- United States

- /

- Consumer Durables

- /

- NYSE:MHO

M/I Homes (MHO): Assessing Valuation Following Earnings Miss and Share Buyback Update

Reviewed by Simply Wall St

M/I Homes (MHO) just announced its third quarter results, revealing both revenue and net income have slipped compared to last year. The company also provided an update on its ongoing share buyback effort.

See our latest analysis for M/I Homes.

M/I Homes' recent earnings update appears to have rattled investors, with the stock posting a sharp 10.1% share price decline over the past month and a 6.6% dip in the last week. Despite these pullbacks, M/I still boasts a remarkable three-year total shareholder return of 216.5%. This reflects impressive long-term wealth creation even as momentum cools lately.

If you're curious to see what else is catching investors’ attention right now, it's a great moment to broaden your search and discover fast growing stocks with high insider ownership

With shares down sharply following recent results, investors are left to consider whether the current weakness presents real value, or if the market is accurately factoring in M/I Homes' future prospects. Is this a buying opportunity, or is optimism already reflected in the price?

Most Popular Narrative: 19% Undervalued

M/I Homes' fair value calculation lands at $162, which is substantially above the latest closing price of $131.01. This invites a closer look at the assumptions behind this optimistic projection, all based on an 8.9% discount rate.

The company is strategically expanding its community count, up 5% year-over-year, and planning continued growth in high-demand regions (Midwest, Southeast, and especially Southern markets like Texas and Florida). Demographic trends, such as millennial and Gen Z buyers and household formation, along with migration patterns, support long-term demand. This places M/I Homes in a favorable position for future revenue growth.

What exactly convinces analysts to back a fair value so much higher than today's share price? One key number in their model projects shrinking margins but relies on a bold call for steady expansion in the hottest U.S. housing regions. Want to know how this mix of risks and opportunities turns into a valuation target? Click to uncover the core financial scenarios at the heart of this narrative.

Result: Fair Value of $162 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent interest rate headwinds and rising inventory risks could quickly erode expected gains and challenge the upbeat narrative for M/I Homes.

Find out about the key risks to this M/I Homes narrative.

Another View: Discounted Cash Flow Tells a Different Story

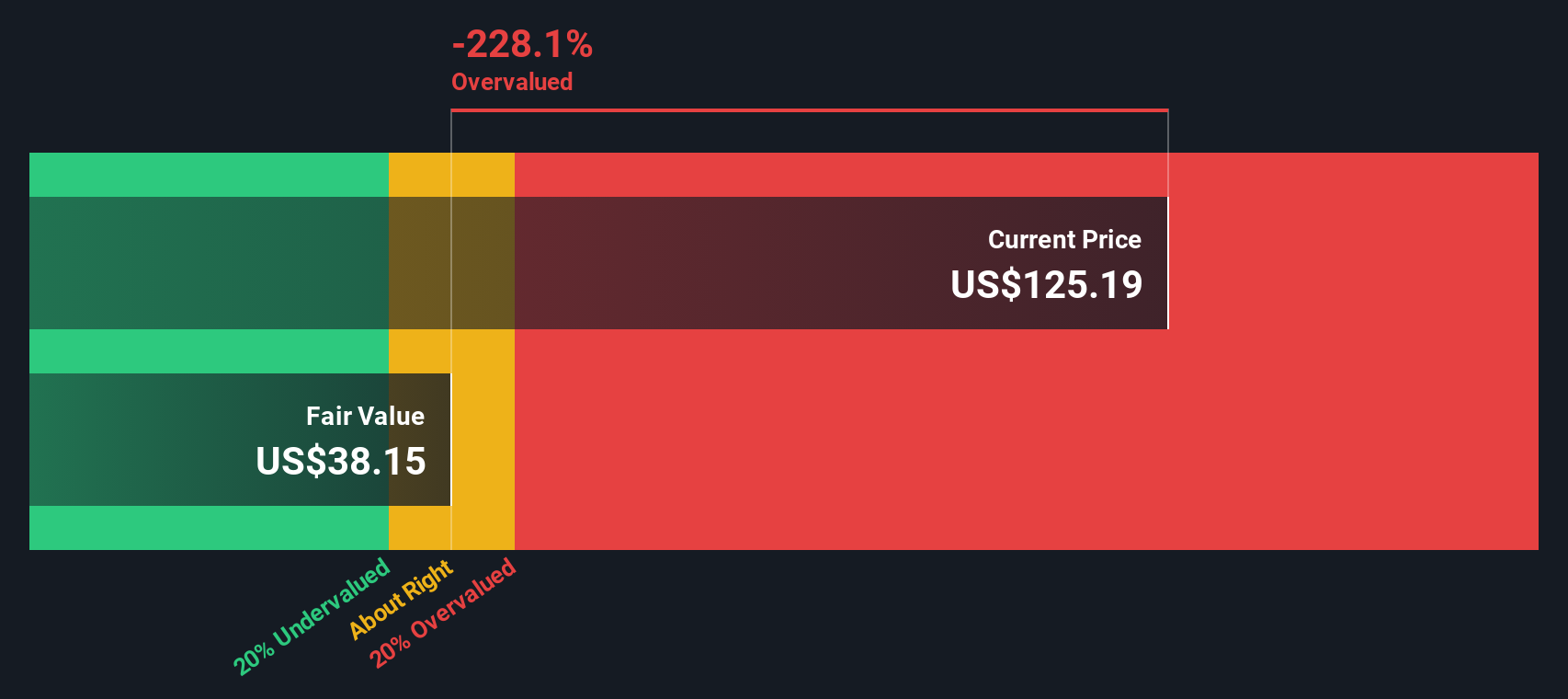

While the analyst consensus sees M/I Homes as undervalued, our SWS DCF model suggests otherwise. According to a detailed discounted cash flow calculation, the stock is trading noticeably above its intrinsic fair value, which raises caution about long-term upside if future cash flows do not accelerate. Will the story play out as optimists hope?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out M/I Homes for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own M/I Homes Narrative

If you'd rather dive into the data firsthand or build your own perspective, you can craft a custom narrative in just a few minutes. Do it your way

A great starting point for your M/I Homes research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity pass you by. If you want to stay ahead, explore game-changing sectors and spot hidden winners that the crowds are missing.

- Capitalize on high yields by checking out these 21 dividend stocks with yields > 3%, which outpace the market with substantial income potential.

- Gain access to companies at bargain prices with these 871 undervalued stocks based on cash flows, screening for the strongest upside backed by real cash flows.

- Ride the next wave in healthcare innovation by scouting these 34 healthcare AI stocks, powering medical breakthroughs with artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MHO

M/I Homes

Engages in the construction and sale of single-family residential homes in Ohio, Indiana, Illinois, Minnesota, Michigan, Florida, Texas, North Carolina, and Tennessee.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives