- United States

- /

- Consumer Durables

- /

- NYSE:LEG

Leggett & Platt, Incorporated's (NYSE:LEG) Share Price Could Signal Some Risk

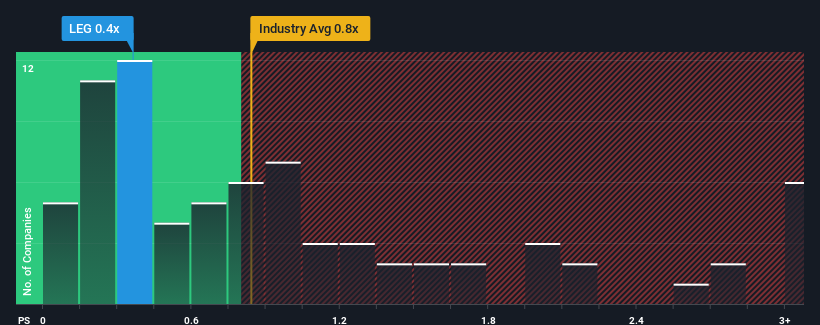

With a median price-to-sales (or "P/S") ratio of close to 0.8x in the Consumer Durables industry in the United States, you could be forgiven for feeling indifferent about Leggett & Platt, Incorporated's (NYSE:LEG) P/S ratio of 0.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Leggett & Platt

How Leggett & Platt Has Been Performing

Leggett & Platt hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Leggett & Platt.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Leggett & Platt would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 7.6% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 9.7% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 0.5% per annum as estimated by the four analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 6.4% per annum, which is noticeably more attractive.

With this in mind, we find it intriguing that Leggett & Platt's P/S is closely matching its industry peers. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What We Can Learn From Leggett & Platt's P/S?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Given that Leggett & Platt's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

You need to take note of risks, for example - Leggett & Platt has 2 warning signs (and 1 which is potentially serious) we think you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:LEG

Leggett & Platt

Designs, manufactures, and sells engineered components and products in the United States, Europe, China, Canada, Mexico, and internationally.

Slight risk and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026