- United States

- /

- Leisure

- /

- NYSE:MODG

How the Planned Topgolf Spin-Off and Board Changes at MODG Are Shaping Its Investment Story

Reviewed by Simply Wall St

- On August 25, 2025, Scott M. Marimow resigned from the board of Topgolf Callaway Brands, and the board subsequently reduced its size to 10 directors; the company also announced plans to spin off its high-growth Topgolf segment into an independent public entity by July 2025, while slowing new venue openings to focus on cash flow and performance at established locations.

- This spin-off initiative is part of a broader effort to unlock shareholder value and optimize the operational efficiency of both the Topgolf and Callaway segments.

- We'll now examine how the planned Topgolf spin-off and renewed performance focus may reshape Topgolf Callaway Brands' investment narrative.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Topgolf Callaway Brands Investment Narrative Recap

To be a shareholder in Topgolf Callaway Brands right now, you need confidence in its ability to unlock value through the upcoming Topgolf spin-off and sharpen its operational focus despite recent softness in same-venue sales and lowered earnings guidance. The resignation of Scott M. Marimow and reduction of the board’s size do not materially affect the most immediate catalysts or main risks; the real short-term focus remains on whether stabilized performance at venues will offset recent declines in revenue. Among recent announcements, the company’s plan to slow down new Topgolf venue openings is particularly relevant to current catalysts. By prioritizing cash flow and performance at established locations, Topgolf Callaway aims to address pressures on same-venue sales and profit margins, aligning with market expectations as the company prepares for a major structural shift through its planned spin-off. However, investors should be especially aware that, in contrast to the company’s efforts to improve traffic with aggressive value promotions, there remains significant risk if discounted offerings continue to reduce average ticket size and...

Read the full narrative on Topgolf Callaway Brands (it's free!)

Topgolf Callaway Brands is projected to reach $4.1 billion in revenue and $209.8 million in earnings by 2028. This scenario assumes a 0.5% annual revenue decline and an earnings increase of $1.7 billion from current earnings of -$1.5 billion.

Uncover how Topgolf Callaway Brands' forecasts yield a $10.50 fair value, a 11% upside to its current price.

Exploring Other Perspectives

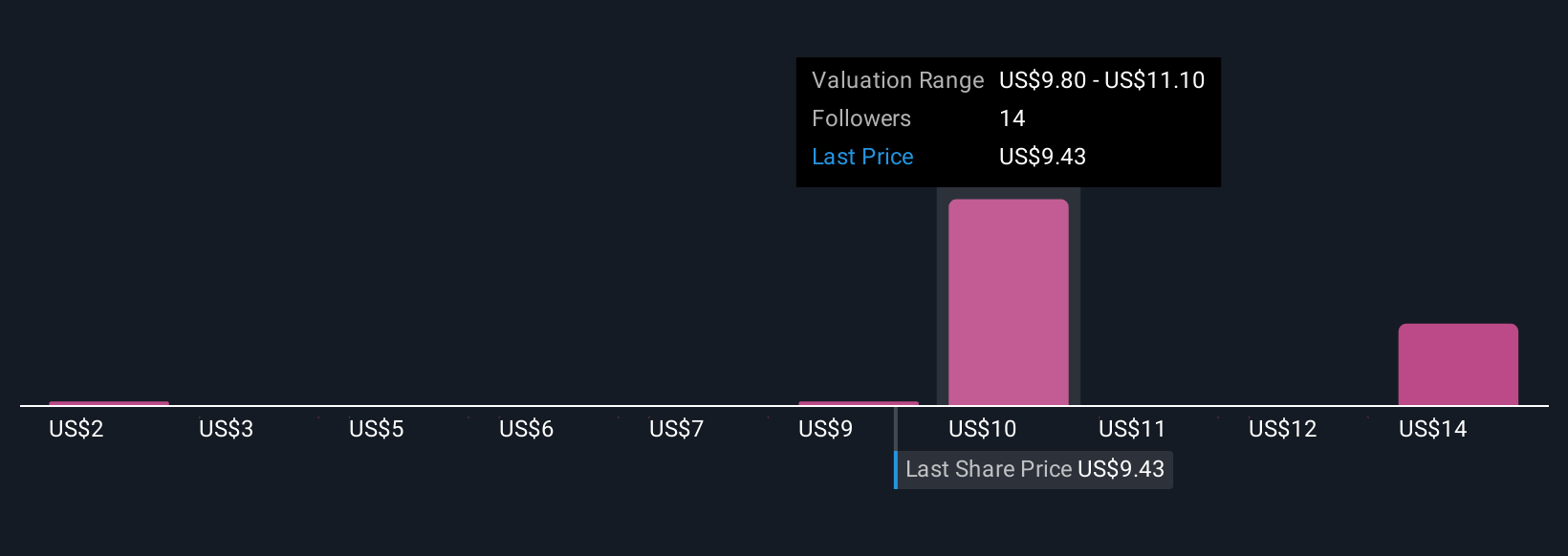

Five retail investor fair value estimates from the Simply Wall St Community for Topgolf Callaway Brands range widely from US$2 to US$15 per share. With same-venue sales still under pressure, this divergence reflects how differently each participant is assessing current risks and future potential.

Explore 5 other fair value estimates on Topgolf Callaway Brands - why the stock might be worth less than half the current price!

Build Your Own Topgolf Callaway Brands Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Topgolf Callaway Brands research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Topgolf Callaway Brands research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Topgolf Callaway Brands' overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Topgolf Callaway Brands might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MODG

Topgolf Callaway Brands

Designs, manufactures, and sells golf equipment, golf and lifestyle apparel, and other accessories in the United States, Europe, Asia, and Internationally.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives