- United States

- /

- Consumer Durables

- /

- NYSE:SDHC

Slammed 31% Smith Douglas Homes Corp. (NYSE:SDHC) Screens Well Here But There Might Be A Catch

Unfortunately for some shareholders, the Smith Douglas Homes Corp. (NYSE:SDHC) share price has dived 31% in the last thirty days, prolonging recent pain. Longer-term shareholders would now have taken a real hit with the stock declining 4.4% in the last year.

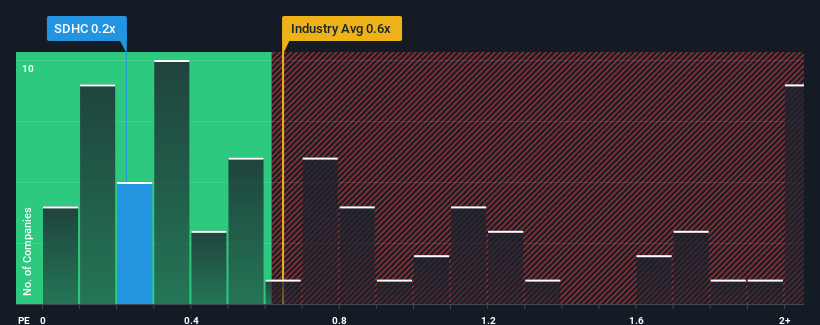

In spite of the heavy fall in price, there still wouldn't be many who think Smith Douglas Homes' price-to-sales (or "P/S") ratio of 0.2x is worth a mention when the median P/S in the United States' Consumer Durables industry is similar at about 0.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Smith Douglas Homes

What Does Smith Douglas Homes' P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Smith Douglas Homes has been doing relatively well. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Smith Douglas Homes will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Smith Douglas Homes would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an exceptional 17% gain to the company's top line. Pleasingly, revenue has also lifted 74% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 15% as estimated by the six analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 5.2%, which is noticeably less attractive.

With this information, we find it interesting that Smith Douglas Homes is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

Smith Douglas Homes' plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Smith Douglas Homes currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Smith Douglas Homes (1 can't be ignored!) that you should be aware of before investing here.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

If you're looking to trade Smith Douglas Homes, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:SDHC

Smith Douglas Homes

Designs, constructs, and sale of single-family homes in the southeastern United States.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives