- United States

- /

- Luxury

- /

- NYSE:PVH

Will PVH's (PVH) Supply Chain Overhaul Strengthen Its Competitive Edge or Signal Deeper Shifts?

Reviewed by Sasha Jovanovic

- Earlier this quarter, PVH Corp. announced the appointment of Patricia Gabriel as Chief Supply Chain Officer and Global Head of Operations, following her extensive experience at Capri Holdings and several global consumer goods companies.

- This leadership transition comes as PVH focuses on optimizing its global supply chain, reflecting continued efforts to strengthen operational efficiency and adapt to evolving industry demands.

- Now, we'll explore how Patricia Gabriel's supply chain expertise could influence PVH's investment narrative and prospects for operational improvement.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

PVH Investment Narrative Recap

To be a PVH shareholder, you need confidence that the company's major brands, Calvin Klein and Tommy Hilfiger, can sustain global relevance while operational improvements offset margin risks from volatile supply chains and international markets. Patricia Gabriel’s appointment as Chief Supply Chain Officer is intended to address operational complexity, but the impact on immediate earnings and the key near-term catalyst, margin recovery, will take time to unfold; her arrival does not materially shift near-term risks, particularly tariff pressures that continue to weigh on profitability.

Among recent announcements, PVH’s progress with its multi-year share buyback plan stands out, with almost 60% of authorized shares repurchased for US$3.74 billion by August. While this signals a commitment to returning cash to investors and can support the share price in the near term, share buybacks alone will not address underlying operational or margin headwinds if global supply chain issues persist.

However, investors should remain alert to additional risks tied to ongoing tariff pressures, as the path to margin expansion still hinges on...

Read the full narrative on PVH (it's free!)

PVH's narrative projects $9.4 billion revenue and $707.7 million earnings by 2028. This requires 2.3% yearly revenue growth and a $239.2 million earnings increase from $468.5 million today.

Uncover how PVH's forecasts yield a $96.79 fair value, a 14% upside to its current price.

Exploring Other Perspectives

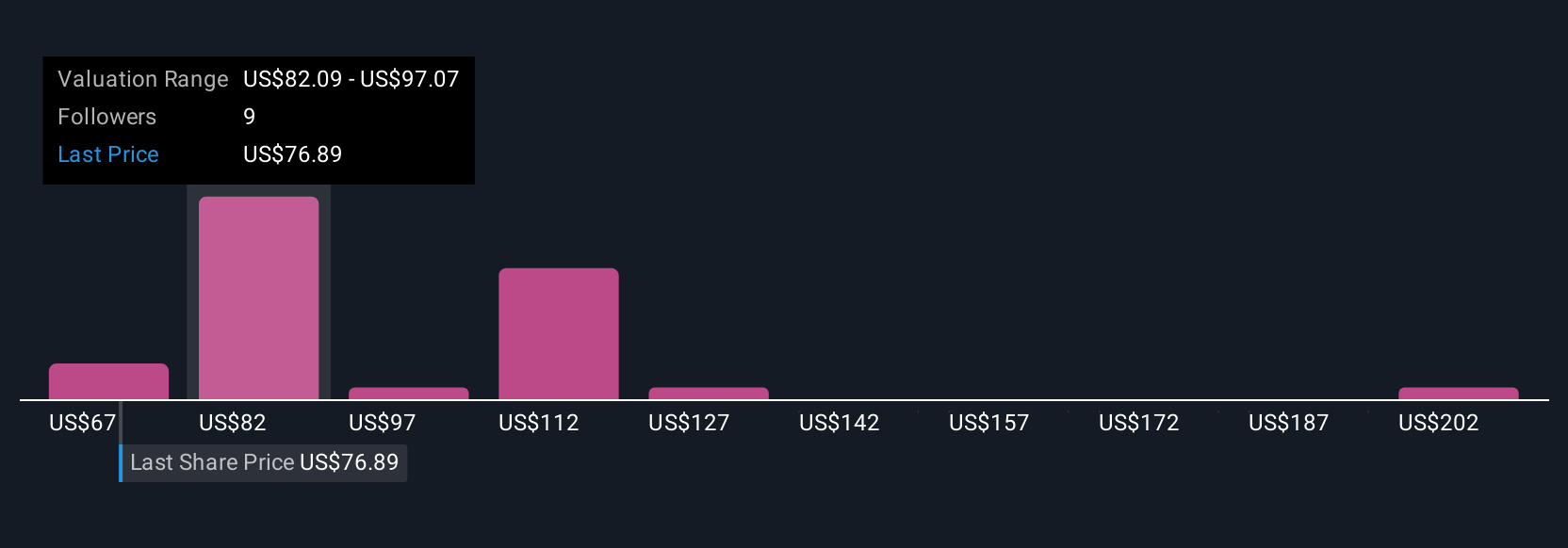

Seven individual fair value estimates from the Simply Wall St Community span from US$67.10 to US$216.96 per share, showing a wide range of expectations. Your view on PVH’s future may come down to how much weight you place on recent supply chain changes to address margin volatility.

Explore 7 other fair value estimates on PVH - why the stock might be worth over 2x more than the current price!

Build Your Own PVH Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PVH research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free PVH research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PVH's overall financial health at a glance.

No Opportunity In PVH?

Our top stock finds are flying under the radar-for now. Get in early:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PVH

PVH

Operates as an apparel company in the United States and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives