- United States

- /

- Leisure

- /

- NYSE:PII

Polaris (PII): Assessing Valuation Following Major Redesigns in Marine Lineup

Reviewed by Simply Wall St

Polaris (NYSE:PII) just took a big step in the marine market, as Godfrey Pontoon Boats announced a sweeping redesign of its popular Sanpan and Monaco series. The new models showcase advanced tech, modular accessories, and more comfort-oriented features for 2026.

See our latest analysis for Polaris.

Polaris’s latest marine innovations land as its share price momentum shows signs of steadying. Despite strong gains earlier in the year and a vibrant 17.7% year-to-date share price return, the one-year total shareholder return of just 1.5% reflects a more cautious long-term outlook from investors. Recent product rollouts like the upgraded Sanpan and Monaco lines are helping to rekindle interest, hinting at growth potential even as some investors wait for clear signs of sustained progress.

If Polaris’s new direction has you curious, why not see what else is out there? Now is a great moment to discover See the full list for free.

With so many changes in the pipeline and investor caution lingering after earlier gains, the big question is whether Polaris offers hidden value at current levels or if the market is already factoring in the company’s next phase of growth.

Most Popular Narrative: Fairly Valued

Polaris is trading just above the consensus fair value, which suggests a close alignment between the latest market price and analyst expectations for the stock’s longer-term earnings power.

Polaris is executing on new product launches and innovations, such as the digital helm in their boating lineup, which are expected to enhance their portfolio and drive future sales growth, potentially increasing revenue.

Want to see which bold new product rollouts ignite analysts’ optimism? The real driver behind this fair value is an unexpected shift in profit trajectory and margin recovery. The projected path to higher returns may surprise you. Discover what is fueling the future performance expectations in the full narrative.

Result: Fair Value of $65.83 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing uncertainty from high tariff costs and the possibility of further declines in international sales could still challenge Polaris’s margin recovery momentum.

Find out about the key risks to this Polaris narrative.

Another View: What Does the SWS DCF Model Say?

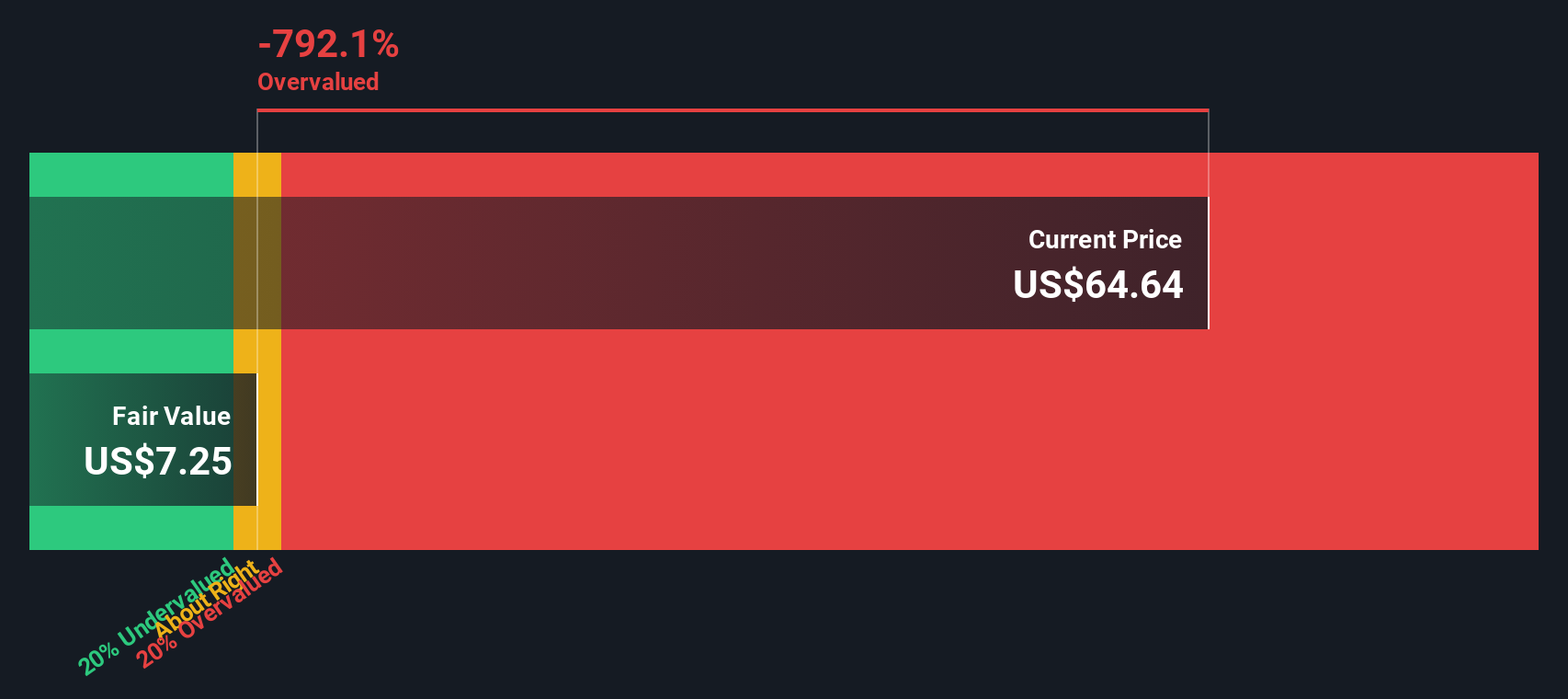

While price-to-sales ratios suggest Polaris is attractively valued compared to peers and the industry, our DCF model presents a very different perspective. The SWS DCF model estimates Polaris’s fair value at just $7.23 per share, indicating the stock may be significantly overvalued at its current price. How do you consider these contrasting outlooks when deciding your next move?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Polaris Narrative

If you have a different perspective or want to dig into the numbers on your own, you can craft a narrative in just a few minutes. Do it your way

A great starting point for your Polaris research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Expand your investing horizons and uncover exciting opportunities you might be missing. The Simply Wall Street Screener puts powerful stock-picking tools at your fingertips, so you can unlock new possibilities ahead of everyone else.

- Pinpoint undervalued companies poised for growth by tapping into these 913 undervalued stocks based on cash flows for hidden gems based on strong cash flow fundamentals.

- Collect reliable passive income streams when you check out these 15 dividend stocks with yields > 3% to find stocks offering attractive yields and a track record of stable payouts.

- Accelerate your portfolio's innovation edge by seeking out tech leaders with these 25 AI penny stocks to spot pioneers building tomorrow’s intelligence today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PII

Polaris

Designs, engineers, manufactures, and markets powersports vehicles in the United States, Canada, and internationally.

Reasonable growth potential with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026