- United States

- /

- Leisure

- /

- NYSE:PII

Does Polaris’ (PII) Racing Dominance and Premium Slingshot Line Reveal a Deeper Brand Strategy Shift?

Reviewed by Sasha Jovanovic

- In December 2025, Polaris announced its 2026 Slingshot lineup, highlighted by a limited-edition Grand Touring model with premium iridescent paint, new Honeycomb wheels, and the subscription-based RIDE COMMAND+ connectivity suite.

- These launches, alongside Polaris RZR Factory Racing’s sweep of every major 2025 off-road event including Dakar and King of the Hammers, reinforce the brand’s performance credentials and premium positioning.

- We’ll now examine how Polaris RZR Factory Racing’s dominant 2025 season may influence Polaris’s broader investment narrative and future brand strength.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Polaris Investment Narrative Recap

To own Polaris, you need to believe in its ability to turn strong brands and premium pricing into sustainable profits despite tariffs, industry softness, and recent losses. The Slingshot 2026 lineup and RZR Factory Racing’s clean sweep at major 2025 events both support the premium and performance narrative, but they do not materially change the near term earnings risk from weak retail demand, tariff costs, and tighter credit conditions that still hang over the story.

The Slingshot 2026 launch, with its limited-edition Grand Touring model and subscription-based RIDE COMMAND+, is the clearest tie-in to this news. It connects Polaris’ racing halo to a concrete product with higher-spec trims and potential recurring software revenue, aligning with the existing catalyst of leaning into premium offerings while the company works to manage tariffs and restore profitability.

Yet, while the racing wins and fresh Slingshot lineup help the brand, investors should still be aware that persistent tariff costs and soft powersports demand could...

Read the full narrative on Polaris (it's free!)

Polaris’ narrative projects $7.5 billion revenue and $224.6 million earnings by 2028.

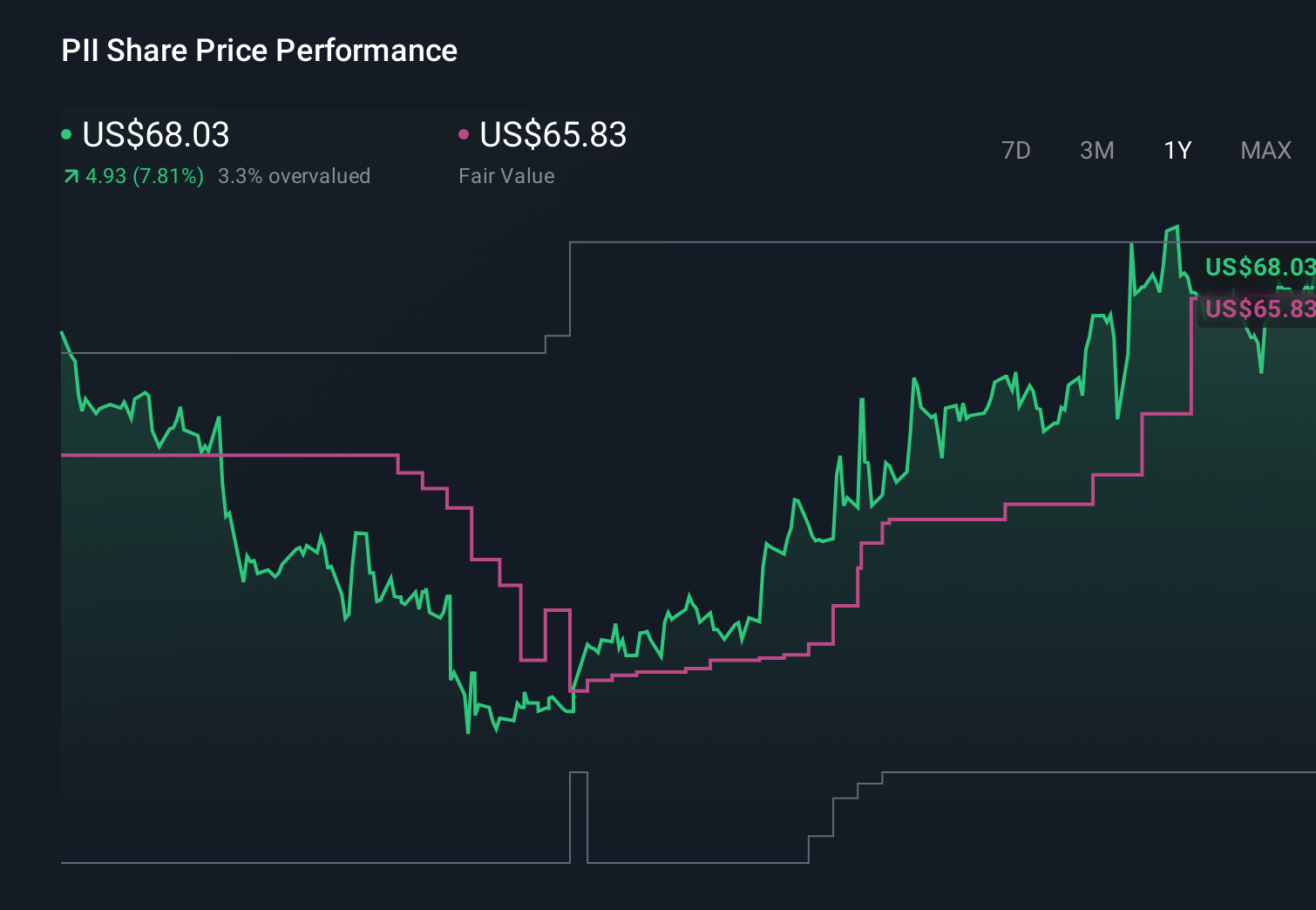

Uncover how Polaris' forecasts yield a $65.83 fair value, a 5% downside to its current price.

Exploring Other Perspectives

Six fair value estimates from the Simply Wall St Community span from about US$7 to US$70 per share, reflecting very different expectations. When you weigh those views against Polaris’ ongoing tariff headwind, it underlines how important it is to compare multiple opinions before deciding how this stock might fit into your portfolio.

Explore 6 other fair value estimates on Polaris - why the stock might be worth as much as $70.00!

Build Your Own Polaris Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Polaris research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Polaris research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Polaris' overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PII

Polaris

Designs, engineers, manufactures, and markets powersports vehicles in the United States, Canada, and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion