- United States

- /

- Consumer Durables

- /

- NYSE:HOV

Exploring Cricut And 2 Hidden Small Caps with Strong Fundamentals

Reviewed by Simply Wall St

The market has climbed by 3.0% over the past week, with every sector up, and in the last year, it has risen by 25%. In this favorable environment where earnings are expected to grow by 15% annually over the next few years, identifying stocks with strong fundamentals can be particularly rewarding; Cricut and two other small-cap companies exemplify these hidden gems.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Teekay | NA | -6.48% | 55.79% | ★★★★★★ |

| Mission Bancorp | 25.37% | 16.23% | 20.16% | ★★★★★★ |

| Omega Flex | NA | 1.31% | 3.88% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.12% | 10.04% | ★★★★★★ |

| Banco Latinoamericano de Comercio Exterior S. A | 311.64% | 21.07% | 24.77% | ★★★★★☆ |

| Innovex International | 19.92% | 29.88% | 40.68% | ★★★★★☆ |

| Valhi | 38.71% | 2.57% | -19.76% | ★★★★★☆ |

| QDM International | 36.42% | 107.08% | 78.76% | ★★★★★☆ |

| FRMO | 0.17% | 12.99% | 23.62% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Cricut (NasdaqGS:CRCT)

Simply Wall St Value Rating: ★★★★★★

Overview: Cricut, Inc. designs, markets, and distributes a creativity platform that allows users to transform ideas into professional-looking handmade goods, with a market cap of $1.35 billion.

Operations: Cricut generates revenue primarily through the sale of its creativity platform and related products. The company’s financial performance includes a net profit margin of 12.5%, reflecting its profitability after accounting for all expenses.

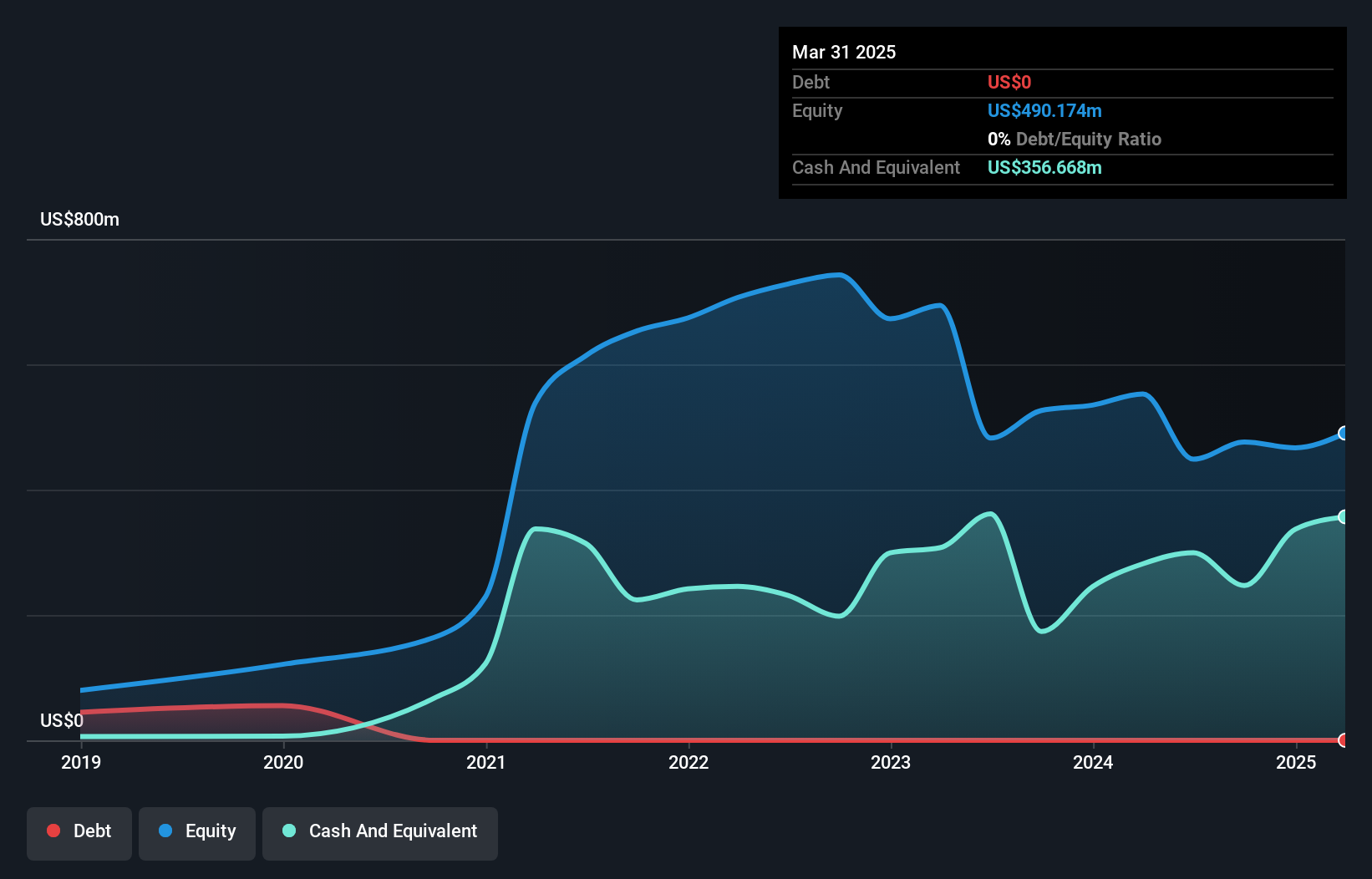

Cricut, a nimble player in the Consumer Durables sector, has shown impressive earnings growth of 40.2% over the past year, outpacing its industry. Trading at 45.3% below estimated fair value and debt-free for five years (previously at 49.9%), it presents a compelling valuation case. Despite significant insider selling recently, Cricut repurchased 1.41 million shares worth US$8.86 million between May and June 2024, indicating confidence in its future prospects amidst recent index additions like Russell Small Cap Value Index.

- Unlock comprehensive insights into our analysis of Cricut stock in this health report.

Understand Cricut's track record by examining our Past report.

Hovnanian Enterprises (NYSE:HOV)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hovnanian Enterprises, Inc., through its subsidiaries, designs, constructs, markets, and sells residential homes in the United States with a market cap of approximately $1.31 billion.

Operations: Hovnanian Enterprises generates revenue primarily from its Homebuilding segments, with the West region contributing $1.37 billion, the Northeast $989.39 million, and the Southeast $474.97 million. The Financial Services segment adds an additional $70.40 million to their revenue stream.

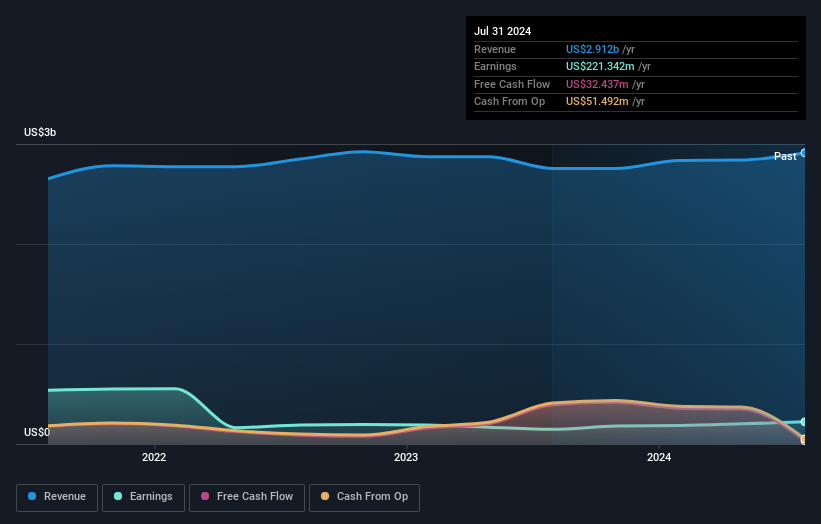

Hovnanian Enterprises has shown impressive growth, with earnings increasing by 51.3% over the past year, significantly outpacing the Consumer Durables industry’s -1.6%. The company reported Q3 2024 revenue of US$722.7 million and net income of US$72.92 million, up from US$649.96 million and US$55.76 million respectively a year ago. HOV's price-to-earnings ratio stands at 6.1x, well below the U.S market average of 18.1x, indicating potential undervaluation in this sector.

- Click to explore a detailed breakdown of our findings in Hovnanian Enterprises' health report.

Explore historical data to track Hovnanian Enterprises' performance over time in our Past section.

Worthington Steel (NYSE:WS)

Simply Wall St Value Rating: ★★★★★☆

Overview: Worthington Steel, Inc. operates as a steel processor in North America with a market cap of approximately $1.67 billion.

Operations: The company's primary revenue stream is derived from its Metal Processors and Fabrication segment, which generated $3.43 billion.

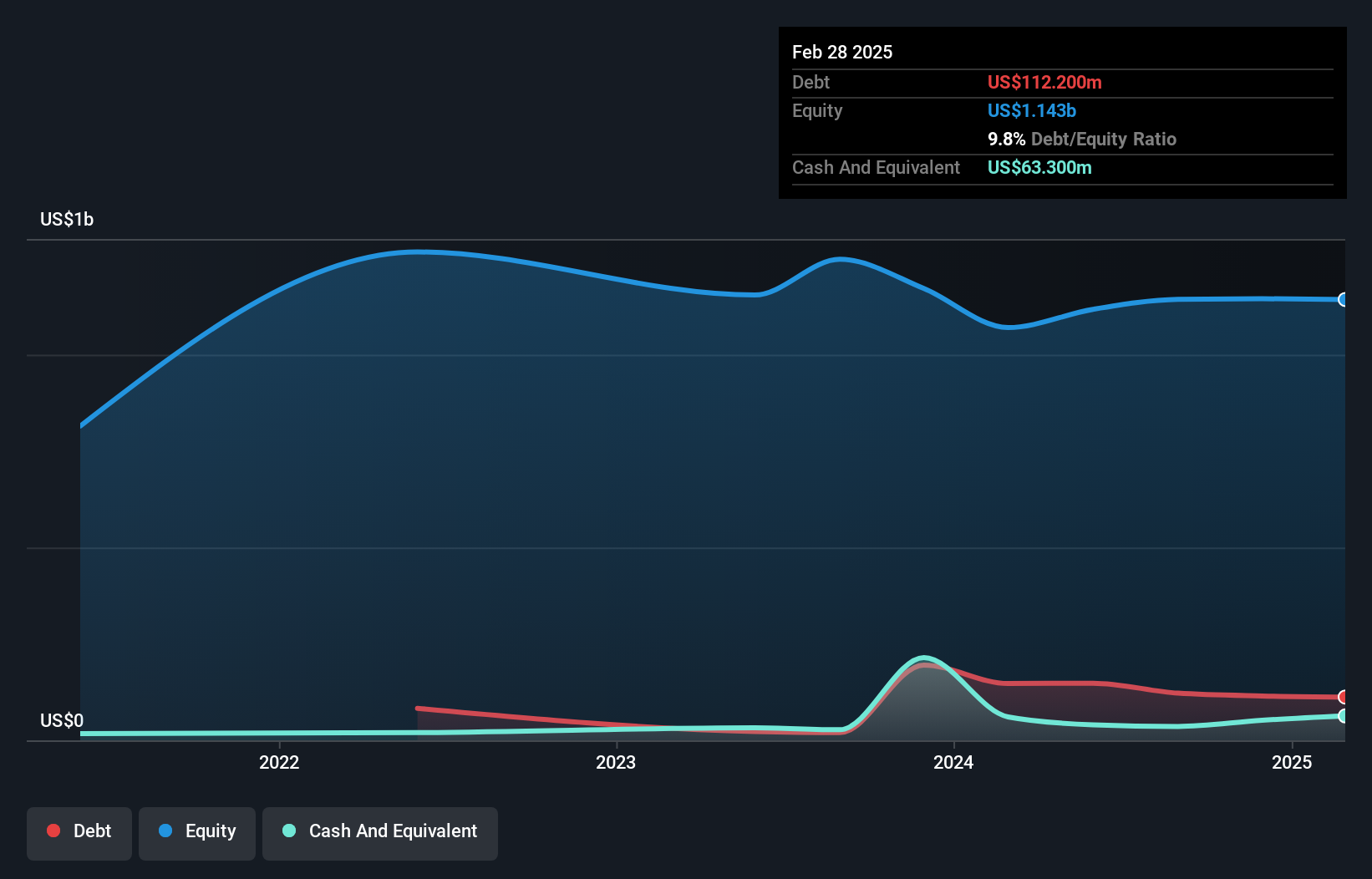

Worthington Steel has shown impressive financial health, with a net debt to equity ratio of 9.6%, indicating satisfactory leverage. The company reported a significant earnings growth of 77.6% over the past year, outpacing the Metals and Mining industry’s -23%. Trading at 42.5% below its estimated fair value, it presents an attractive investment opportunity. Recent earnings for Q4 showed sales of US$911 million and net income of US$53.2 million, despite lower than last year's US$67.3 million.

- Take a closer look at Worthington Steel's potential here in our health report.

Gain insights into Worthington Steel's past trends and performance with our Past report.

Make It Happen

- Embark on your investment journey to our 211 US Undiscovered Gems With Strong Fundamentals selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hovnanian Enterprises might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HOV

Hovnanian Enterprises

Through its subsidiaries, designs, constructs, markets, and sells residential homes in the United States.

Solid track record with adequate balance sheet.