- United States

- /

- Luxury

- /

- NYSE:HBI

Hanesbrands Inc. (NYSE:HBI) May Have Run Too Fast Too Soon With Recent 26% Price Plummet

The Hanesbrands Inc. (NYSE:HBI) share price has fared very poorly over the last month, falling by a substantial 26%. Still, a bad month hasn't completely ruined the past year with the stock gaining 44%, which is great even in a bull market.

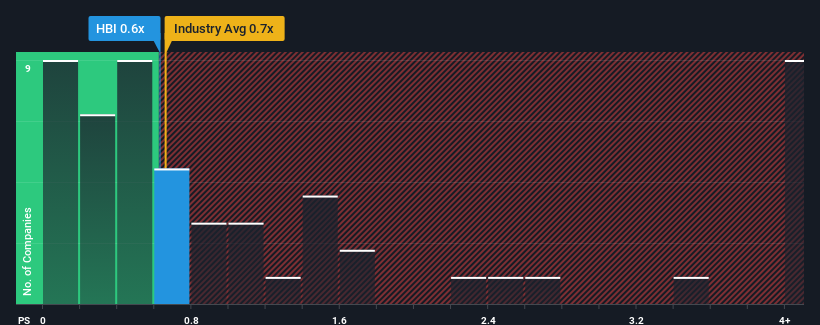

In spite of the heavy fall in price, there still wouldn't be many who think Hanesbrands' price-to-sales (or "P/S") ratio of 0.6x is worth a mention when the median P/S in the United States' Luxury industry is similar at about 0.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Hanesbrands

What Does Hanesbrands' Recent Performance Look Like?

Hanesbrands hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Hanesbrands will help you uncover what's on the horizon.How Is Hanesbrands' Revenue Growth Trending?

Hanesbrands' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 37%. As a result, revenue from three years ago have also fallen 48% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 0.9% per year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 6.9% per year, which is noticeably more attractive.

With this in mind, we find it intriguing that Hanesbrands' P/S is closely matching its industry peers. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Hanesbrands' P/S?

Following Hanesbrands' share price tumble, its P/S is just clinging on to the industry median P/S. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

When you consider that Hanesbrands' revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Hanesbrands you should know about.

If these risks are making you reconsider your opinion on Hanesbrands, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Hanesbrands might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:HBI

Hanesbrands

Designs, manufactures, sources, and sells a range of range of innerwear apparel for men, women, and children in the Americas, Europe, the Asia pacific, and internationally.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives