- United States

- /

- Consumer Durables

- /

- NYSE:GRBK

Will Green Brick Partners' (GRBK) Exclusive Supply Deal Shape Its Quality Edge in Key Markets?

Reviewed by Simply Wall St

- James Hardie Building Products Inc. recently renewed its exclusive three-year supply agreement with Green Brick Partners, securing Hardie® siding and trim for all new Green Brick developments in Texas, Georgia, and Florida through 2028.

- The ongoing exclusivity strengthens Green Brick Partners' supply chain stability and reinforces its reputation for high-quality, durable home construction in rapidly growing housing markets.

- We'll explore how this extended materials partnership may impact Green Brick Partners' investment narrative, particularly its commitment to quality and operational consistency.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Green Brick Partners Investment Narrative Recap

Shareholders in Green Brick Partners are betting on the company’s ability to sustain resilient profit margins and capitalize on ongoing migration to high-growth Texas and Southeast markets, even as earnings face pressure from affordability challenges and slowing order activity. The newly renewed James Hardie partnership reinforces operational execution and materials consistency, but does not meaningfully alter the near-term focus on margin sustainability and the risk of prolonged softness in housing demand if interest rates remain elevated. Among Green Brick’s announcements this year, the launch of its Riviera Pines development in Houston is closely tied to the catalysts underpinning the stock, expanding the Trophy Signature Homes brand into a new market and emphasizing growth in the resilient entry-level segment. This initiative directly aligns with the company’s efforts to capture demographic tailwinds and diversify its regional revenue base. Yet, even with reliable supplier partnerships, investors should watch how quickly affordability pressures could impact homebuyer demand and sales volumes...

Read the full narrative on Green Brick Partners (it's free!)

Green Brick Partners' outlook anticipates $2.0 billion in revenue and $252.1 million in earnings by 2028. This implies a 2.1% annual revenue decline and a $95 million earnings decrease from current earnings of $347.1 million.

Uncover how Green Brick Partners' forecasts yield a $62.00 fair value, a 16% downside to its current price.

Exploring Other Perspectives

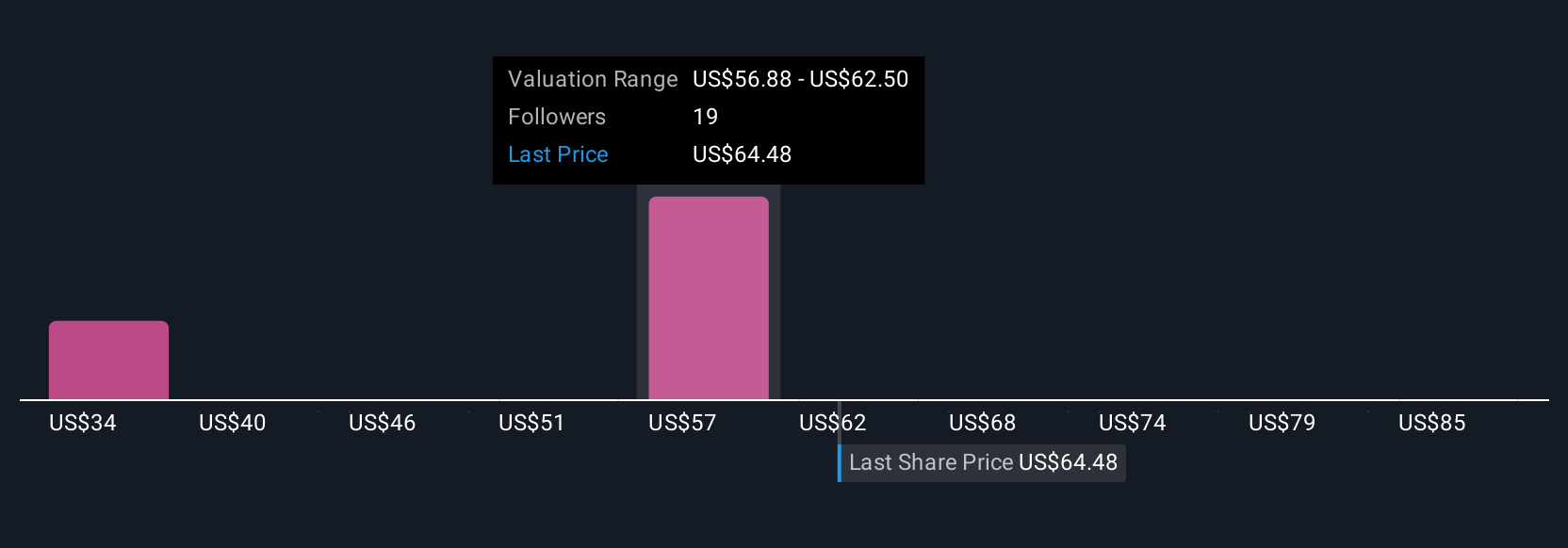

Fair value estimates from six Simply Wall St Community members range from US$33.94 to US$90.58 per share. While the new exclusivity with James Hardie highlights supplier stability, persistent affordability headwinds remain a key concern for future earnings and revenue.

Explore 6 other fair value estimates on Green Brick Partners - why the stock might be worth less than half the current price!

Build Your Own Green Brick Partners Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Green Brick Partners research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Green Brick Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Green Brick Partners' overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GRBK

Green Brick Partners

Green Brick Partners, Inc (NYSE: GRBK), the third largest homebuilder in Dallas-Fort Worth, is a diversified homebuilding and land development company that operates in Texas, Georgia, and Florida.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives