Stock Analysis

- United States

- /

- Consumer Durables

- /

- NYSE:HOV

Exploring Meta Data And Two More Undiscovered Gem Stocks

Reviewed by Simply Wall St

Recent data indicating a potential easing of interest rates has injected optimism into the U.S. stock market, reversing earlier losses and setting a hopeful tone for investors. Particularly, small-cap stocks represented in indices like the S&P 600 may benefit from these broader economic shifts, presenting unique opportunities for growth. In such a dynamic environment, identifying stocks with strong fundamentals and potential for significant impact becomes crucial.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 14.93% | 0.44% | 7.74% | ★★★★★★ |

| Omega Flex | NA | 2.13% | 4.77% | ★★★★★★ |

| Teekay | NA | -8.88% | 49.65% | ★★★★★★ |

| First Northern Community Bancorp | NA | 6.68% | 9.08% | ★★★★★★ |

| Mission Bancorp | 25.37% | 16.23% | 20.16% | ★★★★★★ |

| FirstSun Capital Bancorp | 27.36% | 10.54% | 30.73% | ★★★★★★ |

| Gravity | NA | 15.31% | 24.42% | ★★★★★★ |

| CSP | 2.17% | -5.57% | 73.73% | ★★★★★☆ |

| FRMO | 0.19% | 6.49% | 15.82% | ★★★★☆☆ |

| Meta Data | 2151.54% | -34.97% | -16.25% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Meta Data (NYSE:AIU)

Simply Wall St Value Rating: ★★★★☆☆

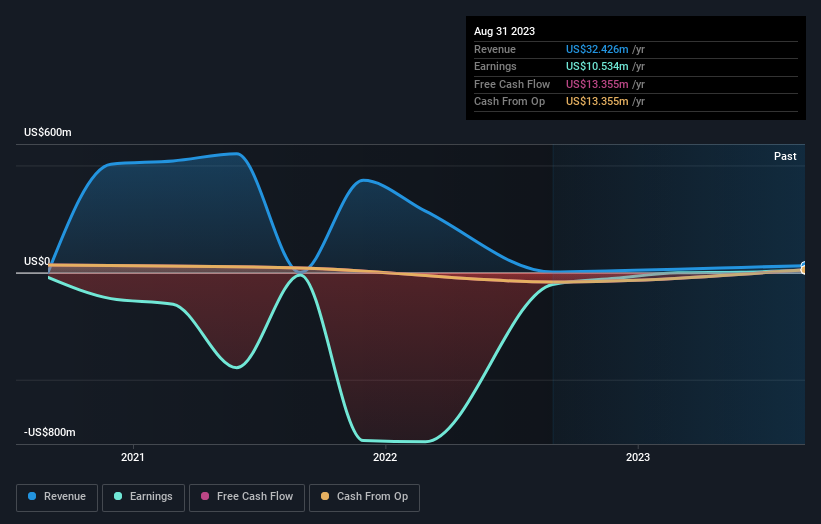

Overview: Meta Data Limited operates a K-12 after-school education platform specializing in mathematics training and English services for young children, serving both the domestic market in the People's Republic of China and international markets, with a market capitalization of approximately $374.09 million.

Operations: AIU operates primarily in the educational services sector, offering education and training services. The company generates revenue through these services, with a notable gross profit margin of 47.56% as of the latest reporting period in August 2023, highlighting its ability to manage production costs effectively relative to sales.

Meta Data, recently spotlighted for a 1:5 stock split, navigates complex waters with a default on a $139 million loan and an ongoing legal petition for winding up. Despite these challenges, the company has shown resilience by becoming profitable this year and covering interest payments effectively with a 4.4x EBIT coverage ratio. However, its debt to equity ratio soared from 41% to 2152% over five years, reflecting substantial shareholder dilution during this period.

- Dive into the specifics of Meta Data here with our thorough health report.

Understand Meta Data's track record by examining our Past report.

Hovnanian Enterprises (NYSE:HOV)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hovnanian Enterprises, Inc. is a U.S.-based company that designs, constructs, markets, and sells residential homes across various regions, with a market capitalization of approximately $1.28 billion.

Operations: The company generates its revenue primarily through homebuilding activities across various U.S. regions, with notable segments being the West ($1.35 billion), Northeast ($936 million), and Southeast ($480 million). It also earns from financial services, contributing $66 million to the total revenue. The firm's operational strategy involves managing costs related to construction and administrative expenses while deriving a gross profit margin recently reported at 21.37%.

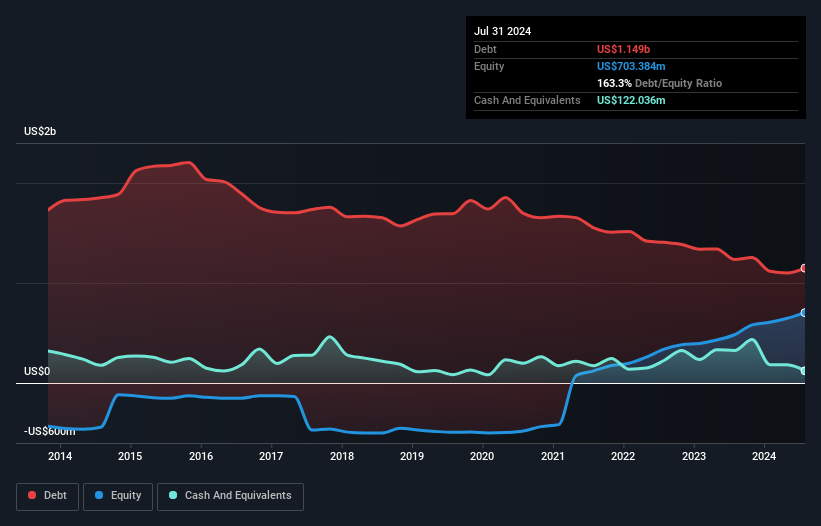

Hovnanian Enterprises, a lesser-known player in the consumer durables industry, outpaced its sector with a 20.3% earnings growth last year, contrasting the industry's -2.6% downturn. Despite high net debt-to-equity at 141.9%, it maintains robust interest coverage at 6.5 times EBIT and trades at an appealing 86.6% below estimated fair value. Recent index inclusions and a completed share repurchase of $36.82 million underscore its proactive market stance, enhancing its appeal as an undiscovered gem with promising financial health indicators.

- Navigate through the intricacies of Hovnanian Enterprises with our comprehensive health report here.

Explore historical data to track Hovnanian Enterprises' performance over time in our Past section.

Worthington Steel (NYSE:WS)

Simply Wall St Value Rating: ★★★★★☆

Overview: Worthington Steel, Inc., a steel processor based in North America, has a market capitalization of approximately $1.96 billion.

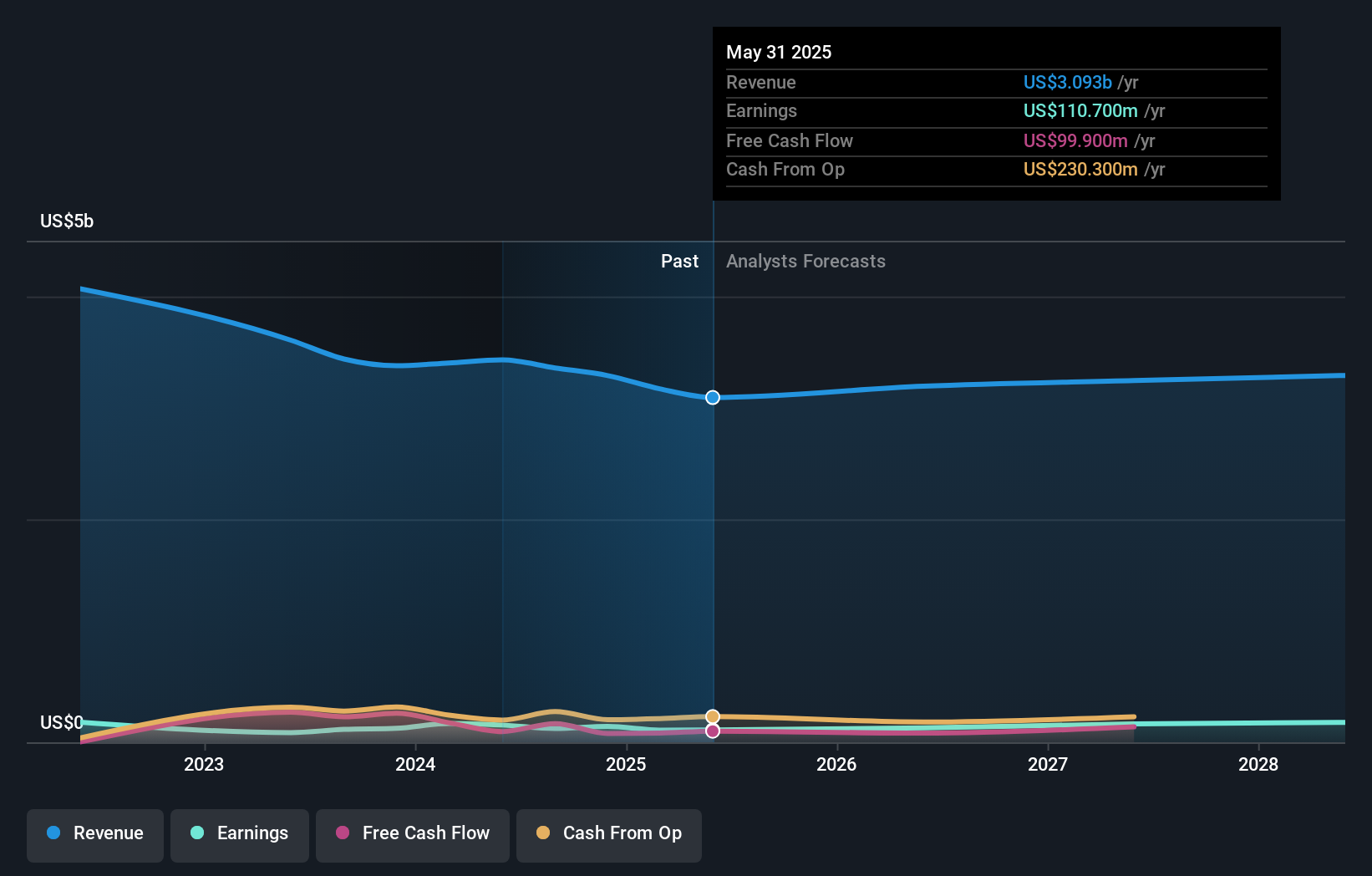

Operations: WS operates primarily in the metal processors and fabrication sector, generating revenue of $3.43 billion as of the latest reporting period. The company's business model involves substantial cost management, with recent figures showing costs of goods sold (COGS) at approximately $2.99 billion and operating expenses around $224.4 million, reflecting a focus on operational efficiency in a competitive industry landscape.

Worthington Steel, a lesser-known yet robust player in the metals sector, reported a significant earnings growth of 77.7% last year, outpacing the industry's decline of 26.6%. With a net debt to equity ratio at a healthy 9.6%, and interest payments well-covered by EBIT (35.9x), the company's financial health appears strong. Recent figures show annual sales reaching $3.43 billion, though slightly down from $3.61 billion previously, with net income improving to $154.7 million from $87.1 million year-over-year.

- Get an in-depth perspective on Worthington Steel's performance by reading our health report here.

Evaluate Worthington Steel's historical performance by accessing our past performance report.

Seize The Opportunity

- Click through to start exploring the rest of the 221 US Undiscovered Gems With Strong Fundamentals now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hovnanian Enterprises might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HOV

Hovnanian Enterprises

Through its subsidiaries, designs, constructs, markets, and sells residential homes in the United States.

Excellent balance sheet and good value.