- United States

- /

- Consumer Durables

- /

- NYSE:GRMN

Garmin (GRMN): Assessing Valuation Following Recent Share Price Pullback

Reviewed by Simply Wall St

See our latest analysis for Garmin.

Garmin’s latest share price of $196.88 reflects some short-term volatility, with a 1-month share price return of -7.97% and a 90-day pullback of -16.90%. Still, when you zoom out, Garmin has delivered a strong 122.06% total shareholder return over the past three years. Momentum has pulled back lately, but the longer-term growth story remains impressive in the context of ongoing innovation and a solid track record.

If you’re curious about which other companies could show strong performance in the months ahead, it’s worth exploring opportunities in fast growing stocks with high insider ownership.

With shares trading at a discount to analyst price targets and recent pullbacks contrasting with strong three-year returns, the big question emerges: is Garmin undervalued right now, or has the market already priced in its next stage of growth?

Most Popular Narrative: 14.8% Undervalued

With Garmin’s last close at $196.88 and the most widely followed narrative setting fair value at $231.14, consensus points to a meaningful discount. Fresh analyst commentary hints at what could power this gap. Here is the catalyst driving the narrative forward.

The launch of the Garmin Connect+ premium service, which offers AI-based health and fitness insights, is likely to boost subscription-based revenue growth and improve overall margins through higher-margin services. The new vívoactive 6 smartwatch release, with advanced features like an AMOLED display and enhanced sports apps, suggests potential revenue growth in the Fitness segment, supported by strong demand for advanced wearables.

Why are analysts so bullish? The narrative’s valuation hinges on ambitious profit growth and margin forecasts, plus a surprisingly robust multiple for future earnings. Curious about the numerical drivers and the optimism fueling an upgrade from both products and services? The real growth assumptions are hidden just beyond this summary.

Result: Fair Value of $231.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising operating costs or softness in Marine and Outdoor sales could challenge the bullish case for Garmin and limit its margin expansion in the future.

Find out about the key risks to this Garmin narrative.

Another View: Are Multiples Telling a Different Story?

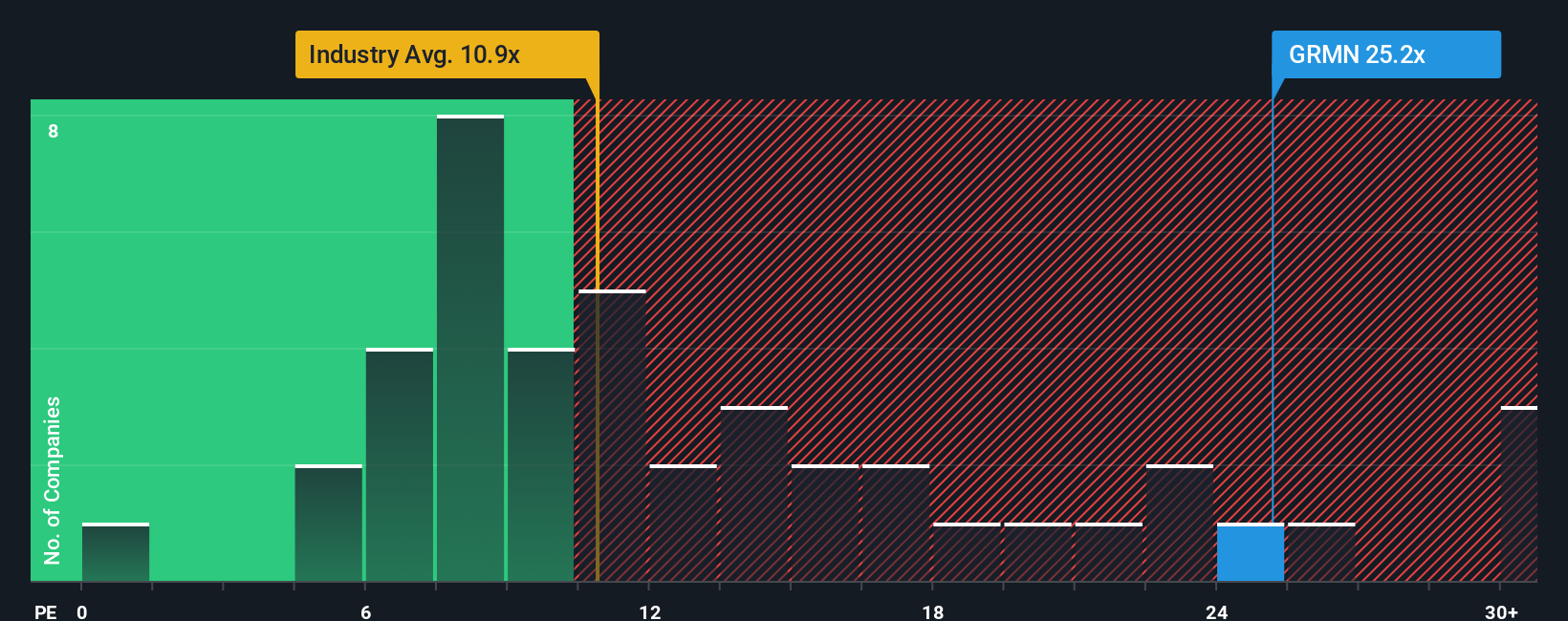

While the consensus narrative sees Garmin as undervalued, the current share price reflects a price-to-earnings ratio of 24.1x, which is substantially higher than the US Consumer Durables industry average of 11.7x and even the fair ratio of 20.6x. This premium suggests investors might be paying up for perceived growth or safety, introducing real valuation risk if future growth falls short.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Garmin Narrative

If the current narrative doesn’t quite fit your outlook or you want to dig into the details yourself, you can shape your own Garmin story in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Garmin.

Looking for More Investment Ideas?

Smart investors never stand still. Be the first among your friends to uncover new opportunities waiting just outside the obvious picks. Don’t miss the chance to position your portfolio for what comes next by using tailored strategies to get ahead of the pack.

- Maximize income potential by tapping into these 14 dividend stocks with yields > 3% with yields above 3% for stable cash flow from proven companies.

- Ride technological breakthroughs by starting with these 25 AI penny stocks that are setting the pace in the artificial intelligence revolution.

- Capitalize on overlooked value by seizing these 923 undervalued stocks based on cash flows that stand out based on strong future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GRMN

Garmin

Designs, develops, manufactures, markets, and distributes a range of wireless devices worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026