- United States

- /

- Leisure

- /

- NYSE:PII

Is Polaris Still an Opportunity After Management Changes and Recent Price Swings in 2025?

Reviewed by Bailey Pemberton

- Wondering if Polaris is undervalued or just misunderstood? If you have questions about whether this might be the right time to look closer at the stock, you are in the right place.

- Polaris shares have climbed 16.4% year-to-date, though they slipped 7.8% over the past week and remain 2.2% below where they were one year ago.

- Much of this movement has followed management shakeups and noteworthy product launches. These events have caught both investor and industry attention. Recent headlines have focused on Polaris’s innovation pipeline and competitive pressures, fueling the debate around its longer-term prospects.

- On our 6-point valuation check, Polaris scores a 3, suggesting a mix of strengths and red flags. Next, we will break down these valuation methods, but make sure to read through to the end for a perspective that might change how you look at value entirely.

Find out why Polaris's -2.2% return over the last year is lagging behind its peers.

Approach 1: Polaris Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a company is worth today by projecting its future cash flows and discounting them back to their present value. This approach helps investors see beyond short-term swings in share price or earnings and focus on the company's underlying value based on its ability to generate cash over time.

For Polaris, the analysis starts with the company's current Free Cash Flow (FCF) of $501.6 million. Analysts provide estimates for the next few years, with projections suggesting FCF will reach $213.7 million by 2026 and $58 million by 2027. After that, future free cash flows are extrapolated, with each year seeing smaller numbers as estimates become less certain. For example, projected FCF in 2035 is $8.8 million, all amounts in $USD.

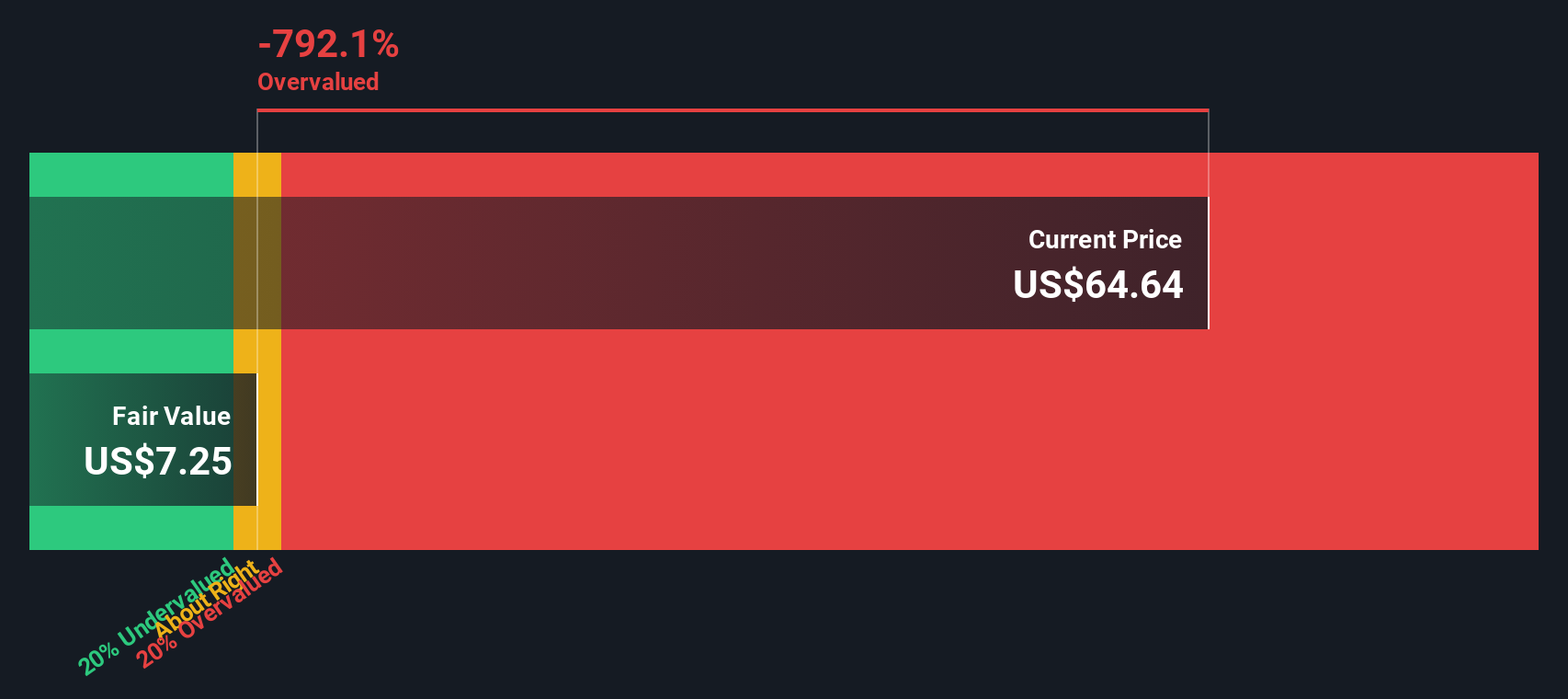

Bringing these future numbers back to today's value, the DCF model estimates an intrinsic value of $7.27 per share. This is significantly below the current share price, implying that Polaris is trading at an 803.3% premium to its calculated fair value.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Polaris may be overvalued by 803.3%. Discover 843 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Polaris Price vs Sales

For companies like Polaris, which has demonstrated consistent revenue generation but volatile earnings, the Price-to-Sales (PS) ratio is a practical valuation tool. The PS ratio helps investors gauge how much they are paying for each dollar of revenue. This metric can be particularly informative when profits are impacted by cyclical trends or temporary headwinds.

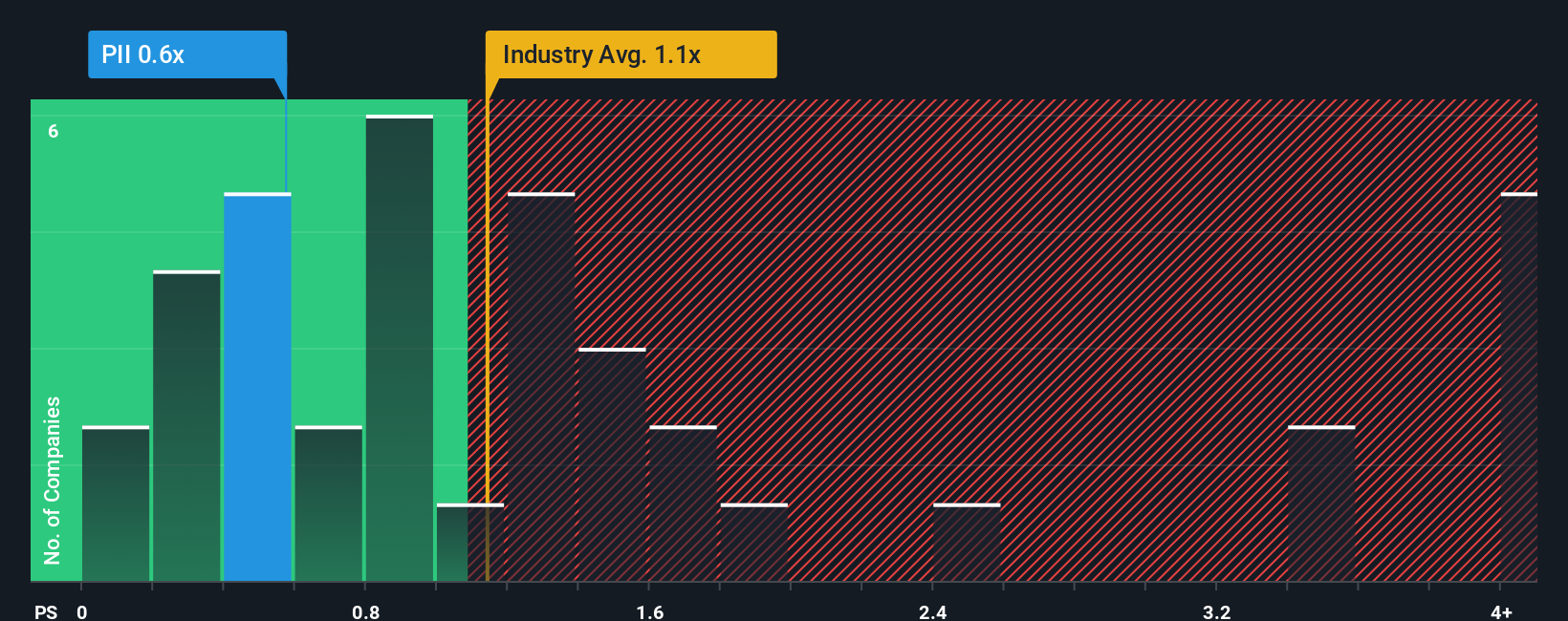

A "normal" or “fair” PS ratio for a company is influenced by growth expectations and risks. Higher expected growth or lower business risks tend to justify higher PS ratios. In contrast, mature or riskier businesses typically demand lower multiples. For Polaris, the current PS ratio is 0.52x. The average for the Leisure industry is around 0.93x, and peers trade at a higher 1.23x multiple.

Simply Wall St's “Fair Ratio” is a more tailored benchmark. It represents the PS ratio justified by Polaris's unique combination of revenue growth, profit margins, industry trends, company size, and risk profile. Unlike simple comparisons with industry or peer averages, the Fair Ratio provides a deeper lens into value based on all of these current characteristics. In this case, the Fair Ratio for Polaris has been assessed at 0.60x. Since this is quite close to the company’s actual multiple, the shares look neither particularly undervalued nor overvalued on this metric.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Polaris Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives, the power tool for connecting market stories to investment decisions.

A Narrative is a simple, approachable way to capture your view of a company by combining its unique story with your expectations for future revenue, earnings, margins, and what makes it special or risky.

Think of a Narrative as a bridge. It connects how you see Polaris's business evolving, translates that perspective into a financial forecast, then uses those numbers to estimate a fair value.

Narratives are easy to create and use on Simply Wall St's Community page, where millions of investors share their views and debate fair value in real time.

This approach empowers you to make smarter buy or sell decisions by comparing your Narrative's fair value to the current share price, so you can see not just what the market thinks, but what fits your own outlook and risk profile.

The best part? Narratives update dynamically as new news, reports, or company results are announced, helping you keep your investment view relevant.

For Polaris, one investor might see margin gains and premium product growth as supporting a $70 fair value, while another worries about tariffs and weak international business, supporting a $29 outlook. Your Narrative makes your investment logic visible and actionable.

Do you think there's more to the story for Polaris? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PII

Polaris

Designs, engineers, manufactures, and markets powersports vehicles in the United States, Canada, and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion