- United States

- /

- Consumer Durables

- /

- NYSE:LZB

A Fresh Look at La-Z-Boy (LZB) Valuation After Recent Share Price Decline

Reviewed by Simply Wall St

La-Z-Boy (LZB) stock has seen some movement recently, with shares slipping over the past month. Investors may be weighing the company’s sales growth and profitability as they look for signs of momentum in the furniture sector.

See our latest analysis for La-Z-Boy.

While La-Z-Boy’s share price has pulled back more than 24% year-to-date and remains well below recent highs, the longer-term total shareholder return tells a different story. Shareholders are still up over 38% in three years. The latest moves reflect shifting market confidence as investors balance near-term headwinds with the company’s earnings growth and established brand.

If you’re watching for opportunities beyond the big names, now is a smart time to broaden your search and discover fast growing stocks with high insider ownership

With shares trading at a notable discount to analyst price targets, and modest but positive annual growth in both revenue and net income, investors must ask whether La-Z-Boy is undervalued right now or if future gains are already reflected in the price.

Most Popular Narrative: 20% Undervalued

With La-Z-Boy’s last close at $32.73 and the most-followed narrative fair value at $41.00, the valuation gap has turned heads among market watchers. This consensus storyline attributes the difference to operating improvements and upcoming strategic shifts, and it invites debate about just how far profitability and growth can stretch in a challenging sector.

“Streamlined distribution, refreshed branding, and vertical integration enhance operating efficiency, brand appeal, and protection from supply chain disruptions. Macroeconomic and industry challenges, margin compression from promotions, and underperforming segments threaten profitability, while expansion initiatives risk straining cash flow and delaying earnings improvement.”

Want to know which bold bets and financial levers are essential for this 20% upside? There’s tension between gradual growth and aggressive expansion. Dive in to see which assumptions have the biggest impact, and why the outcome could surprise you.

Result: Fair Value of $41.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weak store traffic or prolonged margin pressure in key segments could quickly erode optimism about La-Z-Boy’s path to recovery.

Find out about the key risks to this La-Z-Boy narrative.

Another View: What Do the Multiples Say?

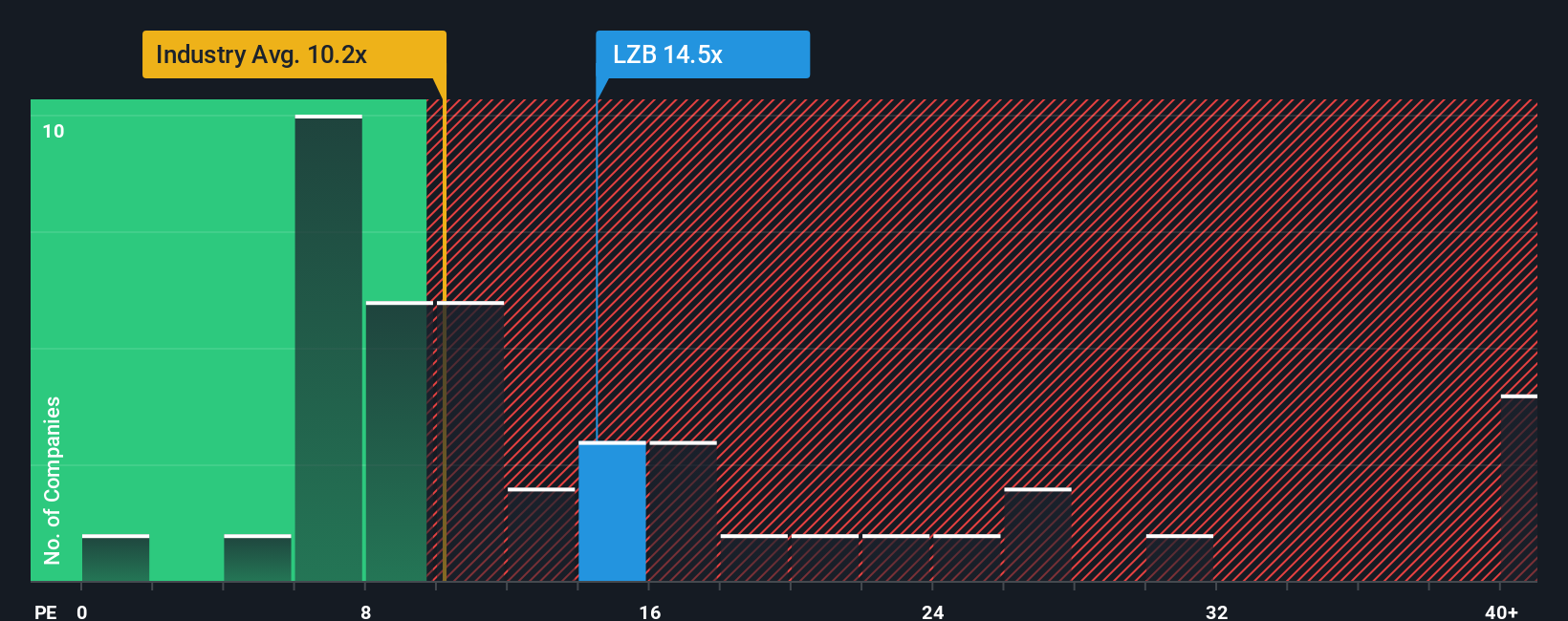

Taking a practical look at valuation multiples, La-Z-Boy trades at 14.7 times earnings. That is well above both the peer average of 12.1x and the US Consumer Durables industry average of 10.6x. This suggests the market is pricing in either resilience or future growth that others do not see. The fair ratio is 15.3x, a level the stock could gravitate toward if trends shift. Is this a premium worth paying, or a warning that expectations may be set too high?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own La-Z-Boy Narrative

If you think the story could unfold differently or want to dig into the numbers yourself, it only takes a few minutes to shape your own take. Do it your way

A great starting point for your La-Z-Boy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit yourself to just one opportunity when a whole world of unique stocks is waiting. Use these powerful tools to find your next standout investment:

- Accelerate your income goals by reviewing these 17 dividend stocks with yields > 3% and target companies with strong yields above 3%.

- Spot tomorrow’s tech leaders as you scan these 27 AI penny stocks that are driving real innovation in artificial intelligence.

- Take advantage of market mispricings with these 877 undervalued stocks based on cash flows and pinpoint stocks trading below their intrinsic value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LZB

La-Z-Boy

Manufactures, markets, imports, exports, distributes, and retails upholstery furniture products in the United States, Canada, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives