- United States

- /

- Consumer Durables

- /

- NYSE:MHO

M/I Homes (MHO): Assessing Valuation Following $250 Million Share Buyback Authorization

Reviewed by Simply Wall St

M/I Homes (MHO) just announced a fresh share repurchase program, allowing the company to buy back up to $250 million of its own stock. These programs often catch investors’ eyes, as they can signal company confidence.

See our latest analysis for M/I Homes.

Shares have seen a dip this year, with a year-to-date price return of -1.2%. M/I Homes completed its prior $170 million buyback and has introduced a new $250 million program. While the 1-year total shareholder return is notably down at -23.6%, momentum is mixed amid management initiatives and shifting sentiment. The company’s impressive 198% three-year total return still highlights its long-term growth story.

If news of M/I Homes' new buyback has you looking for promising opportunities beyond homebuilders, now's the perfect time to broaden your search and explore fast growing stocks with high insider ownership.

With buybacks making headlines and the stock trading well below analyst targets, the key question is whether M/I Homes is currently undervalued and offering investors a hidden opportunity, or if future growth is already fully factored in.

Most Popular Narrative: 20% Undervalued

The prevailing narrative places M/I Homes' fair value at $162, roughly 20% above the last close of $129.17, raising eyebrows about its current market discount and what is driving this valuation. Several competitive and financial strategies appear to be in play. Let’s take a direct look.

M/I Homes maintains a robust land position with an owned and controlled supply equating to 5 to 6 years. This, along with disciplined acquisition and inventory management, minimizes financial risk, enables consistent earnings growth, and positions the company to seize market share during future housing upturns.

Want to know what propels this price target? There is a bold set of expectations buried in this narrative about future revenues, profit margins, and market positioning. See which ambitious financial forecasts and industry assumptions are shaping the fair value today. Uncover the story behind the numbers.

Result: Fair Value of $162 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent higher interest rates and rising inventory exposure could quickly erode margins and dampen the outlook for M/I Homes' future earnings.

Find out about the key risks to this M/I Homes narrative.

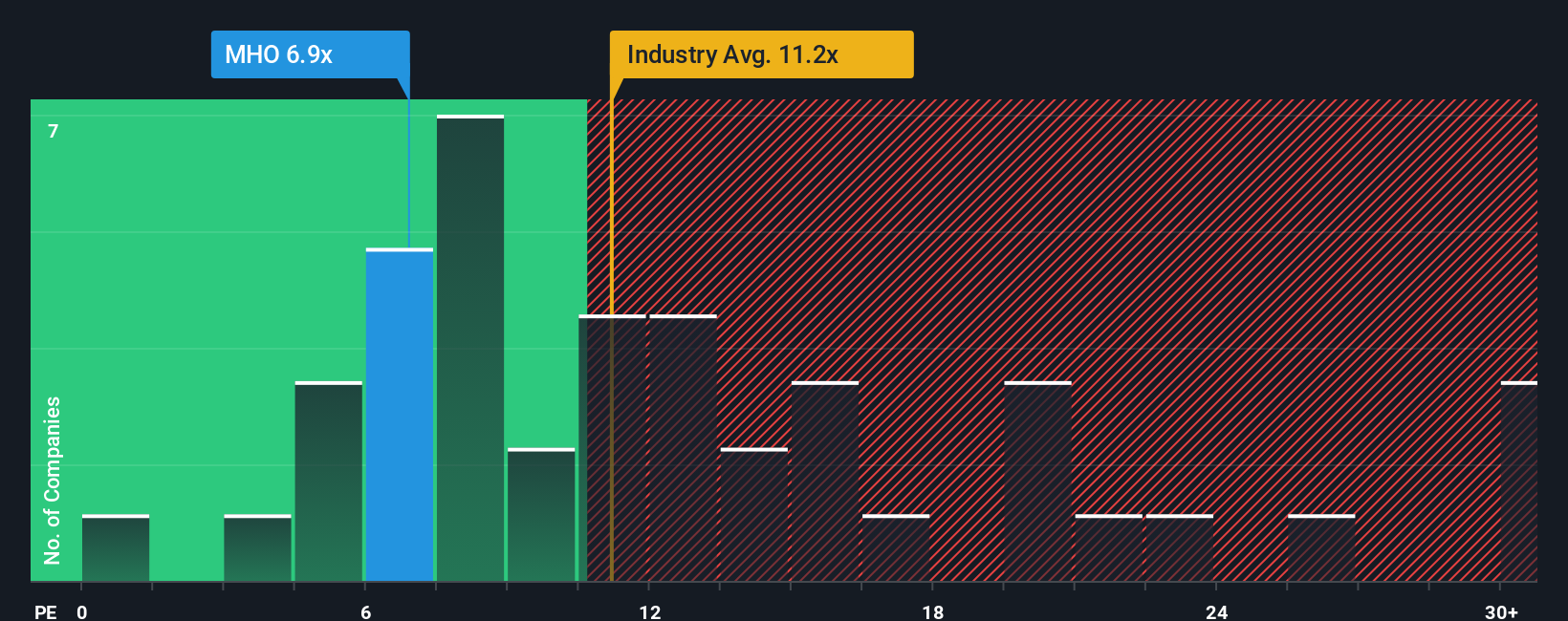

Another View: How Peer Comparisons Stack Up

Looking at market valuation ratios offers a different angle. M/I Homes trades at just 7.1 times earnings, which is meaningfully lower than both the US Consumer Durables industry average of 11.8x and its peer group average of 11.9x. Even compared to its fair ratio of 11.6x, M/I Homes appears discounted. This gap suggests a bargain, but also raises questions about whether the market is overlooking risks or if an opportunity is being missed. Is the low price a red flag or a green light?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out M/I Homes for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 917 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own M/I Homes Narrative

If you have your own perspective or want to challenge the consensus, you can dive into the data and build your own view in just a few minutes. Do it your way.

A great starting point for your M/I Homes research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Expand your portfolio with exciting opportunities and stay ahead of the market curve. Don’t miss out on these potential gems, as smart investors act first.

- Uncover fresh value by targeting these 917 undervalued stocks based on cash flows that are trading well below their potential and could deliver significant gains over time.

- Capture future trends by targeting these 26 AI penny stocks leveraging artificial intelligence breakthroughs and reshaping entire industries right now.

- Maximize your passive income by adding these 14 dividend stocks with yields > 3% with reliable yields above 3% to your holdings for steady returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MHO

M/I Homes

Engages in the construction and sale of single-family residential homes in Ohio, Indiana, Illinois, Minnesota, Michigan, Florida, Texas, North Carolina, and Tennessee.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026