- United States

- /

- Luxury

- /

- NYSE:RL

What Ralph Lauren (RL)'s Strong Q2 Results and Upgraded 2026 Outlook Mean For Shareholders

Reviewed by Sasha Jovanovic

- Ralph Lauren Corporation recently reported strong second-quarter results, with sales rising to US$2,010.7 million and net income reaching US$207.5 million, while also providing increased revenue guidance for the third quarter and full year fiscal 2026.

- An additional insight is that foreign currency movements are forecast to add a sizeable benefit to revenue growth in fiscal 2026, boosting the impact of the company's operational performance.

- We'll now explore how these higher earnings and an improved full-year revenue outlook may affect Ralph Lauren's future growth narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Ralph Lauren Investment Narrative Recap

To be a shareholder in Ralph Lauren, you need to believe in its ability to drive premium brand growth, expand internationally, and protect margins despite macroeconomic uncertainty. The latest earnings beat and raised revenue guidance are positive for short-term sentiment, but do not directly resolve the underlying risks around wholesale channel volatility and the sustainability of recent growth rates. At present, the impact on these key catalysts and risks appears incremental.

Among the recent announcements, updated full-year fiscal 2026 guidance is most relevant here. Management now expects a 5% to 7% revenue increase on a constant currency basis, with foreign exchange movements providing a further boost, a clear indication of confidence in continued top-line momentum, even as margin headwinds remain in focus.

By contrast, investors should also be aware of the potential challenges tied to shifts in the wholesale channel and the risk that...

Read the full narrative on Ralph Lauren (it's free!)

Ralph Lauren is projected to reach $8.4 billion in revenue and $1.0 billion in earnings by 2028. This outlook relies on 5.0% annual revenue growth and a $205 million increase in earnings from the current $794.7 million.

Uncover how Ralph Lauren's forecasts yield a $365.87 fair value, a 10% upside to its current price.

Exploring Other Perspectives

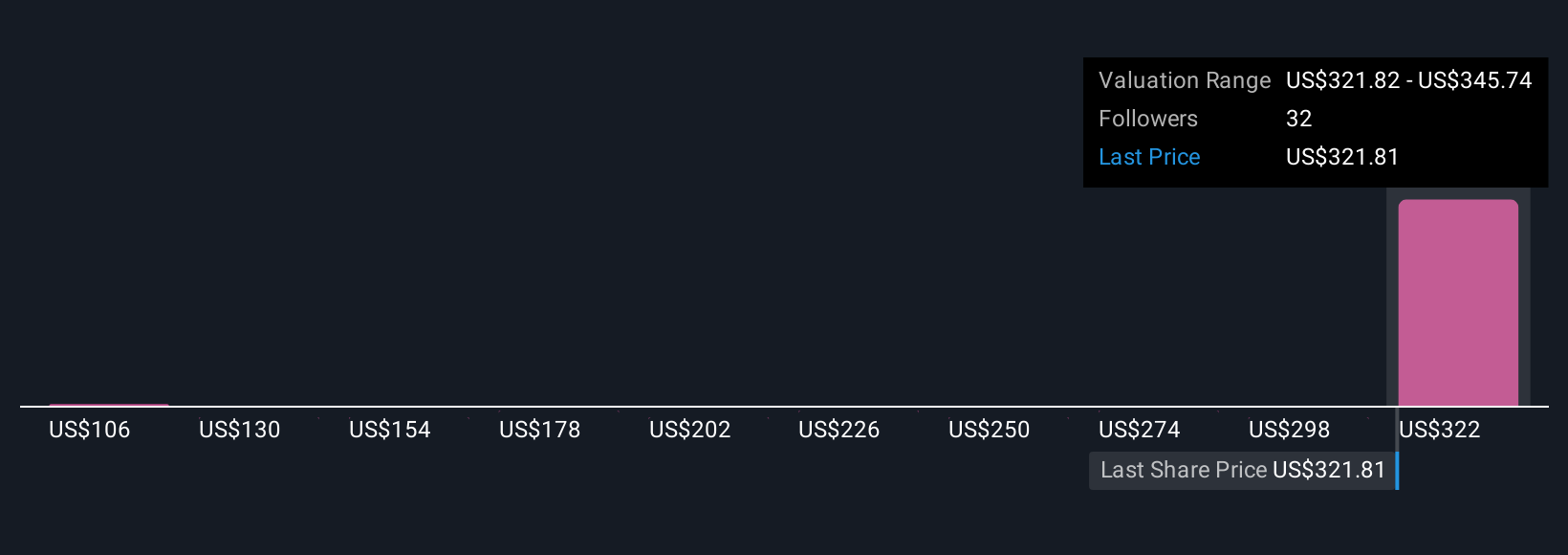

Fair value estimates from seven Simply Wall St Community members range from US$106.47 to US$373.35. While many see top-line growth potential, the risk of weaker demand in key channels remains a live concern that could shape future outcomes.

Explore 7 other fair value estimates on Ralph Lauren - why the stock might be worth less than half the current price!

Build Your Own Ralph Lauren Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ralph Lauren research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ralph Lauren research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ralph Lauren's overall financial health at a glance.

No Opportunity In Ralph Lauren?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RL

Ralph Lauren

Designs, markets, and distributes lifestyle products in North America, Europe, Asia, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives