- United States

- /

- Consumer Durables

- /

- NYSE:MTH

Meritage Homes (MTH) Is Up 5.4% After Analyst Upgrades and Rising Institutional Interest - Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- In recent days, Meritage Homes received prominent endorsements from UBS analyst John Lovallo and the ClearBridge Small Cap Strategy, both highlighting improved prospects for homebuilders amid expectations of declining interest rates and a persistent U.S. housing shortage.

- Institutional investment interest has surged, spotlighting Meritage's potential to benefit from industry-wide trends favoring large, efficient builders as the market environment shifts.

- We'll explore how renewed analyst confidence and institutional backing, driven by optimism for lower interest rates, influence Meritage Homes' investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Meritage Homes Investment Narrative Recap

Shareholders in Meritage Homes need to believe that industry-wide optimism about declining interest rates and the persistent U.S. housing shortage can support renewed growth, especially as institutional and analyst endorsements intensify. However, the immediate impact on the company’s most important catalyst, new home demand, remains uncertain, while the primary risk continues to be price and margin pressure if affordability issues and high incentives persist; recent news provides investor confidence, but the fundamental risks appear largely unchanged for the short term.

Among recent company moves, Meritage’s decision to increase its share buyback authorization by US$500 million stands out. This action underscores management’s confidence in the company’s value and may offer some support if market volatility returns, especially as the housing market reacts to interest rate changes and competition.

On the other hand, investors should be aware that Meritage is still exposed to rapid shifts in affordability and consumer hesitancy, meaning that if...

Read the full narrative on Meritage Homes (it's free!)

Meritage Homes is projected to reach $7.1 billion in revenue and $549.0 million in earnings by 2028. This outlook assumes annual revenue growth of 4.8%, but also a decrease in earnings of $89.3 million from the current $638.3 million.

Uncover how Meritage Homes' forecasts yield a $84.00 fair value, a 20% upside to its current price.

Exploring Other Perspectives

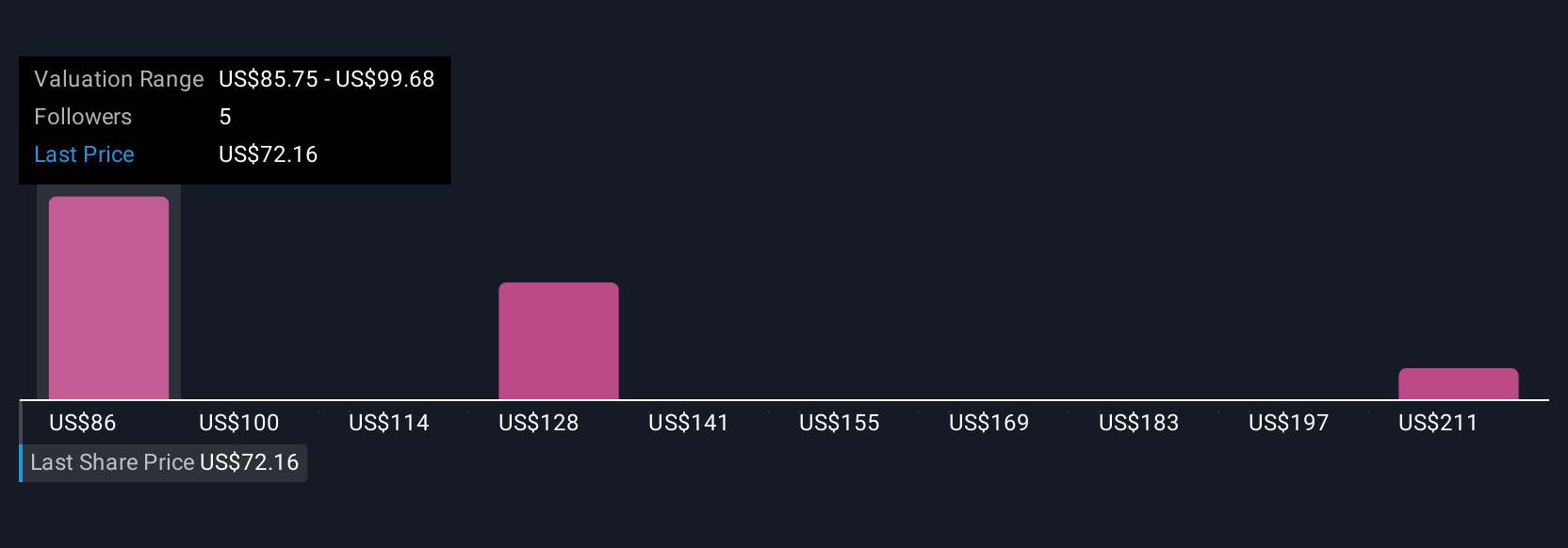

Three distinct fair value forecasts from the Simply Wall St Community range from US$29.30 to US$225 per share. Despite this broad spread, ongoing margin risk from affordability and pricing pressure may shape future results, so consider several viewpoints before deciding.

Explore 3 other fair value estimates on Meritage Homes - why the stock might be worth over 3x more than the current price!

Build Your Own Meritage Homes Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Meritage Homes research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Meritage Homes research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Meritage Homes' overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MTH

Meritage Homes

Designs and builds single-family attached and detached homes in the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives