looking robust, investors must ask whether current levels reflect all future gains or if there is genuine upside left for those who act now.

Most Popular Narrative: 2.1% Undervalued

Somnigroup International’s narrative fair value estimate sits above the last close, showing that recent analyst optimism is not yet fully reflected in the stock price. With a modest valuation gap, close attention is being paid to whether the strategic moves in play will deliver the anticipated value.

The integration of Mattress Firm is already generating meaningful sales and cost synergies, with $100 million in annual net cost synergies projected and sales synergies ahead of schedule. These operational improvements are positioned to expand EBITDA and enhance net margins moving into 2026 and beyond.

Want to see what’s fueling this premium? The valuation hinges on ambitious growth expectations, margin expansion, and a bold profit surge that rivals industry benchmarks. Intrigued by the numbers behind this bullish thesis? The full story reveals key projections driving this target.

Result: Fair Value of $85.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifts in consumer preferences and intensifying digital competition could still disrupt Somnigroup International’s growth trajectory and challenge these optimistic forecasts.

Find out about the key risks to this Somnigroup International narrative.

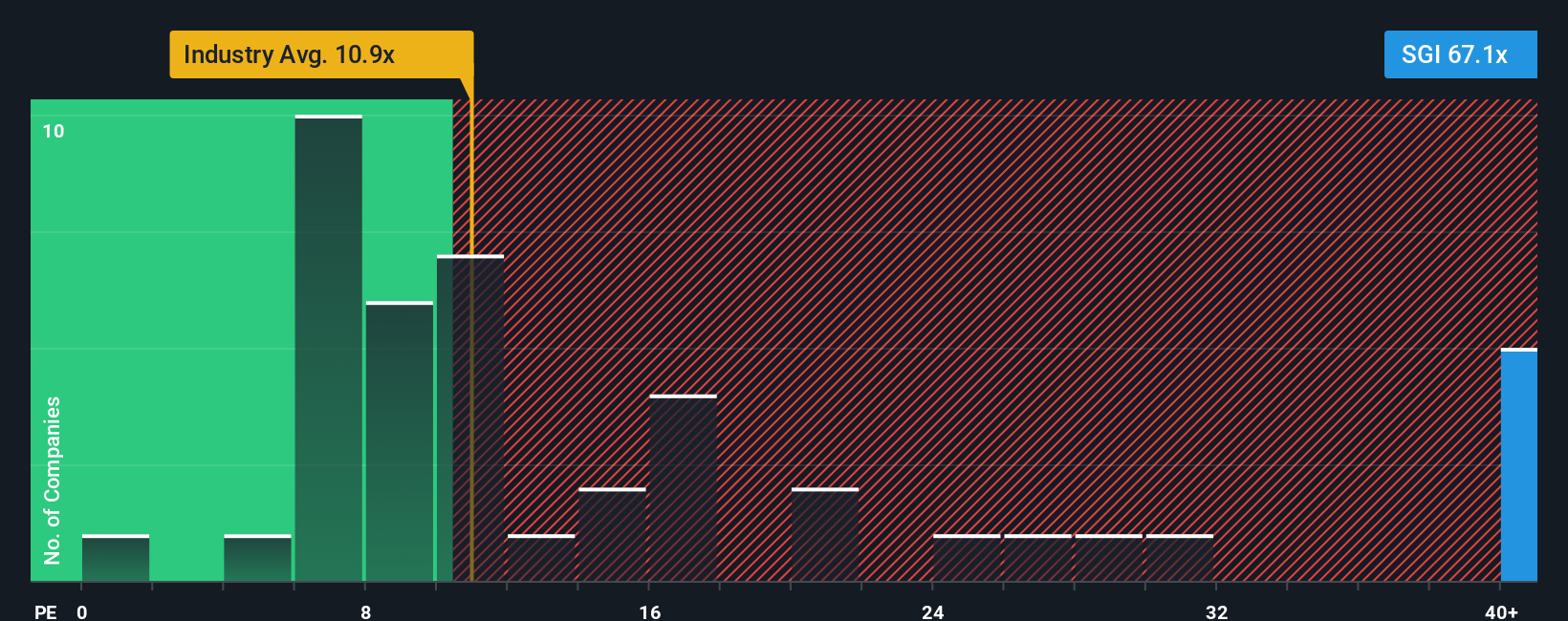

Another View: Market Multiples Tell a Different Story

Looking at the price-to-earnings ratio, Somnigroup International appears expensive. Its current ratio of 65.8x is far above both the Consumer Durables industry average of 11.8x and its peer group at 13.8x. Even the fair ratio estimate, based on regression analysis, sits well below at 28.3x. This wide gap suggests elevated valuation risk if growth assumptions fall short, highlighting a potential disconnect between market expectations and fundamentals. Could this premium indicate hidden strength, or is the stock at risk if sentiment shifts?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Somnigroup International Narrative

If you’re ready to dig into the numbers and shape your own perspective, you can easily assemble your own narrative in just a few minutes. Your view awaits: Do it your way

A great starting point for your Somnigroup International research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Stay ahead of the curve by tapping into fresh opportunities before everyone else. Uncover stocks offering powerful trends, explosive growth, or breakthrough technology. Don't let these slip by.

- Capitalize on market volatility by scanning for opportunities in these 3569 penny stocks with strong financials that have strong underlying financials and real breakout potential.

- Secure steady income streams and enhance your portfolio with these 19 dividend stocks with yields > 3%, featuring companies with proven, high-yielding dividends above 3%.

- Get a head start on tomorrow's innovations with early movers in quantum computing by checking out these 26 quantum computing stocks now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SGI

Somnigroup International

Designs, manufactures, distributes, and retails bedding products in the United States and internationally.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives