- United States

- /

- Consumer Durables

- /

- NYSE:MHK

Will Mohawk Industries’ (MHK) Cost Cuts and Buybacks Redefine Its Competitive Edge?

Reviewed by Simply Wall St

- Mohawk Industries recently reported second-quarter 2025 results, with sales holding steady at US$2.80 billion while net income declined to US$146.5 million compared to the prior year, and completed its latest share repurchase tranche under the ongoing buyback program.

- Ongoing operational restructuring and cost-saving efforts are positioned to deliver annual savings of up to US$100 million, reflecting a proactive approach to margin improvement and efficiency amid a cautious demand environment.

- We’ll explore how Mohawk’s cost-saving measures and buyback activity influence the investment outlook for the flooring manufacturer.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Mohawk Industries Investment Narrative Recap

To be a Mohawk Industries shareholder right now, investors need to trust in the company’s ability to control costs and drive efficiency until a broader rebound in housing demand materializes. The latest earnings and share buyback news don't materially alter the key short-term catalyst, macroeconomic recovery in residential construction, or address the central risk around sustained weak demand and pressure on margins, both of which remain front and center for the flooring segment.

The company’s recent announcement of $100 million in annualized cost savings through further restructuring directly ties into Mohawk’s efforts to protect profitability in a period of softer top-line growth. These developments reinforce cost control as a crucial tool for managing through challenging cycles, especially while broader demand signals remain mixed and pricing pressures persist.

However, investors should be aware that if residential remodeling and new housing activity remain subdued, especially with ongoing economic uncertainties...

Read the full narrative on Mohawk Industries (it's free!)

Mohawk Industries' narrative projects $11.5 billion revenue and $804.7 million earnings by 2028. This requires 2.3% yearly revenue growth and a $319.4 million earnings increase from $485.3 million currently.

Uncover how Mohawk Industries' forecasts yield a $127.84 fair value, a 5% upside to its current price.

Exploring Other Perspectives

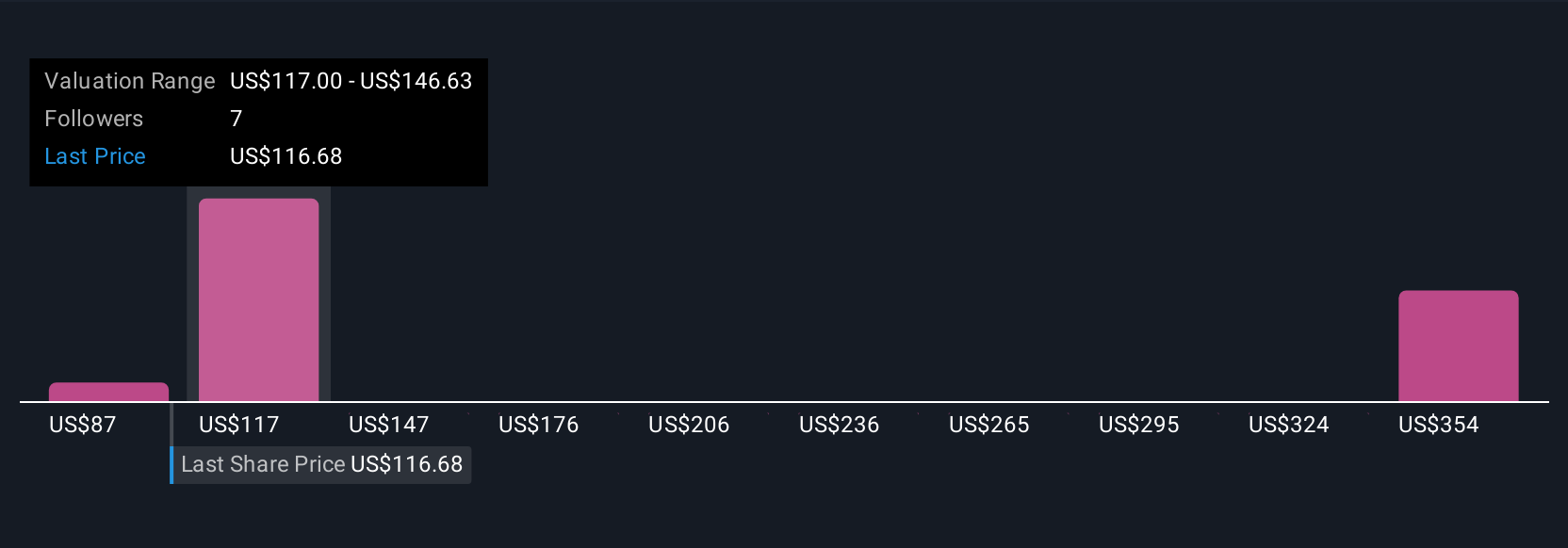

Simply Wall St Community members have posted US$87 to US$386 per share as fair value estimates, reflecting a wide span of calculations across three views. As working capital risk grows in a weak housing market, it is worth comparing these perspectives before forming your own outlook on Mohawk’s performance.

Explore 3 other fair value estimates on Mohawk Industries - why the stock might be worth 28% less than the current price!

Build Your Own Mohawk Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mohawk Industries research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Mohawk Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mohawk Industries' overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MHK

Mohawk Industries

Designs, manufactures, sources, distributes, and markets flooring products for residential and commercial remodeling, and new construction channels in the United States, Europe, Latin America, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives