- United States

- /

- Luxury

- /

- NYSE:RL

Ralph Lauren (RL): Evaluating Valuation Strength Following Steady Share Climb

Reviewed by Simply Wall St

See our latest analysis for Ralph Lauren.

Momentum has been steadily building for Ralph Lauren, with the stock’s 30-day share price return of 4.7% adding to the 43.7% year-to-date climb. That strength has made an impact for long-term investors, as the total shareholder return sits at 59.5% for the past year and over 245% across three years. This signals that investors are increasingly confident in the company’s trajectory and underlying value.

If you’re following these strong moves and want to see what other dynamic companies are making waves, broaden your search and discover fast growing stocks with high insider ownership

With shares continuing to climb and some analyst price targets suggesting modest upside remains, investors are left wondering if Ralph Lauren is still trading at a discount or if the market is already anticipating future growth.

Most Popular Narrative: 9% Undervalued

Ralph Lauren's most followed valuation narrative places its fair value notably above the last close, suggesting the company's market price may not fully reflect its long-term earnings and margin potential. A closer look reveals the underlying business trends supporting this positive view.

Accelerating international expansion, especially in Asia and Greater China where sales grew over 30% and now represent 9% of company revenue (up from 3-4% a few years ago), positions Ralph Lauren to benefit from rising global wealth and middle-class growth. This supports sustained top-line revenue gains.

Curious about the numbers behind this optimism? The fair value is based on a strategy of expanding profitability and global brand power. One projection relies on a sector-topping profit multiple and higher future margins. Want the details behind these forecasts? Dive in to uncover the assumptions fueling this narrative's price target.

Result: Fair Value of $365.87 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent macroeconomic uncertainty as well as shifts in consumer demand or price sensitivity could quickly challenge Ralph Lauren's optimistic growth and margin assumptions.

Find out about the key risks to this Ralph Lauren narrative.

Another View: Mixed Signals on Valuation

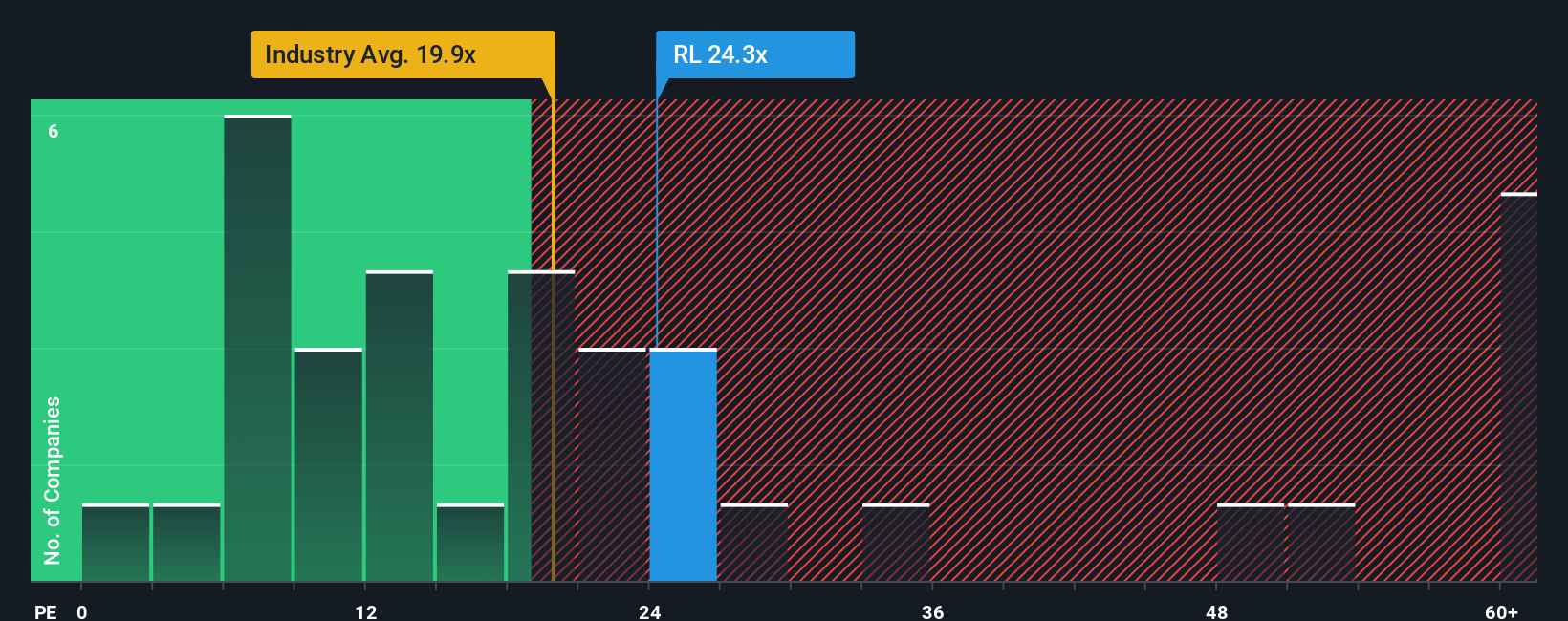

While one method sees Ralph Lauren as undervalued based on future earnings growth, a look at the price-to-earnings ratio paints a more complex picture. The current P/E of 23.6x is higher than the US Luxury industry’s average of 18.6x, and notably above the fair ratio of 17.6x. Our analysis suggests the market could move towards this fair ratio. This means that, compared to peers and expected fair value, shares are priced at a premium, introducing both risk and possible opportunity depending on how expectations are met. So, is the premium a sign of lasting brand power or a potential valuation trap?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ralph Lauren Narrative

If you have a different perspective or want to dig into the numbers firsthand, you can easily assemble your own view and story in just a few minutes. Do it your way

A great starting point for your Ralph Lauren research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Stock Ideas?

Seize the opportunity to stay ahead. Don’t limit yourself to just one company when there are so many innovative plays ready for the spotlight.

- Capitalize on growth by adding high-potential holdings through these 882 undervalued stocks based on cash flows, which highlights undervalued gems based on strong cash flows.

- Boost your portfolio’s future-focus and momentum with these 27 AI penny stocks, companies shaping the market in artificial intelligence.

- Grow your passive income and stability by exploring these 15 dividend stocks with yields > 3%, which features yields above 3% for investors who want reliable returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RL

Ralph Lauren

Designs, markets, and distributes lifestyle products in North America, Europe, Asia, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives