- United States

- /

- Consumer Durables

- /

- NYSE:HOV

There's No Escaping Hovnanian Enterprises, Inc.'s (NYSE:HOV) Muted Earnings Despite A 27% Share Price Rise

The Hovnanian Enterprises, Inc. (NYSE:HOV) share price has done very well over the last month, posting an excellent gain of 27%. The last 30 days bring the annual gain to a very sharp 81%.

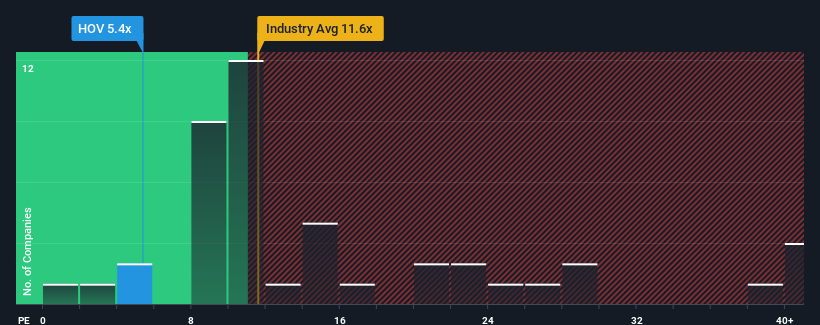

Although its price has surged higher, Hovnanian Enterprises' price-to-earnings (or "P/E") ratio of 5.4x might still make it look like a strong buy right now compared to the market in the United States, where around half of the companies have P/E ratios above 18x and even P/E's above 33x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

The earnings growth achieved at Hovnanian Enterprises over the last year would be more than acceptable for most companies. It might be that many expect the respectable earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

Check out our latest analysis for Hovnanian Enterprises

How Is Hovnanian Enterprises' Growth Trending?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Hovnanian Enterprises' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 19% gain to the company's bottom line. Still, incredibly EPS has fallen 59% in total from three years ago, which is quite disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Comparing that to the market, which is predicted to deliver 13% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

In light of this, it's understandable that Hovnanian Enterprises' P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Bottom Line On Hovnanian Enterprises' P/E

Shares in Hovnanian Enterprises are going to need a lot more upward momentum to get the company's P/E out of its slump. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Hovnanian Enterprises revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Before you settle on your opinion, we've discovered 2 warning signs for Hovnanian Enterprises that you should be aware of.

Of course, you might also be able to find a better stock than Hovnanian Enterprises. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Hovnanian Enterprises might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HOV

Hovnanian Enterprises

Through its subsidiaries, designs, constructs, markets, and sells residential homes in the United States.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026