- United States

- /

- Leisure

- /

- NYSE:PII

Polaris (PII): Five-Year Net Loss Increase Challenges Bullish Turnaround Narratives

Reviewed by Simply Wall St

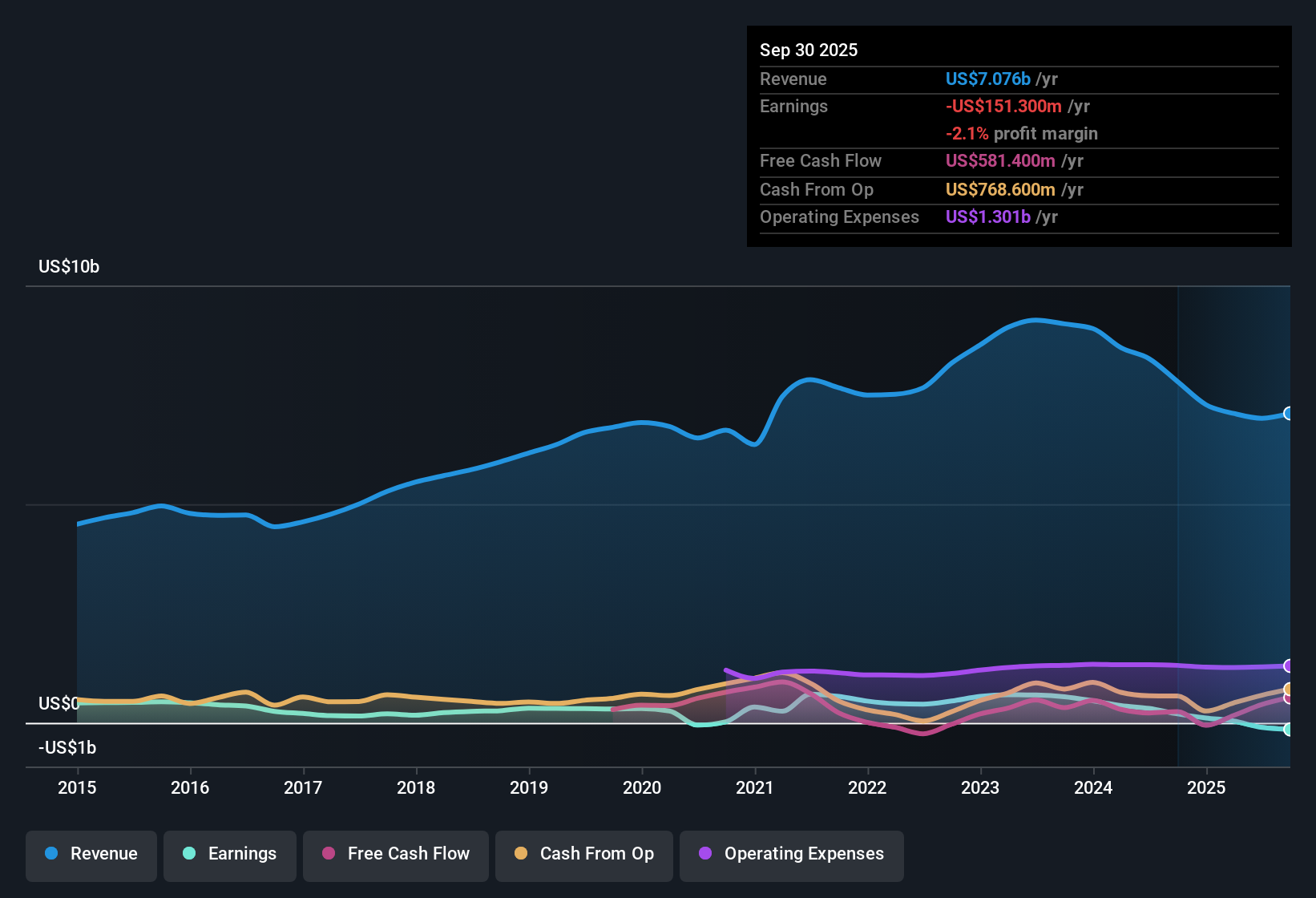

Polaris (PII) reported continued losses, with the company's net losses widening at an average annual rate of 19.6% over the past five years. Despite the current unprofitability and a comparatively muted revenue growth forecast of 1.8% per year, profitability is projected to turn around. Earnings growth is expected to surge at 115.33% annually, with the potential for positive earnings within three years. The mix of a low Price-to-Sales Ratio at 0.5x and rising earnings expectations sets the stage for investors to weigh the potential upside against ongoing risks to financial strength and dividend reliability.

See our full analysis for Polaris.Next, we will see how these headline results stack up against the broader market narratives for Polaris and whether prevailing views get confirmed or challenged.

See what the community is saying about Polaris

Margins Pressured by Tariff Costs

- Gross tariff costs are forecasted at $320 to $370 million, a direct hit to Polaris’s cost structure that could weigh meaningfully on margins and cash flow.

- Analysts' consensus view notes Polaris has responded by mobilizing a tariff mitigation strategy. Supply chain tweaks and cost controls are being rolled out to support margins and earnings, but

- the company’s decision to withdraw its full-year guidance underscores that these pressures create elevated uncertainty for near-term profit improvement,

- and compressing margins may persist as the competitive and economic environment remains volatile.

Premium Lineup Powers Revenue Upside

- Strong demand for premium models, like the XPEDITION and RANGER, and recent launches such as a digital helm in boating, are singled out as key catalysts targeting higher average selling prices and future sales growth.

- Analysts' consensus view argues that growth in premium product sales, together with strategic partnership alignment and effective inventory management, boosts long-term revenue potential and market share, but

- ongoing economic headwinds and a 16% decline in international sales could limit overall momentum,

- meaning much of the revenue upside is still dependent on successful execution in a challenging macro environment.

Valuation Discount Versus Industry

- Polaris trades at a 0.5x Price-to-Sales Ratio, well below the US leisure industry’s 1x and peer average of 1.3x, but the current $67.60 share price sits far above its DCF fair value of $12.49 and is also above the consensus analyst target of $65.64.

- Analysts' consensus view suggests that while Polaris screens as a relative value based on sales multiples, analysts remain cautious here.

- Projected improvement in profitability and margin expansion underpins hopes for re-rating, but

- the stark gap versus fair value and a consensus target price below the market indicate doubts about how fast fundamentals can catch up.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Polaris on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a fresh take on the data? Share your point of view and build your own story in just a few minutes. Do it your way

A great starting point for your Polaris research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Polaris’s discounted valuation is overshadowed by ongoing margin pressure, volatile earnings, and doubts about its ability to quickly deliver fundamental improvements.

If you want to focus on companies with more attractive valuations and clearer upside, discover the potential value opportunities among these 848 undervalued stocks based on cash flows right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PII

Polaris

Designs, engineers, manufactures, and markets powersports vehicles in the United States, Canada, and internationally.

Reasonable growth potential with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives