- United States

- /

- Luxury

- /

- NYSE:RL

Can Ralph Lauren’s 72% Rally Continue in 2025?

Reviewed by Bailey Pemberton

If you have been keeping an eye on Ralph Lauren’s stock over the past few years, you have seen quite a ride. Whether you are wondering if now is finally the time to buy, looking to take some profits off the table, or just want to make sense of the numbers before you act, you are in good company. Ralph Lauren has truly captured investor attention with its impressive streak: the stock is up 45.0% so far this year and a remarkable 72.2% over the past year. Those are numbers very few apparel names can match. Over the past five years, it has skyrocketed more than 450%, turning what once looked like a staid luxury brand into a growth story that is hard to ignore.

That runup did not happen in a vacuum. Investors have taken note of a wave of positive signals out of the company recently. Ralph Lauren’s expansion into new international markets has started paying dividends, and the brand’s smart retail partnerships in both brick-and-mortar and e-commerce channels have led to a visible boost in consumer sentiment. The company’s refreshed focus on younger, globally connected shoppers seems to be resonating as well. This has contributed to a shift in the way risk is perceived around the stock.

Of course, with the stock price higher than it has ever been before, the conversation naturally turns to valuation. Let’s put Ralph Lauren under the microscope with a look at six popular valuation metrics. Based on these methods, Ralph Lauren currently has a valuation score of 2 out of 6, meaning it is only undervalued on two key checks. But there is more to the story. Before you make your final call, let’s break down the details and explore a potentially smarter approach to valuing Ralph Lauren.

Ralph Lauren scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Ralph Lauren Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's value using a required rate of return. This method is especially useful for businesses with predictable future cash flows like Ralph Lauren.

For Ralph Lauren, the current Free Cash Flow stands at $867 Million. Analysts forecast steady growth over the next several years, with projections estimating Free Cash Flow to reach approximately $1.17 Billion by 2029. It is important to note that analyst estimates carry out to around 2029, after which Simply Wall St uses reasonable extrapolations to extend the forecast a full decade ahead.

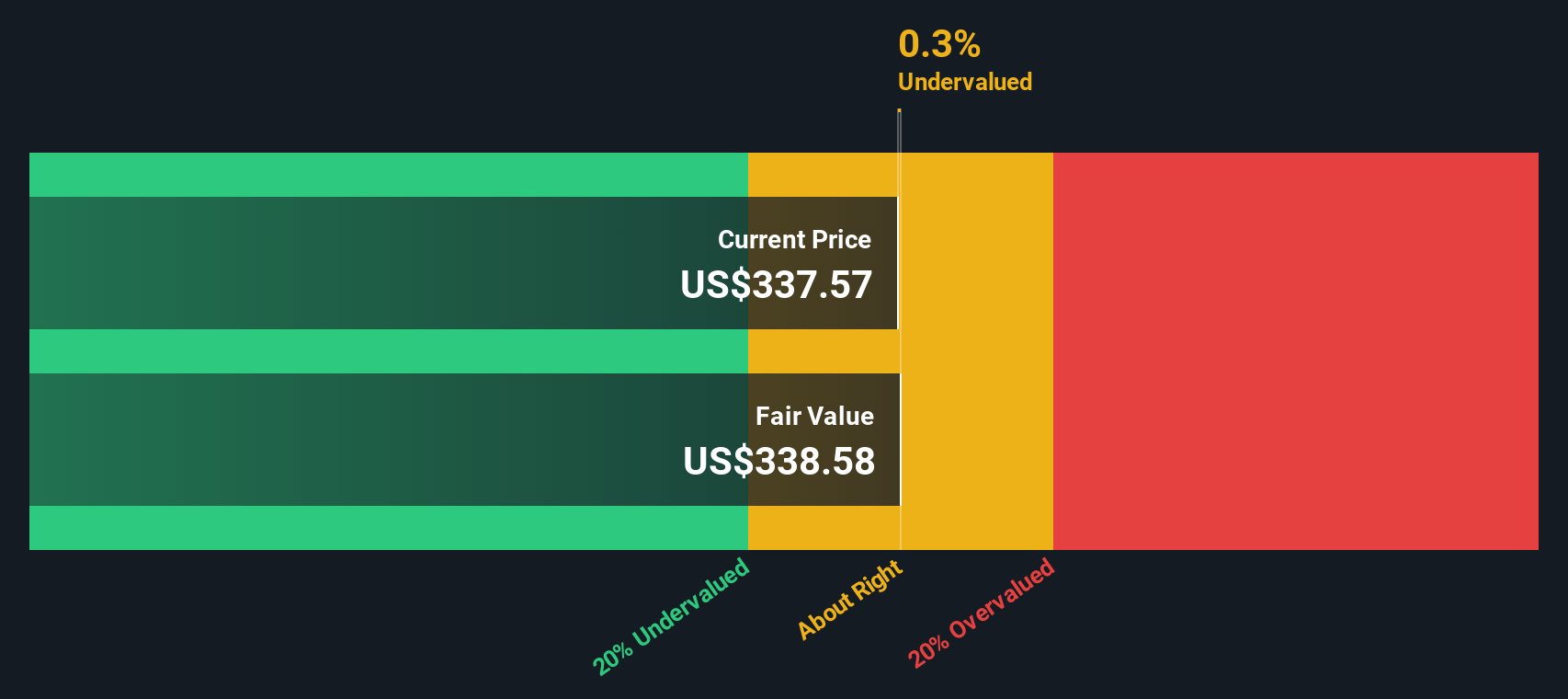

Based on the DCF model, Ralph Lauren's estimated intrinsic fair value is $338.45 per share. Compared to the current market price, this calculation implies the stock is about 0.8% undervalued, suggesting it is trading almost exactly at its fair value. For investors, this means Ralph Lauren’s stock is neither a steal nor dangerously overpriced at these levels.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Ralph Lauren's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Ralph Lauren Price vs Earnings (P/E Ratio)

For established, profitable companies like Ralph Lauren, the price-to-earnings (P/E) ratio is a widely used valuation tool. It provides a quick sense of whether the market price appropriately reflects the company's current and future earning power. Typically, a company's growth outlook, stability, and sector risks all play into what counts as a "normal" or "fair" P/E ratio.

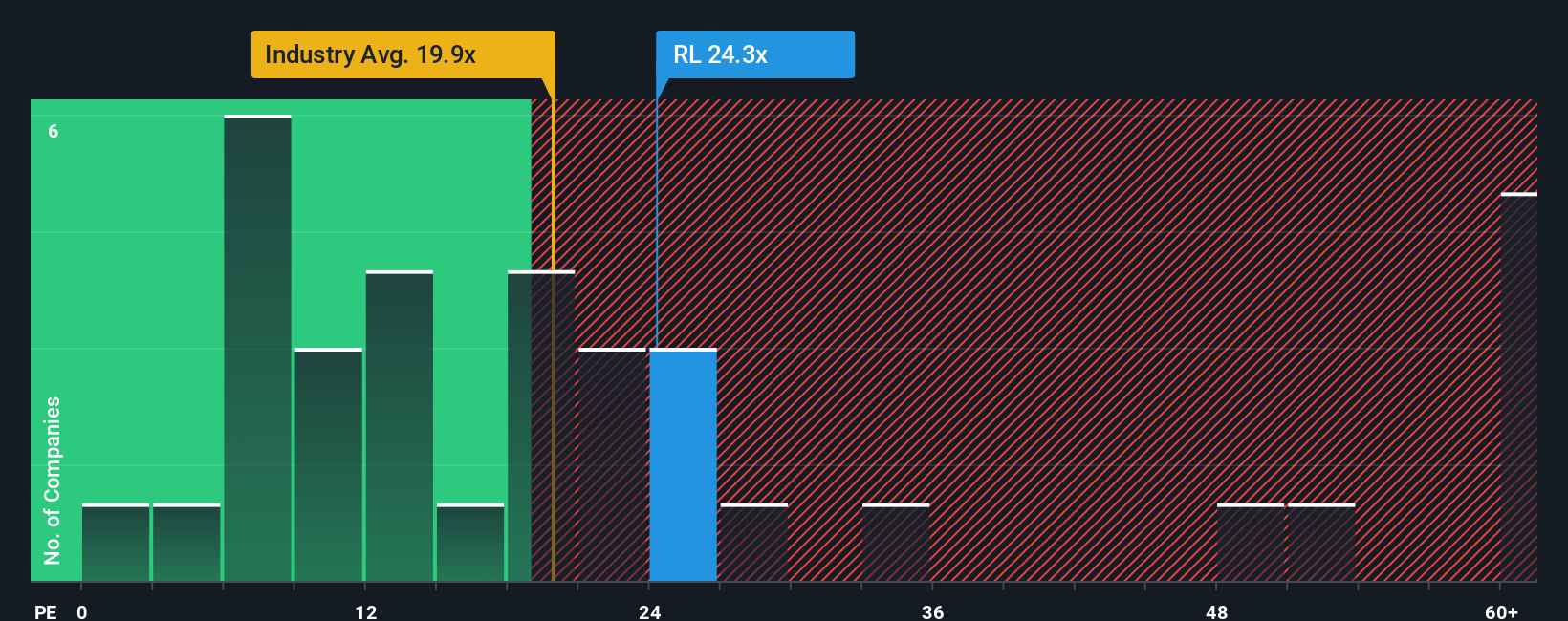

Currently, Ralph Lauren trades at a P/E ratio of 25x. To put this in context, the average P/E among similar luxury industry peers is 59x. The broader luxury sector has a more moderate average of 20x. On paper, Ralph Lauren appears less expensive than direct peers, but a touch higher than the sector average.

Simply Wall St's proprietary "Fair Ratio" offers a more nuanced perspective. It weighs not only peer groups and industry trends but also company-specific factors such as expected earnings growth, profit margins, risks, and market size. For Ralph Lauren, the Fair Ratio is calculated to be 19x. This means that, accounting for all relevant variables, Ralph Lauren’s shares are trading slightly above the level you might expect in light of its own profile.

All in, with an actual P/E of 25x compared to a Fair Ratio of 19x, the stock leans toward being overvalued on this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Ralph Lauren Narrative

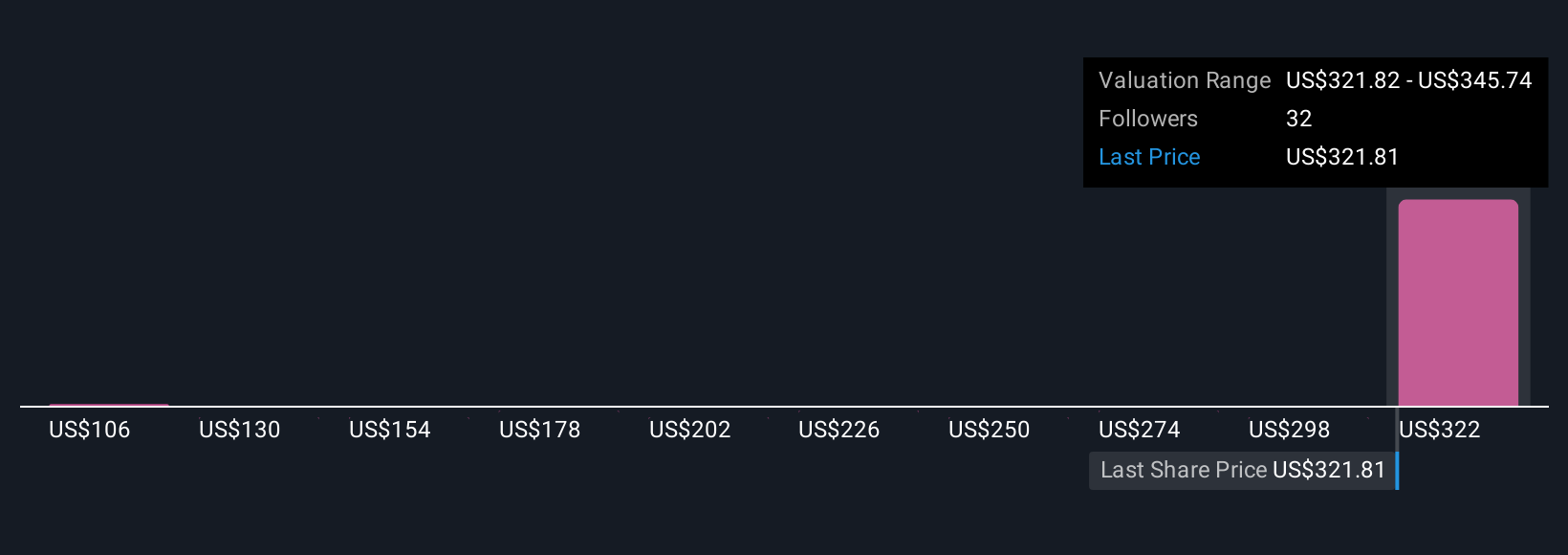

Earlier, we mentioned there is an even better way to understand a company's value by creating and following a Narrative. A Narrative is a simple, dynamic story you build around your investment view: you link your expectations about a company's future (like revenue, earnings, and margins) to a fair value and then track how the real world matches up. It connects the numbers to what you actually believe about Ralph Lauren as a business and is much more powerful than just using a P/E ratio or a price target alone.

Narratives are easy for anyone to use on Simply Wall St’s platform, right on the Community page, and are updated live as news or earnings reports come in. Narratives help you organize your thoughts, see how your forecast stacks up against others’, and quickly compare your calculated Fair Value to the current price to make more confident buy/hold/sell decisions.

For example, some investors currently see Ralph Lauren’s international growth and digital adoption fueling years of expansion, supporting price targets as high as $423, while others, concerned about macroeconomic risks, lean as low as $185. By creating or following a Narrative, you can clarify your perspective and respond swiftly as the company or industry changes.

Do you think there's more to the story for Ralph Lauren? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RL

Ralph Lauren

Designs, markets, and distributes lifestyle products in North America, Europe, Asia, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives