- United States

- /

- Consumer Durables

- /

- NYSE:PHM

Does Strong Homebuyer Demand Signal More Upside for PulteGroup in 2025?

Reviewed by Bailey Pemberton

- Ever wondered whether PulteGroup is actually a bargain or if the price has already run away from you? We are diving into what the numbers and market signals are really saying about its value.

- Despite some ups and downs lately, PulteGroup's stock has climbed 10.0% year-to-date and delivered a massive 183.5% gain over the past three years. However, it is down 7.8% over the last twelve months.

- Recent headlines highlight strong U.S. homebuyer demand and ongoing supply constraints. Analysts point out how industry fundamentals continue to shift in response to interest rate policies and demographic trends. News of new community openings and favorable mortgage incentive initiatives has kept investors' attention, fueling fresh debates about the group's growth prospects.

- PulteGroup currently scores an impressive 5 out of 6 on key valuation checks, hinting at real value potential. Let’s break down the standard approaches to valuing the company. Keep in mind there is an even sharper lens we will bring in at the end of this article to really put things in perspective.

Approach 1: PulteGroup Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and then discounting them back to today’s value. This approach relies on cash flow forecasts, assumptions about growth, and a suitable discount rate. It provides a grounded view of what a business is truly worth rather than simply looking at recent share prices.

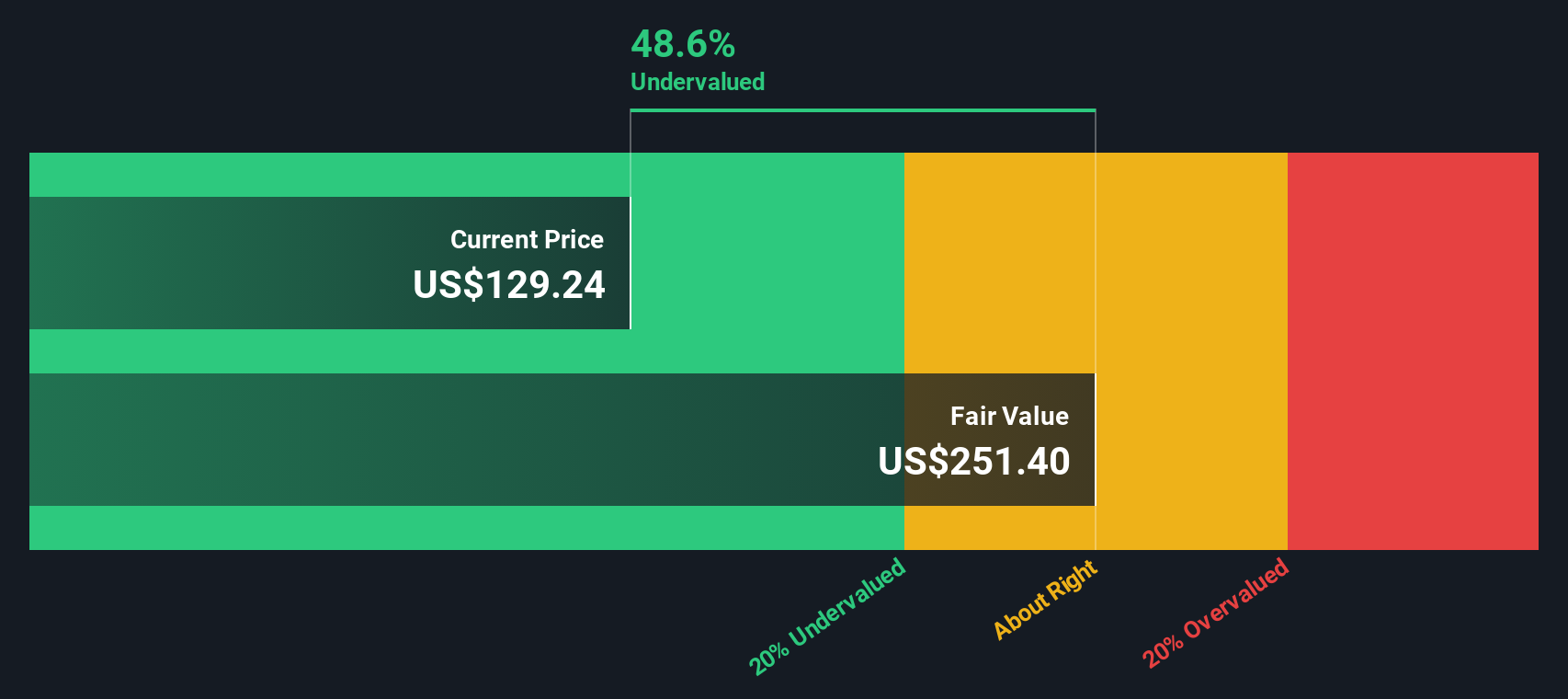

PulteGroup’s DCF analysis starts with current Free Cash Flow of $1.56 billion. Analyst estimates project these cash flows to stay above $2 billion annually through 2027, with the 2035 projection landing just above $2.03 billion. While analyst estimates only look ahead five years, Simply Wall St extrapolates further using reasonable growth assumptions, showing a steady trajectory over the coming decade.

Once these projected cash flows are discounted back to their present value, PulteGroup’s intrinsic value is estimated at $153.14 per share. This is roughly 22.7% higher than its recent market price, suggesting that the stock is undervalued based on core cash generation potential and prudent growth forecasts.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests PulteGroup is undervalued by 22.7%. Track this in your watchlist or portfolio, or discover 872 more undervalued stocks based on cash flows.

Approach 2: PulteGroup Price vs Earnings (PE)

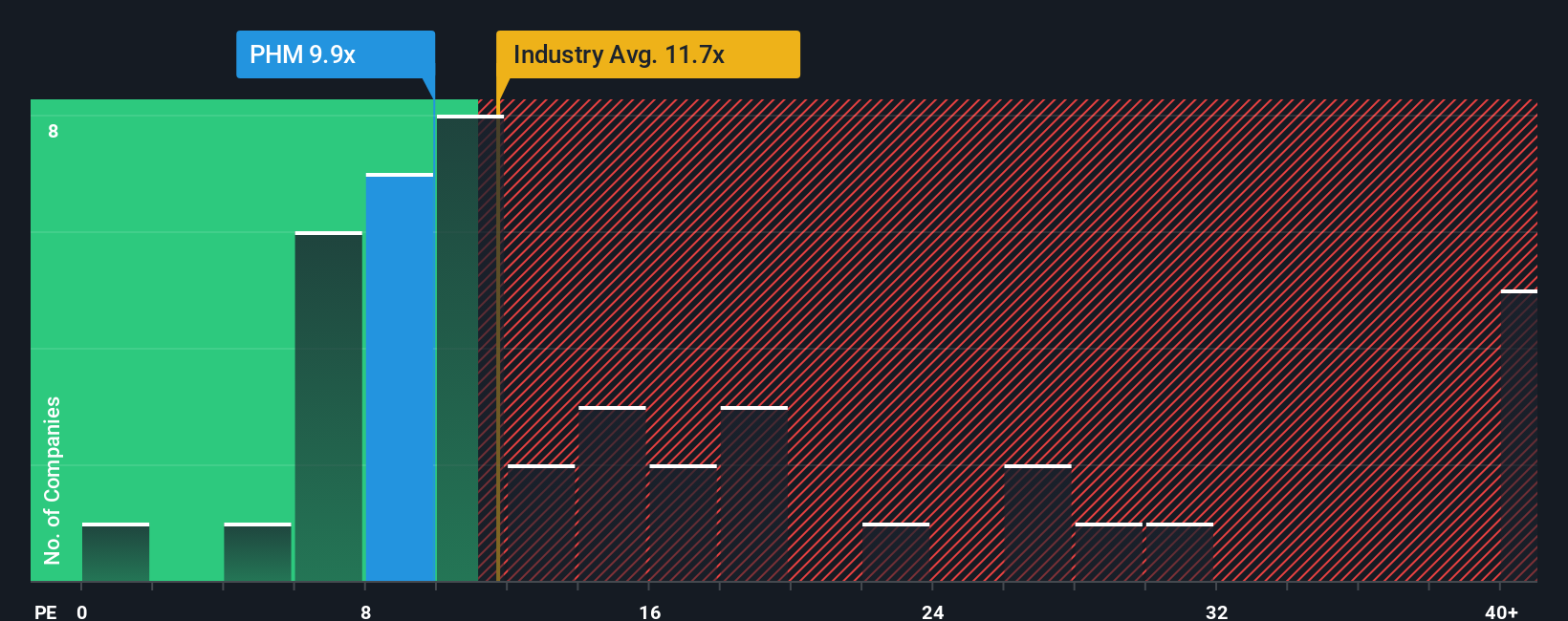

The Price-to-Earnings (PE) ratio is a classic tool for valuing profitable companies, providing a straightforward way to compare what investors are willing to pay today for a dollar of current earnings. When a company is consistently posting healthy profits, as PulteGroup is, the PE ratio offers an intuitive snapshot of relative value.

However, a “normal” or “fair” PE ratio is not one size fits all. It is shaped by expectations around future growth and the risks associated with a company’s earnings stream. Fast-growing companies typically command higher PE ratios, while those facing sector or economic risks might trade at a discount.

PulteGroup currently sports a PE ratio of 8.8x. For perspective, that is noticeably below both the industry average of 10.5x and the peer average of 11.8x.

Simply Wall St’s proprietary Fair Ratio for PulteGroup comes in at 13.8x. This Fair Ratio goes a step beyond a basic comparison to industry averages or peers, as it considers the company's specific earnings growth rates, profitability, scale, risks, and its position within the Consumer Durables sector. By adjusting for these unique company and industry factors, the Fair Ratio gives a more nuanced target for valuation.

Comparing the actual PE of 8.8x to the Fair Ratio of 13.8x suggests PulteGroup is trading at a significant discount to where it could reasonably be valued. This supports the case for the stock being undervalued based on earnings multiples, not just on cash flow analysis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1399 companies where insiders are betting big on explosive growth.

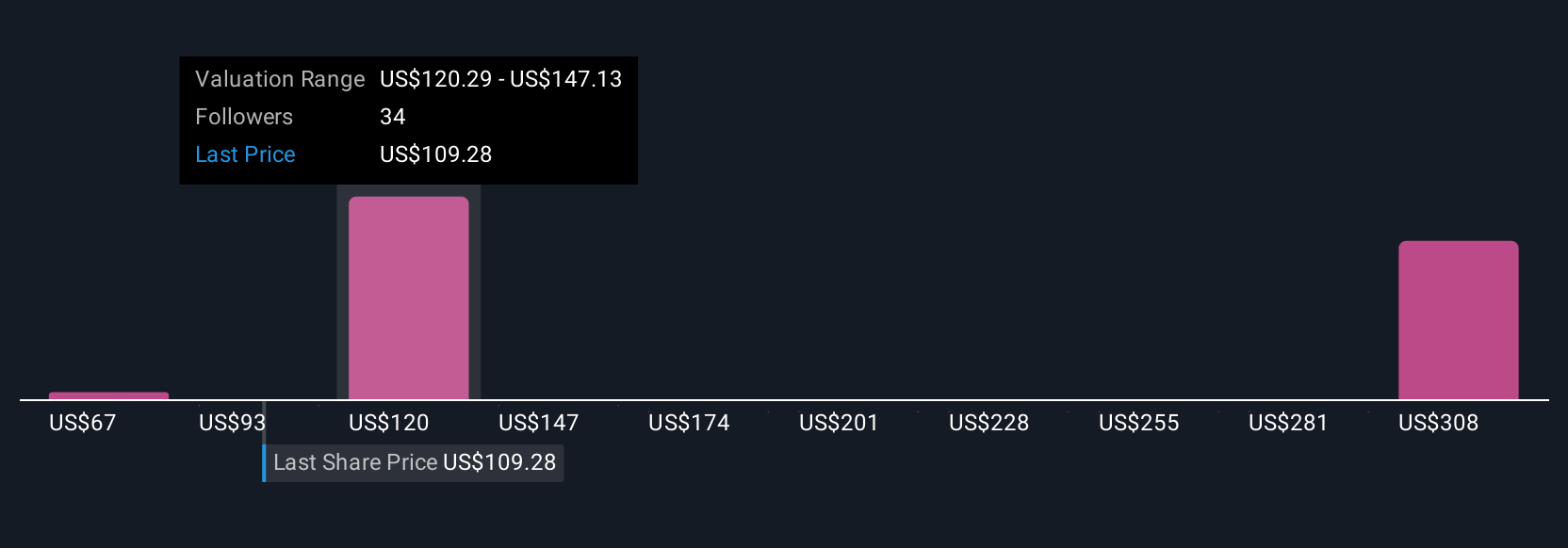

Upgrade Your Decision Making: Choose your PulteGroup Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is simply the story or viewpoint you have about a company—what you think will drive its future, how its industry is changing, and where it’s headed. Unlike static models, Narratives let you connect your perspective to numbers by linking your assumptions about future revenue, margins, and risks to a fair value estimate. On Simply Wall St, Narratives are easy to create, share, and compare on the Community page, used by millions of investors. Narratives give you a dynamic, living forecast that automatically updates when news or results are released. This helps you continuously decide if PulteGroup’s price is attractive compared to your fair value view. For example, some investors may believe PulteGroup should be valued as high as $163.00, anticipating robust demand and margin expansion from active adult communities and digital innovation. More cautious investors, seeing risks in affordability and regional market slowdowns, set their Narrative fair value closer to $98.00. By using Narratives, you can see exactly how your story compares to both the market and to other investors, making buy or sell choices far more transparent and personal.

Do you think there's more to the story for PulteGroup? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PHM

PulteGroup

Through its subsidiaries, engages in the homebuilding business in the United States.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives