- United States

- /

- Luxury

- /

- NYSE:LEVI

Why Levi Strauss (LEVI) Is Up 5.8% After Expanding Its Premium Blue Tab Denim Line

Reviewed by Sasha Jovanovic

- Levi Strauss & Co. has announced the expansion of its premium “Blue Tab” denim line, planning a broader rollout in 2026 after experiencing strong early sales across Asia, Europe, and the US.

- This move highlights Levi’s ambition to balance its traditional value offerings with a push into the upscale market, signaling a significant shift in its growth strategy and market positioning.

- We'll explore how Levi's growing presence in luxury denim could influence its overall brand momentum and future business outlook.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Levi Strauss Investment Narrative Recap

To be optimistic about Levi Strauss as a shareholder, you need to believe the company can successfully defend and grow its denim leadership while deepening its push into premium segments without eroding the mainstream business. The Blue Tab expansion is a positive signal for strengthening brand equity and margin potential, but in the near term, it doesn't fundamentally shift the largest catalyst, Levi's international and DTC channel growth, or change the biggest risk around changing consumer preferences and denim category exposure.

One recent announcement that matters in this context is Levi's raised 2025 earnings guidance, which followed continued strength in both top and bottom line performance. This growth outlook supports the narrative that brand repositioning and premiumization efforts, highlighted by the Blue Tab rollout, could reinforce margins if demand holds up in a fast-moving fashion market.

However, against this progress, investors should remember that if denim trends fade or consumer tastes shift away from Levi’s core category, then ...

Read the full narrative on Levi Strauss (it's free!)

Levi Strauss' outlook anticipates $6.8 billion in revenue and $769.0 million in earnings by 2028. This scenario assumes a 1.4% annual revenue growth rate and an increase in earnings of $345.9 million from the current earnings of $423.1 million.

Uncover how Levi Strauss' forecasts yield a $26.79 fair value, a 25% upside to its current price.

Exploring Other Perspectives

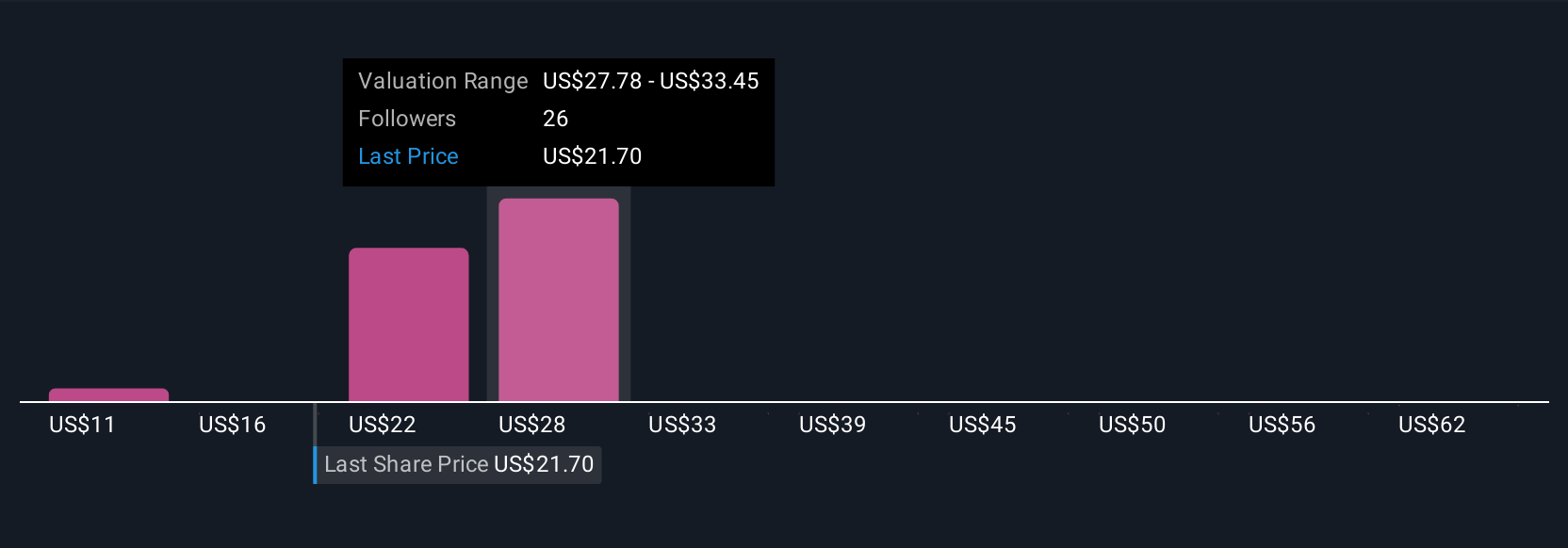

Seven fair value estimates from the Simply Wall St Community span US$10.77 to over US$1,010. With such range in opinion, don't lose sight that Levi's reliance on denim means shifts in fashion or consumer preferences could have an outsize impact on future returns.

Explore 7 other fair value estimates on Levi Strauss - why the stock might be a potential multi-bagger!

Build Your Own Levi Strauss Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Levi Strauss research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Levi Strauss research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Levi Strauss' overall financial health at a glance.

No Opportunity In Levi Strauss?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LEVI

Levi Strauss

Designs, markets, and sells apparels and related accessories for men, women, and children in the United States and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives