- United States

- /

- Consumer Durables

- /

- NYSE:LZB

Does La-Z-Boy’s 30% Price Drop Reveal a Hidden Opportunity in 2025?

Reviewed by Bailey Pemberton

- Ever wondered if La-Z-Boy's current stock price actually reflects its true worth? You're not alone. We are diving right in to explore whether there's hidden value beneath the surface.

- Despite a tough year with shares down 29.7% year-to-date and 27.5% over the past 12 months, La-Z-Boy has posted a solid 26.5% gain over the last 3 years. This hints at some underlying strengths.

- Recent news around shifting consumer preferences and evolving supply chain challenges has kept La-Z-Boy in the spotlight, especially as the furniture industry adapts to broader economic trends. Commentators continue to speculate on the company's resilience and ability to capture future growth, fueling debate about where the stock might be headed next.

- When we run La-Z-Boy through our six-part valuation framework, it scores just 2 out of 6 for undervaluation. This is definitely a mixed result. We'll walk through our key valuation approaches next, and at the end, share a more insightful way to judge if La-Z-Boy is a value opportunity right now.

La-Z-Boy scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: La-Z-Boy Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by forecasting its future cash flows and discounting them back to today's dollar value. DCF is widely used because it grounds the valuation in the cash the business is expected to actually generate.

For La-Z-Boy, the latest twelve months Free Cash Flow (FCF) amounts to $107.3 million. Analysts forecast steady FCF growth, with projections reaching $126 million by 2029. Notably, only the first five years are based on specific analyst estimates. The further years are extrapolated by Simply Wall St. This method offers a systematic look forward, using both real-world and modelled growth assumptions.

Applying the DCF methodology, La-Z-Boy's estimated intrinsic value per share is $50.15. With the current price implying a 39.5% discount to this intrinsic valuation, the model suggests La-Z-Boy stock is trading well below what the company is fundamentally worth.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests La-Z-Boy is undervalued by 39.5%. Track this in your watchlist or portfolio, or discover 901 more undervalued stocks based on cash flows.

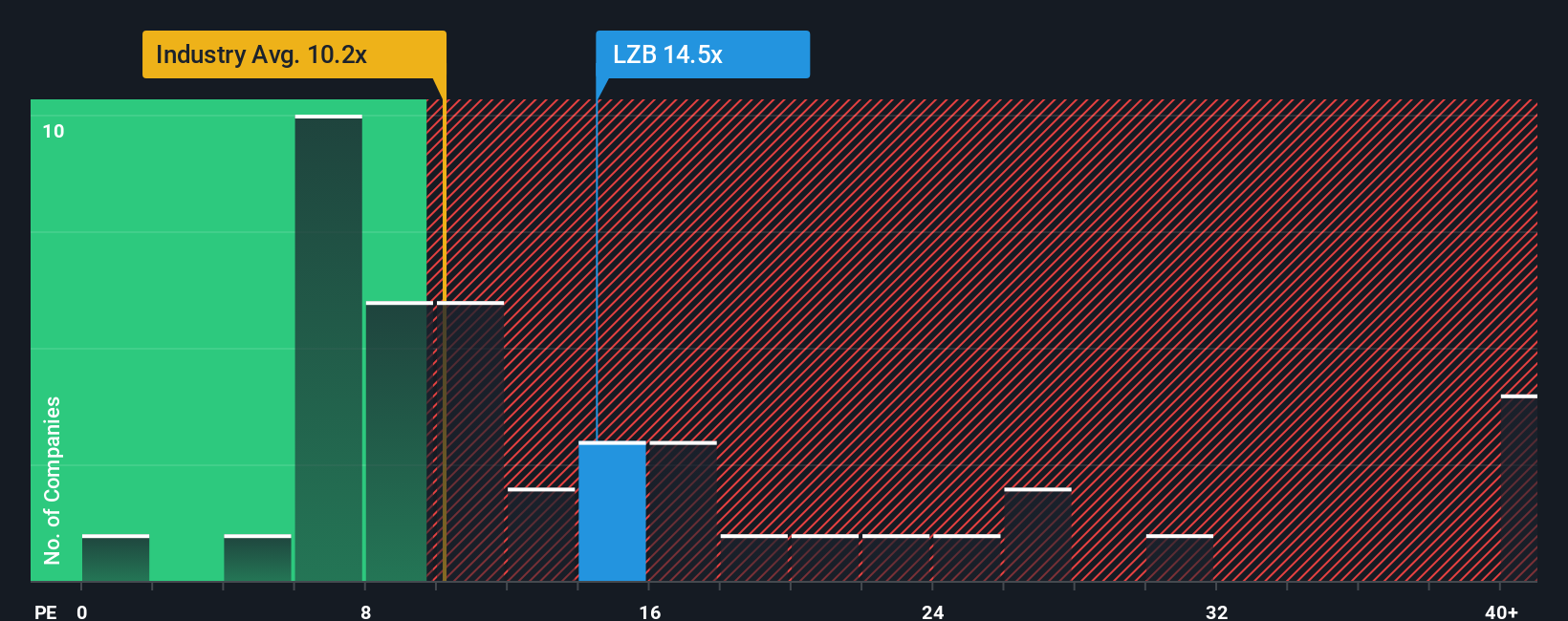

Approach 2: La-Z-Boy Price vs Earnings

For profitable companies like La-Z-Boy, the Price-to-Earnings (PE) ratio is often the preferred valuation metric. This ratio gives investors a way to quickly gauge how much they are paying for each dollar of current earnings, making it a practical tool for judging value in mature businesses.

What defines a "normal" or "fair" PE ratio, though, depends on expectations for future growth and company-specific risks. Companies with higher earnings growth or fewer perceived risks will typically command a higher PE, while slower growth or greater uncertainty results in lower multiples.

La-Z-Boy currently trades at a PE ratio of 13.66x. This is above the Consumer Durables industry average of 11.62x, and higher than the average PE of its closest peers, which sits at 10.35x. At first glance, this could suggest that the stock is valued at a premium.

However, Simply Wall St has developed a “Fair Ratio” to provide a more nuanced benchmark. For La-Z-Boy, the Fair Ratio is 13.48x, reflecting an expectation of above-average profitability, moderate risk, and sector context. Unlike basic comparisons to the industry or peers, this approach accounts for the company’s specific growth outlook, profit margins, risk profile, and market capitalization.

In this case, La-Z-Boy’s actual PE (13.66x) and Fair Ratio (13.48x) are very close, indicating that the stock is priced about right given its fundamentals and outlook.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your La-Z-Boy Narrative

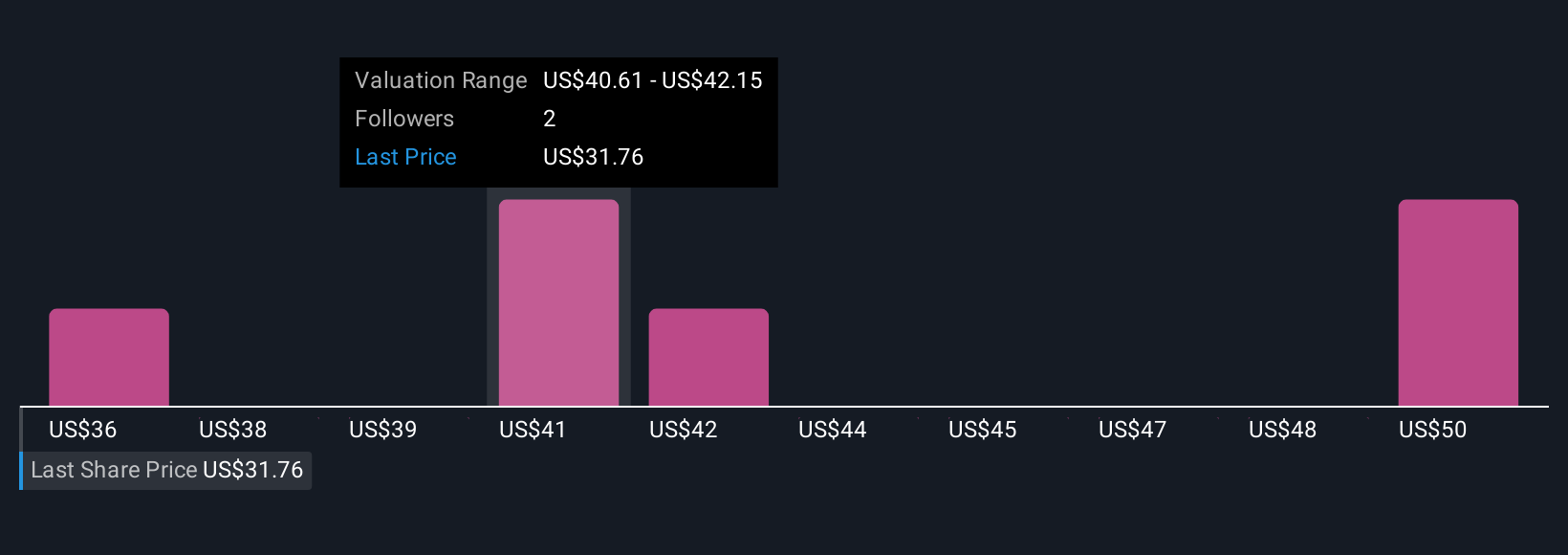

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple, story-driven framework that allows you to connect your perspective on a company, such as assumptions about future revenue, profits, and margins, with a concrete financial forecast and a fair value estimate.

This approach moves beyond just looking at ratios or model outputs by making your investment thesis explicit. It links what you believe about La-Z-Boy’s business direction, competitive strengths, or risk factors directly to your estimate of what the company is worth. Narratives are especially accessible, as they are built and shared by everyday investors and market experts alike on Simply Wall St’s Community page, helping millions to test out their ideas before making decisions.

By comparing the Fair Value implied by your Narrative to La-Z-Boy’s current share price, you can objectively decide whether it looks like a buying opportunity or a potential sell. In addition, as new information such as earnings, news, or major announcements comes in, Narratives are dynamically updated. This ensures your view stays relevant.

For example, some investors see La-Z-Boy’s retail expansion and supply chain upgrades as a catalyst for strong growth and set a bullish fair value of $46 per share, while others remain cautious due to industry risks and assign a conservative target of $36. This shows how Narratives make the range of viewpoints visible and actionable.

Do you think there's more to the story for La-Z-Boy? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LZB

La-Z-Boy

Manufactures, markets, imports, exports, distributes, and retails upholstery furniture products in the United States, Canada, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives